Plainly a brand new hype coin entered the scene and left Doge within the mud. Whereas the crypto market has been stagnating this yr, ApeCoin is hovering above all of them, together with Monero as a privateness coin outlier. For the final 30 days, APE outperformed Bitcoin alone by over 40%.

Nevertheless, at a one-month excessive of $16.96 this Wednesday, APE remains to be removed from its all-time excessive of $39.40 on March seventeenth. Nonetheless, going from $13.09 to 16.96 in a single day, on April twentieth, is a efficiency that we’re not prone to see with numerous large-cap cash.

The truth is, a 30% bounce often follows when a coin will get listed on a significant alternate or another favorable occasion is incoming.

Latest Developments Pushes ApeCoin to New Highs

After ApeCoin (APE) launched on March sixteenth, the hype surrounding Yuga Labs‘ newest providing propelled it as much as 700% on some exchanges. Nevertheless, APE quickly took an 80% dive. On the present charge, 28.48% of APE cash are in circulation out of the whole 1 billion provide. To stop depreciation whereas the APE ecosystem ramps up, ApeCoin DAO has a multi-tiered unlocking method.

As an example, 4,166,666.67 tokens are to be unlocked per 30 days for 36 months, after Yuga Labs’ 12-month lockup of 150 million APEs. The latest rise of the APEs is basically owed to a basic cause—alternate itemizing. Particularly, itemizing on Gemini Earn, which has similarities to the just lately canceled Celsius Earn program for US buyers.

Such lending packages are easy. Customers deposit their crypto cash for others to borrow and earn an rate of interest for supplying this lending service. Subsequently, identical to a financial institution deposit however with a lot greater yields. As of April twentieth, the annual proportion yield (APY) for ApeCoin is 5.58%. This could yield $485.17 over 4 years with a $2,000 preliminary deposit.

After all, given how risky APE is, this yield might go considerably greater or decrease. In flip, it will depend upon the tasks that may make use of APE cash.

Why Would One Want ApeCoin?

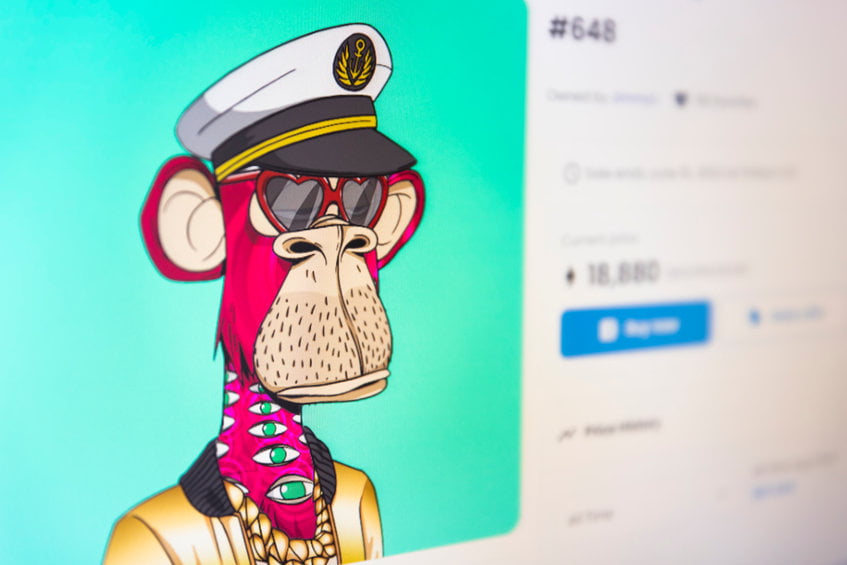

Yuga Labs gained its blockchain glory with Bored Ape Yacht Membership (BAYC) NFTs, which generated $1.8 billion price of gross sales along with $1.23 billion from Mutant Ape Yacht Membership. These colourful cartoon apes NFTs steadily appreciated as celebrities displayed them on their social media accounts; from Steve Aoki and Eminem to Justin Bieber, Snoop Dogg, and Mark Cuban.

As of April, the BAYC ground value stands at a formidable 120 ETH ($369,777). As an alternative of retiring, Yuga Labs is constructing on that accrued goodwill and repute with ApeCoin, a utility and governance token for the Ape ecosystem.

After having raised $450 million final month, Yuga Labs’ subsequent massive factor is the Otherside challenge, a 3D blockchain recreation. That is alleged to be the staple for the corporate’s metaverse enterprise, identical to Horizon Worlds is for Meta, however doubtless with out the egregious Meta charges.

Now that we’re in April, rumors are circulating of NFT land drops for this metaverse. Metaverse land NFTs have lengthy established themselves as prized commodities, first spearheaded by Axie Infinity’s Genesis land plots. One in every of which bought for 550 ETH ($2.4 million final November).

By the identical NFT token, in keeping with BAYC proprietor Renegademaster, Yuga Labs is prone to launch land plot gross sales for Otherside beginning at 600 APE, which is now $9,675.

Whereas that is occurring, or about to occur, BAYC gained such recognition that it spawned a burger joint in South California. The Bored & Hungry restaurant shouldn’t be solely Ape-themed however it additionally accepts ETH and APE for service cost.

Be a part of our Telegram group and by no means miss a breaking digital asset story.

APE Surpasses Marketcap of SAND and MANA

Each Decentraland (MANA) and The Sandbox (SAND) haven’t carried out almost in addition to ApeCoin. The truth is, they’ve entered unfavorable territory for final month’s efficiency.

To make issues worse, regardless of being two years older than APE, MANA’s market cap is now decrease than APE’s at $3.9 billion vs. $4.6 billion. SAND is even decrease at $3.34 billion.

Zooming out, what seems to be occurring with hype/metaverse cash is akin to company model rollouts. These tasks which have efficiently made their NFTs an integral a part of social media avatars at the moment are in an advantageous place. Static NFTs have been the leaping ramp, and Yuga Labs appears to be leaping to create an formidable ecosystem that rivals Axie Infinity because the blockchain gaming pioneer.

Nevertheless, making a generative NFT assortment is a wholly totally different wheelhouse than making a blockchain recreation. Even with out the token layer, many parts need to align to make it a compelling expertise. The silver lining for all events concerned is that, if profitable, such tasks have their very own endurance past the Fed’s proclamations or geopolitical tensions.

Finance is altering.

Find out how, with 5 Minute Finance.

A weekly publication that covers the massive tendencies in FinTech and Decentralized Finance.

Do you suppose ApeCoin will be capable to preserve tempo with its progress sooner or later? Tell us within the feedback under.

In regards to the creator

Tim Fries is the cofounder of The Tokenist. He has a B. Sc. in Mechanical Engineering from the College of Michigan, and an MBA from the College of Chicago Sales space Faculty of Enterprise. Tim served as a Senior Affiliate on the funding group at RW Baird’s US Non-public Fairness division, and can be the co-founder of Protecting Applied sciences Capital, an funding agency specializing in sensing, safety and management options.