In an encouraging flip of occasions, Asian equities and currencies rallied on the again of the US greenback’s depreciation, as investor sentiment was bolstered by the anticipation of an imminent finish to the Federal Reserve’s tightening cycle. The newest market information unveiled a promising trajectory for a number of Asian markets, together with Thailand, the place shares surged, reflecting a burgeoning confidence amongst merchants and buyers.

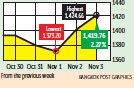

Thai shares demonstrated a notable upward development, reaching a variety of 1,373.20 and 1,424.66 factors earlier than concluding at 1,419.76, marking a 2.3% enhance from the earlier week. Notably, institutional buyers exhibited an optimistic outlook, recording internet purchases amounting to three.24 billion baht. Conversely, international buyers and retail buyers displayed a minor retreat, with internet gross sales totaling 2.6 billion baht and 546.98 million baht, respectively.

Latest shifts in international financial insurance policies have been pivotal in shaping the present market panorama. The US Federal Reserve’s choice to keep up rates of interest, together with the European Central Financial institution’s strategic strategy to quell inflation, have supplied a stabilizing affect on the general financial sentiment. In the same vein, the Financial institution of England’s retention of rates of interest, following a protracted interval of will increase, underscored a cautious but balanced strategy to financial administration.

Amidst the monetary market developments, the erstwhile “crypto king” Sam Bankman-Fried’s authorized entanglements served as a stark reminder of the dangers related to the burgeoning cryptocurrency business. The US private consumption expenditure (PCE) index’s surprising surge in September and Apple’s resilient quarterly income, regardless of fluctuating revenues, additional exemplified the resilience of the worldwide financial panorama.

Within the East, Japan’s cupboard authorised a considerable stimulus bundle, incorporating tax cuts and monetary aid measures aimed toward addressing the challenges posed by inflation. Notably, the Financial institution of Japan’s latest coverage changes, alongside Nippon Metal’s optimistic forecast revision, signified concerted efforts to navigate the evolving financial local weather.

In the meantime, China encountered a decline in its actual property lending and manufacturing exercise, portray a cautionary image of the nation’s financial trajectory. The unfolding challenges confronted by Chinese language producers, coupled with a drop within the buying managers’ index (PMI), steered a necessity for proactive measures to stimulate development and consumption.

On a broader scale, the precarious scenario surrounding Evergrande in Hong Kong prompted a high-stakes judicial intervention, highlighting the intricacies related to managing large-scale debt and liquidation issues. In Malaysia, the central financial institution’s choice to keep up the benchmark rate of interest mirrored a nuanced understanding of the area’s monetary dynamics, balancing financial stability with the necessity for sustainable development.

Domestically in Thailand, the federal government’s initiatives to bolster tourism and improve the automotive business have garnered consideration, with strategic interventions aiming to stimulate key sectors of the financial system. The Ministry of Commerce’s efforts to stabilize sugar costs, within the wake of weather-related challenges, underscored the authorities’ proactive strategy to handle potential provide disruptions.

Because the area prepares for upcoming financial releases, market watchers are keenly anticipating the Financial institution of Japan’s assembly minutes, the European Union’s manufacturing PMI, China’s commerce figures, and the US commerce information, that are anticipated to supply helpful insights into the worldwide financial restoration trajectory.

Within the Thai market, buyers are suggested to think about the efficiency of particular sectors, together with these benefiting from increased oil costs, undervalued shares with strong fundamentals, and corporations poised for sturdy income within the fourth quarter. These suggestions, together with technical views emphasizing key help and resistance ranges, underscore the necessity for a nuanced strategy in navigating the evolving monetary panorama.