The current Argo Blockchain monetary report presents a combined bag, with the corporate making strides in decreasing operational prices and debt, but additionally going through a decline in income and a internet loss. The publicly-listed agency’s outcomes for the primary half of 2023 present what issues the mining trade centered round Bitcoin (BTC) and different cryptocurrencies is at the moment going through.

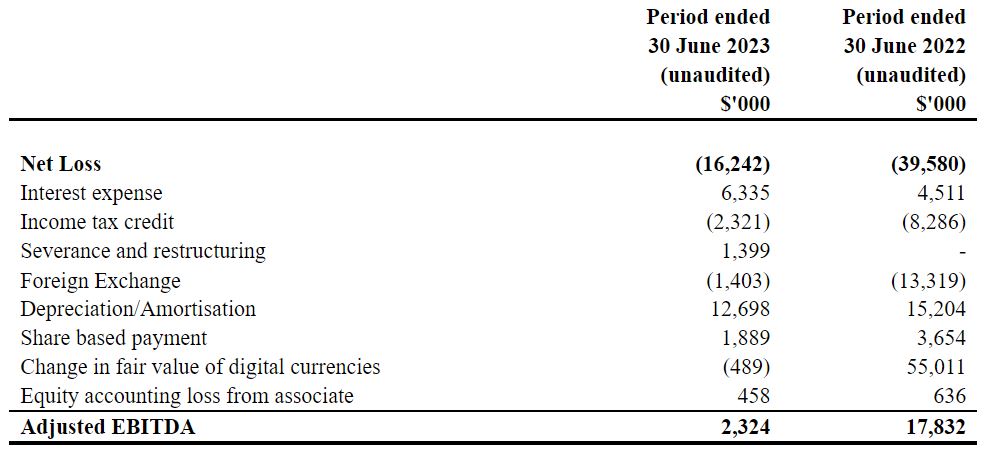

Argo Blockchain managed to chop its non-mining operational prices by 21% within the second quarter of 2023, in comparison with the earlier quarter. This led to a optimistic Adjusted EBITDA of $1 million for Q2 and $2.3 million for H1 2023. Moreover, the corporate diminished its debt by $4 million throughout the quarter, bringing it all the way down to $75 million as of 30 June. It marked a big drop from $143 million a yr in the past.

Nevertheless, this doesn’t change the truth that adjusted EBITDA in the identical interval a yr earlier was a lot increased at almost $18 million.

Mining, Revenues and Internet Loss

The corporate mined 947 Bitcoin and Bitcoin Equal (BTC) throughout the first half of 2023, marking a rise of 1% over the identical interval final yr.

“Throughout H1 2023, the Firm achieved a mining margin of 42%, which is a rise from the mining margin in H2 2022 of 33%,” the corporate commented within the official assertion.

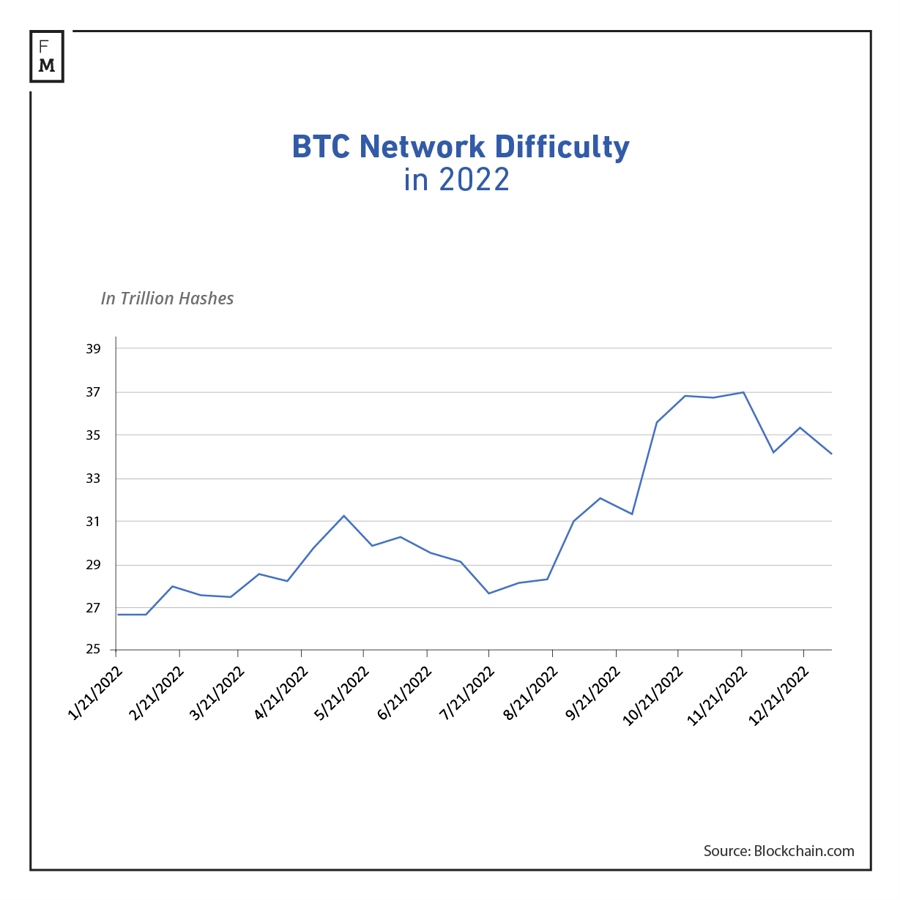

Nevertheless, this achievement was overshadowed by a income lower of 31%, totaling $24 million for H1 2023. The decline was primarily attributable to a drop in Bitcoin costs and a rise in world hashrate, which made mining extra aggressive. In H1 2022, revenues ranked at $34.6 million.

New RNS: Argo has launched its H1 2023 financials and Q2 2023 replace:

????Mined 947 BTC w/ $24m of rev in H1’23

????Minimize bills by 21% in Q2’23 vs prior quarter

????Ended June with $9m money & 46 BTC

????Mining margin of 42% for H1’23Full outcomes: https://t.co/4NhsOaW3Jt#ARB $ARBK

— Argo (@ArgoBlockchain) August 29, 2023

Regardless of the optimistic value and debt discount strides, Argo Blockchain reported a internet lack of $18.8 million for H1 2023. Though it’s an enchancment over the $39.6 million internet loss reported in H1 2022, it clearly reveals the troublesome state of affairs going through the mining trade.

The corporate ended June with $9.1 million in money and 46 BTC in its steadiness sheet. It raised an extra $7.5 million in July via a share placement.

Argo Saved by Mike Novogratz

In a transfer that quashed rumors of impending chapter, the corporate, listed on the London and New York inventory exchanges, entered right into a pivotal settlement with Galaxy Digital Holdings, Ltd. The latter is a monetary establishment specializing in digital property and is helmed by Mike Novogratz. As a part of the deal, Argo Blockchain offloaded its Texas-based Helios cryptocurrency mine for a sum of $65 million. Galaxy Digital additionally restructured the loans Argo had beforehand secured to fund its ongoing operations.

A number of months after the Galaxy deal, Argo Blockchain introduced the appointment of Jim MacCallum as its new Chief Monetary Officer. Alongside this management change, the corporate disclosed its newest operational metrics, which indicated a decline in mining output relative to the earlier month. In keeping with the corporate’s July 2023 report, there was a noticeable lower in each month-to-month Bitcoin manufacturing and income. In June 2023, the corporate mined a mean of 4.6 Bitcoin per day, marking a 17% drop from the 5.6 Bitcoin mined every day in Might 2023.

As you’ll be able to see from the chart above, the yr 2022 proved to be a troublesome interval for Bitcoin miners, following a extremely worthwhile 2021. The decline in earnings—amounting to a staggering $6 billion—was primarily attributed to the growing complexity of the mining course of.