- LTC was in a value correction mode however in a bullish market construction

- Quick-term LTC holders have made large income within the final two days

Litecoin [LTC] placed on a large mid-week rally, reaching $83.6, its highest stage since mid-Might. On the similar time, BTC regained the psychological $16K mark. Nevertheless, on the time of writing, BTC had misplaced 1.5% within the final 24 hours, setting LTC for a value correction.

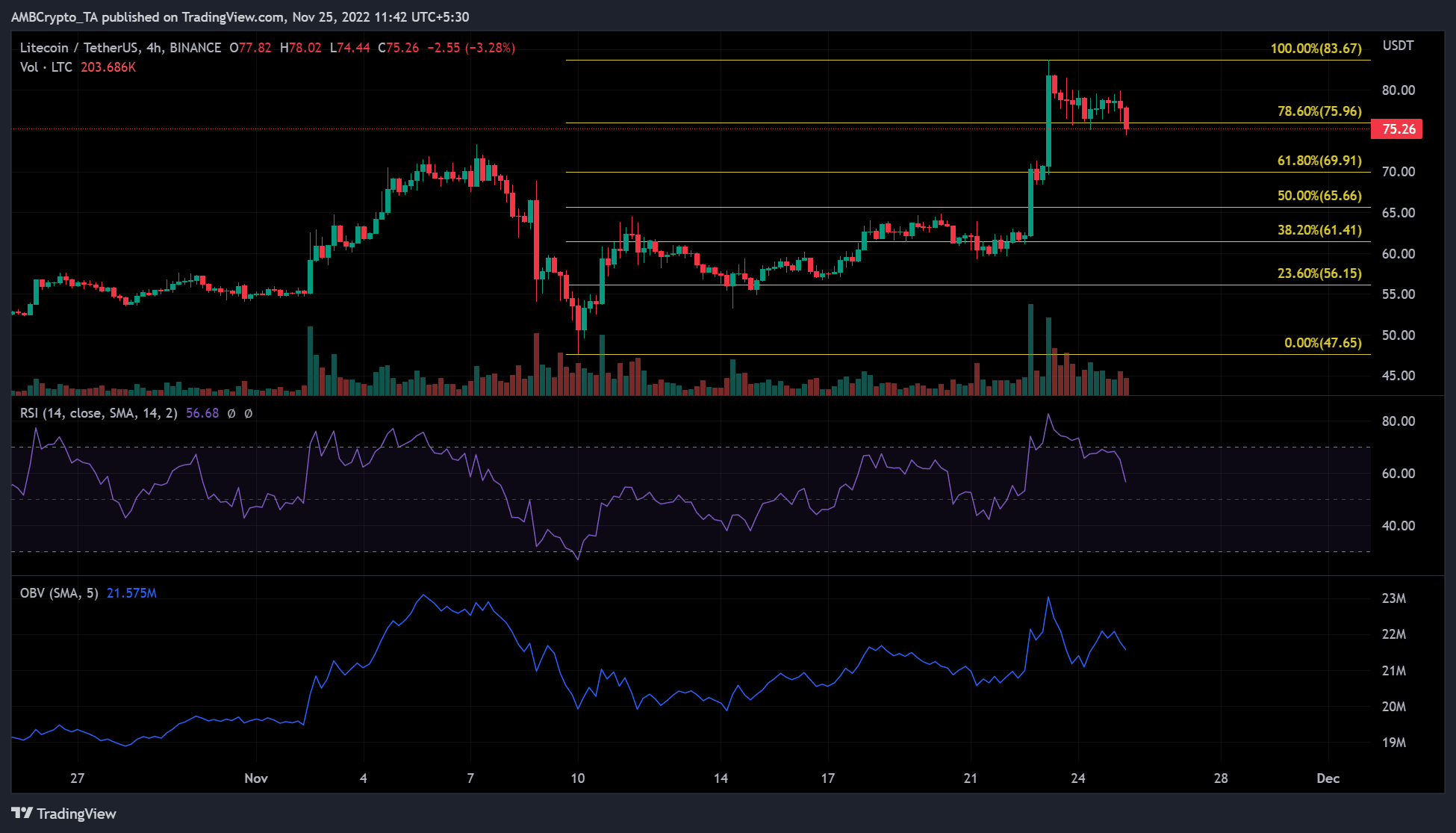

At press time, it was buying and selling at $75.26 and appeared decided to fall additional. The subsequent new helps may very well be on the 61.8% and 50% Fib retracement ranges if LTC maintains the downtrend. Buybacks from these ranges may can help you lock in income.

78.6% Fib help is about to be damaged: will it go additional down?

Supply: LTC/USDT on TradingView

The 78.6% Fib stage was an essential help zone and a bullish order block line. It was examined a number of occasions on the 4-hour chart and may very well be breached. At press time, the bears threatened a massacre slightly below this stage.

Technical indicators additionally counsel the potential of an prolonged massacre because the bears slowly take management. The Relative Energy Index (RSI) has pulled again from the overbought territory with an prolonged downtick. It signifies a large drop in shopping for stress that’s slowly permitting sellers to realize momentum.

As well as, the On Steadiness Quantity recorded a downward pattern, indicating a lower in buying and selling quantity and shopping for stress. Total, the indications counsel that sellers will achieve floor inside just a few hours or a day.

On this case, LTC costs may fall additional and discover new help zones between 61.8% ($69.9) and 50% ($65.66). The downtrend of LTC may lengthen if BTC loses its help at $16K and falls additional.

Nevertheless, a candlestick shut above the present help ($75.96) would invalidate the above bias. In such a case, LTC may commerce sideways alongside the 78.6% and 100% Fib pocket ranges or break by resistance.

Quick-term LTC holders are having fun with large income, however….

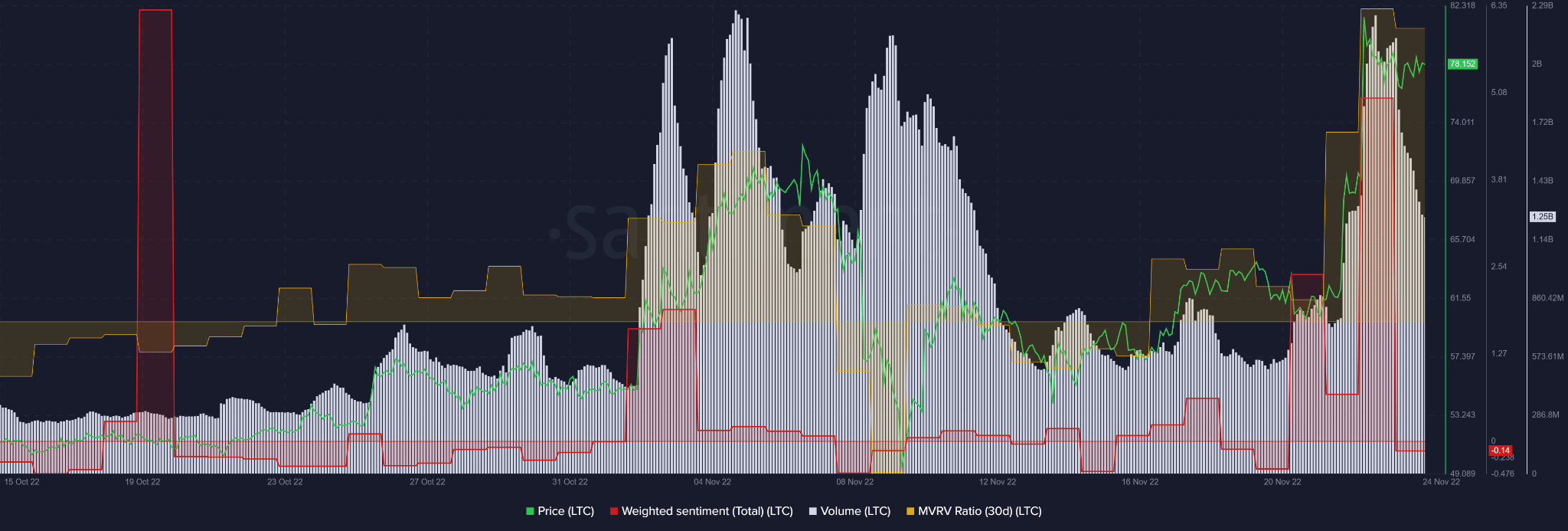

Supply: Santiment

The 30-day Market Worth to Realized Worth (MVRV) is constructive, as per Santiment information. This implies short-term LTC holders have posted file positive factors since Tuesday, 22 November. This era additionally coincides with a constructive weighted sentiment.

Nevertheless, buying and selling quantity declined, and weighted sentiment slipped into detrimental territory as of press time. This might point out {that a} value reversal is imminent, and LTC may head south.

Quick-term LTC buyers ought to subsequently monitor BTC’s efficiency and LTC’s sentiment earlier than buying and selling.