Over the past couple of years, the world has been grappling with the dearth of semiconductors, that are the substances that conduct electrical energy between metals and isolates. Probably the most well-known semiconductor is silicon.

If correlating this idea to digital gadgets, then the important thing semiconductors are processors and different microcircuits which might be current in nearly all gadgets that folks use daily, from smartphones to vehicles.

In 2021, semiconductors hit a world document when it comes to gross sales. Electronics manufacturing additionally boomed, with a whole lot of tens of millions of complicated semiconductors being devoured by gaming consoles. The variety of GPUs produced grew to unseen ranges, with main producers like Nvidia seeing all-time highs when it comes to manufacturing.

Regardless of all this, electronics costs skyrocketed and producers of associated items have been struggling to search out semiconductors.

Crypto miners: Responsible or harmless?

It has change into customary to not solely point out however responsible cryptocurrency miners for the worldwide scarcity of GPU playing cards and semiconductors. To their credit score, miners would purchase up big swaths of graphics processing items, typically emptying complete shops directly.

Some nations which might be feeling the scarcity of playing cards acutely are already preventing towards cryptocurrency mining.

On the similar time, the producers, themselves, don’t take such a particular place. AMD CEO Lisa Su stated in June 2021 that miners are removed from responsible for the dearth and even full absence of sure GPU playing cards. She stated that their affect in the marketplace is mostly minimal and doesn’t exceed 5%–10% of the entire demand.

Andy Lengthy, CEO of White Rock Administration, a digital asset expertise firm located in Switzerland, agreed with Su that mining is not fully responsible:

“GPUs are nonetheless in excessive demand to energy Ethereum and different altcoin mining. Nvidia’s revealed estimate for the share of conventional GPUs going to miners is within the single digits, however the true determine is probably going larger than that — someplace round 20%.”

One other vital issue behind the scarcity of GPU playing cards is the COVID-19 pandemic. The provision chain confirmed that because of the many staff who started to work from home, the variety of patrons elevated a lot that graphics processors — an important part in dwelling computer systems — merely disappeared from sale.

Nevertheless, the scenario with miners’ urge for food for GPU playing cards started to alter noticeably initially of this yr.

Firstly, the change is because of Ethereum (ETH) switching to the proof-of-stake (PoS) protocol, which is slated to happen in the summertime of 2022.

At the moment, the Ethereum blockchain is maintained by miners fixing cryptographic puzzles and subsequently receiving a reward, the worth of which is calculated based on the hash charge of every particular person GPU.

That is referred to as proof-of-work (PoW). As quickly as Ethereum switches to the brand new protocol, miners will not be wanted as crypto holders will validate block transactions based mostly on the variety of tokens they stake.

Since GPU playing cards will not be wanted for Ether mining, as soon as Ethereum 2.0 goes into impact, the demand for them will cut back drastically.

This shift in demand is already very noticeable. Within the first two months of 2022, Nvidia’s GPU card gross sales are down by 75% in comparison with 2021 as massive mining corporations that used to buy such playing cards have stopped shopping for. This additionally implies that Nvidia might be compelled to redirect GPU playing cards to the gaming sector and reduce costs.

There are different causes for the worth lower. Since April of this yr, the US has decreased import tariffs on the provision of products from China by 25%. America is without doubt one of the foremost gamers within the GPU market, the place corporations comparable to Nvidia, AMD and Intel function, so the tariff cuts have led to decrease costs for GPU playing cards.

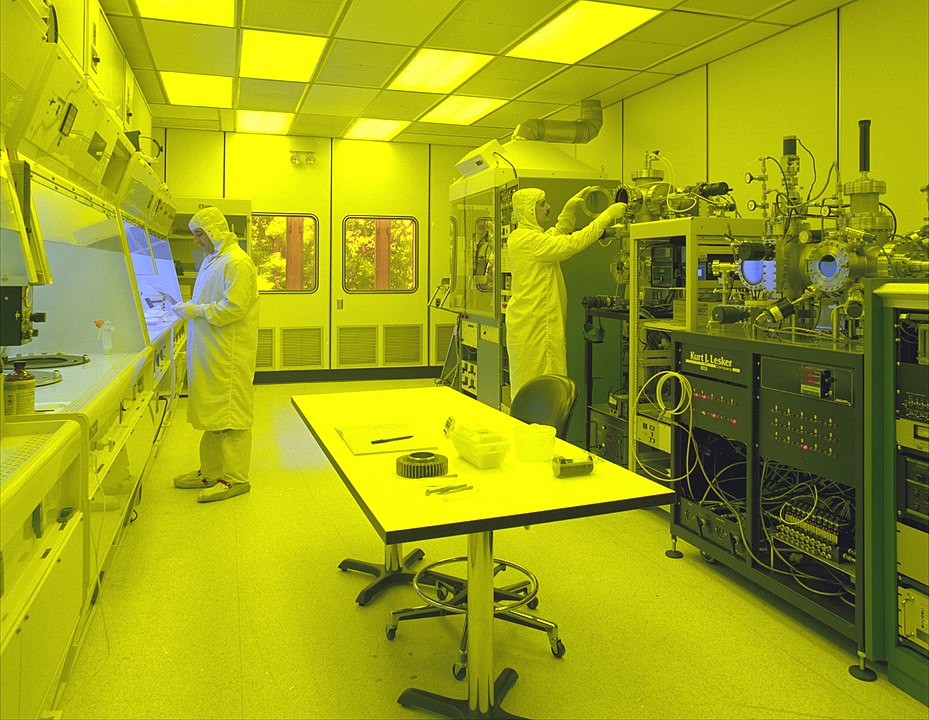

Clear room at NASA’s Glenn Analysis Heart. Such clear rooms are important for semiconductor wafer fabrication.

Patrons’ curiosity within the playing cards can be declining towards the backdrop of a gradual return of individuals to places of work after two years of distant work and the necessity to have a contemporary laptop at dwelling to comfortably carry out work duties.

“Devoted mining playing cards are additionally a bigger a part of the image now,” stated Lengthy, “These are playing cards with out video output which might be solely for knowledge processing. We first noticed these in 2017 with the launch of devoted Pascal structure playing cards such because the P106 and P104. Now the Nvidia CMP vary explicitly targets the miners — with some devoted high-end SKUs solely accessible to these prepared to put orders within the tens of tens of millions of {dollars}. The scarcity in devoted gaming playing cards is as a lot to do with easy provide and demand for the core goal of gaming — and in addition “HPC” sort functions the place folks use gaming playing cards for rendering and AI duties.”

The deficit isn’t over

The answer to the issue of the scarcity of GPU playing cards sounds easy: Producers have to make extra playing cards to satisfy the demand. Nevertheless, in apply, this isn’t the case. One of many issues is the provision of silicon wafers, that are used to provide the chips. In 2019, the demand for wafers was fairly low, however in 2020, after the entire world went into quarantine, the demand for computer systems, tablets, TVs and different tools that requires chips rose sharply. The demand for wafers has elevated a lot that Sumco Corp, the second-largest producer of wafers, stated that its manufacturing is booked till 2026.

Samsung’s Xian, China 300mm wafer facility, Might 2014. Supply: iTers Information

Nevertheless, the manufacturing of processors, GPU playing cards and reminiscence playing cards requires extra than simply silicon wafers. After the beginning of battle actions in Ukraine, world producers of semiconductors confronted a scarcity of neon, which is important for the operation of the laser techniques used to create the chips. The issue is that the 2 Russian corporations, Ingas and Krion, produce 45%–54% of the world’s provide of neon-containing fuel mixtures. How international producers will search for a approach out of this example isn’t but clear.

In March 2022, some consultants believed that the semiconductor scarcity might finish in 2023. Particularly, the top of Micron Expertise, one of many largest producers of laptop reminiscence and laptop knowledge storage, believes that beginning this yr, producers will be capable of construct up a major inventory of chips in addition to prepare provides. In 2023, there might be no such issues and international corporations will largely be capable of attain the extent of manufacturing that that they had earlier than the pandemic.

However the scenario in Ukraine can cease this restoration and redouble the deficit of chips, forcing the worth to rise with renewed vigor. Just lately, Intel has claimed that it has stockpiled and continues to watch provide disruptions whereas looking for different sources of neon. Samsung said that some factories could face shortages, the Dutch ASML, which produces scanners for printing chips which might be utilized by TSMC and Samsung, didn’t disguise their considerations and stated that over the following two years, producers might face a scarcity of main equipment tools.

So what is going to occur to semiconductors within the nearest future, and subsequently to tools? The GPU market might seemingly get better from the COVID-19 pandemic and the declining demand from miners, however international occasions are as soon as once more placing producers to the take a look at with the dearth of elements for the manufacturing of kit. After all, it’s price believing that the enterprise will discover the uncooked supplies and construct new provide chains, however nobody can predict how quickly this will occur. In any case, the scarcity of semiconductors appears to proceed, and GPU card costs will go up once more, however on this case, the miners may have had nothing to do with it.