Whereas a plethora of cryptocurrency property posted excessive double-digit positive factors up to now few days, metaverse tokens didn’t see the identical degree of a rally.

As per CoinMarketcap, of the main metaverse tokens, ApeCoin [APE] noticed probably the most positive factors within the final seven days, with a ten% development in its worth.

It was adopted by Decentraland [MANA], which noticed a 4% rally in its worth inside the identical interval.

Horizon doesn’t look nice for APE holders

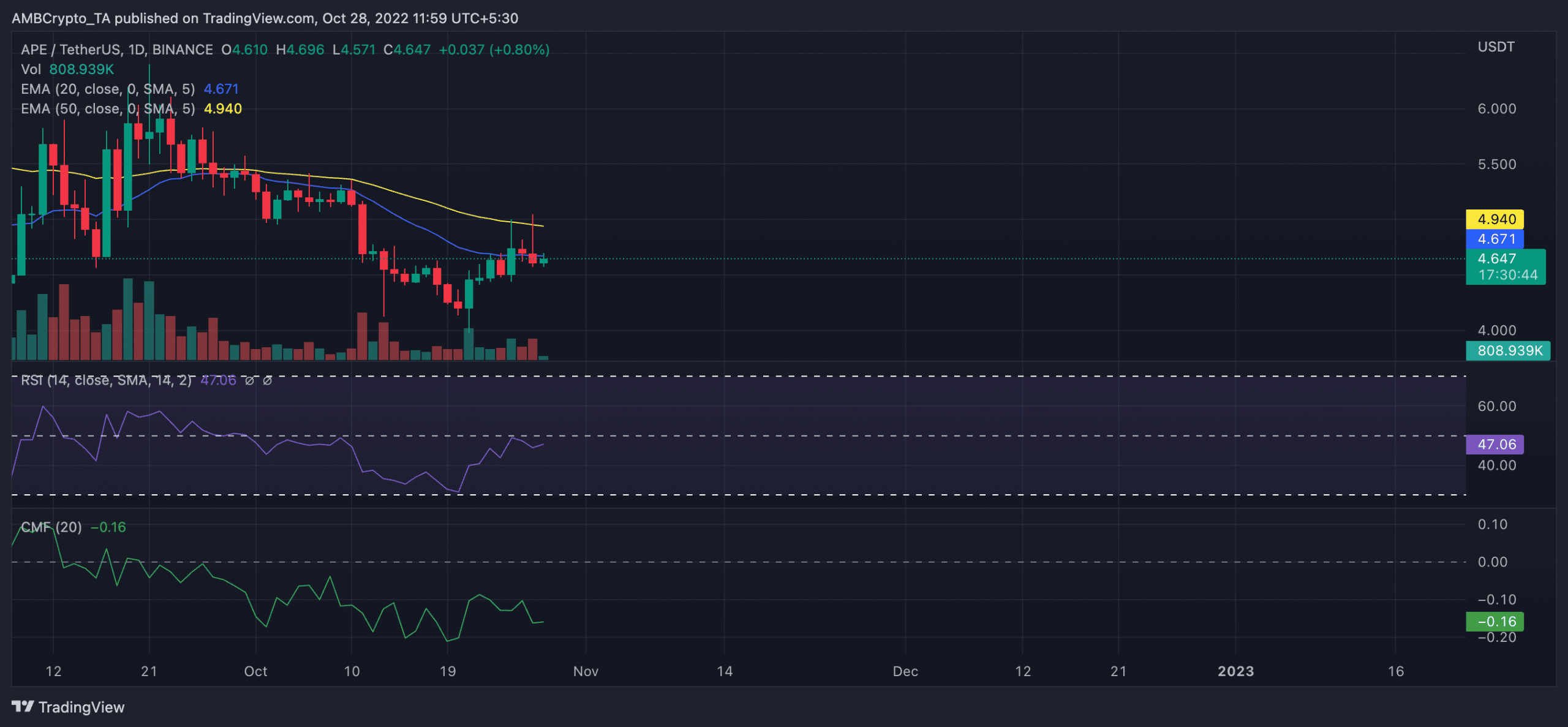

At press time, APE exchanged fingers at $4.65. Its worth had declined by 6% within the final 24 hours, and its buying and selling quantity had additionally dropped by 7%.

As regards APE liquidations inside the identical interval, knowledge from Coinglass confirmed that $729,268 value of APE tokens have been faraway from the cryptocurrency market.

On a day by day chart, shopping for strain appeared to have waned for the main metaverse token. Its Relative Energy Index (RSI) was positioned beneath the 50 impartial spot at 46.

Removed from the middle line in a downtrend, the dynamic line (inexperienced) of APE’s Chaikin Cash Circulate (CMF) was -0.16 at press time. This indicated that purchasing strain had declined severely, and token distribution was the order of the day.

Confirming that the sellers had management of the market at press time, the 20 EMA (blue) was under the 50 EMA (yellow) line, depicting the severity of the continued bear motion.

Supply: TradingView

MANA isn’t any higher

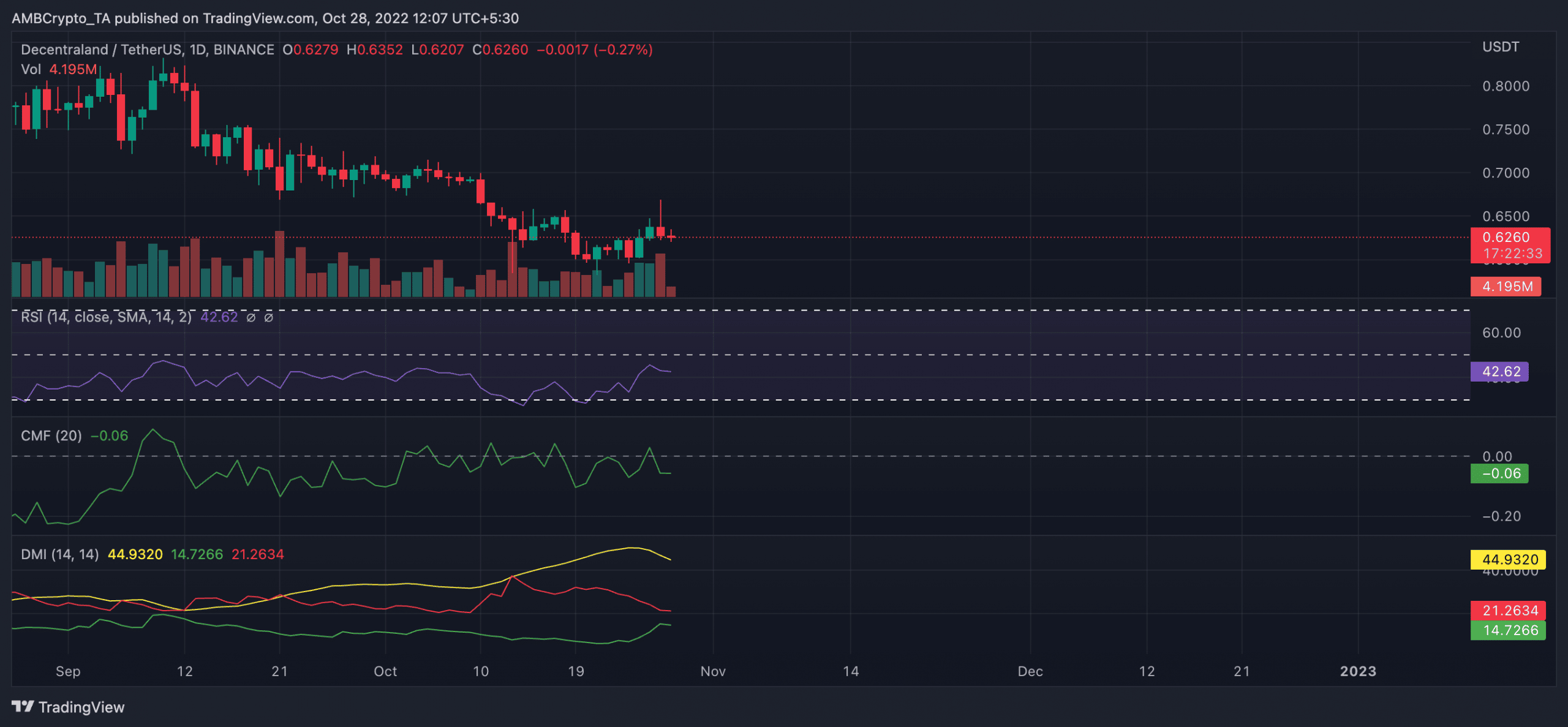

An evaluation of those key indicators additionally confirmed that MANA approached the oversold place at press time and coin distribution rallied. As of this writing, its RSI was 42, whereas its MFI was pegged at -0.06.

As to who had management of the market at press time, MANA’S Directional Motion Index (DMI) confirmed that sellers had management. The sellers’ power (purple) at 21.26 rested above the patrons’ (inexperienced) at 14.72.

Moreover, the Common Directional Index (ADX) confirmed that the sellers’ power was one which patrons may discover tasking to upturn within the brief time period.

This token exchanged fingers at $0.6263 on the time of writing.

Supply: TradingView

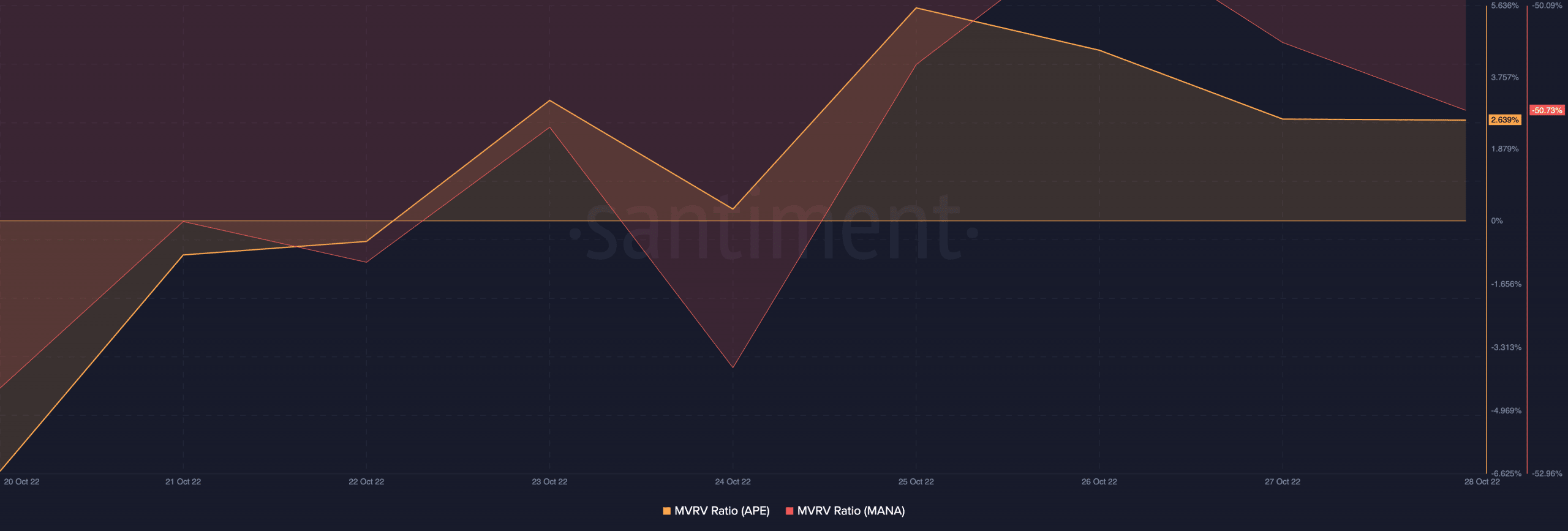

As regards the Market Worth to Realized Worth (MVRV) ratio for each tokens, per knowledge from Santiment, APE’s MVRV was 2.693% at press time.

With its 10% development in worth within the final week, if all holders bought their holdings on the present worth, they might see positive factors on their investments.

MANA, then again, posted a unfavourable MVRV ratio of -50.73% displaying {that a} vital rely of its holders held at a loss.

Supply: Santiment

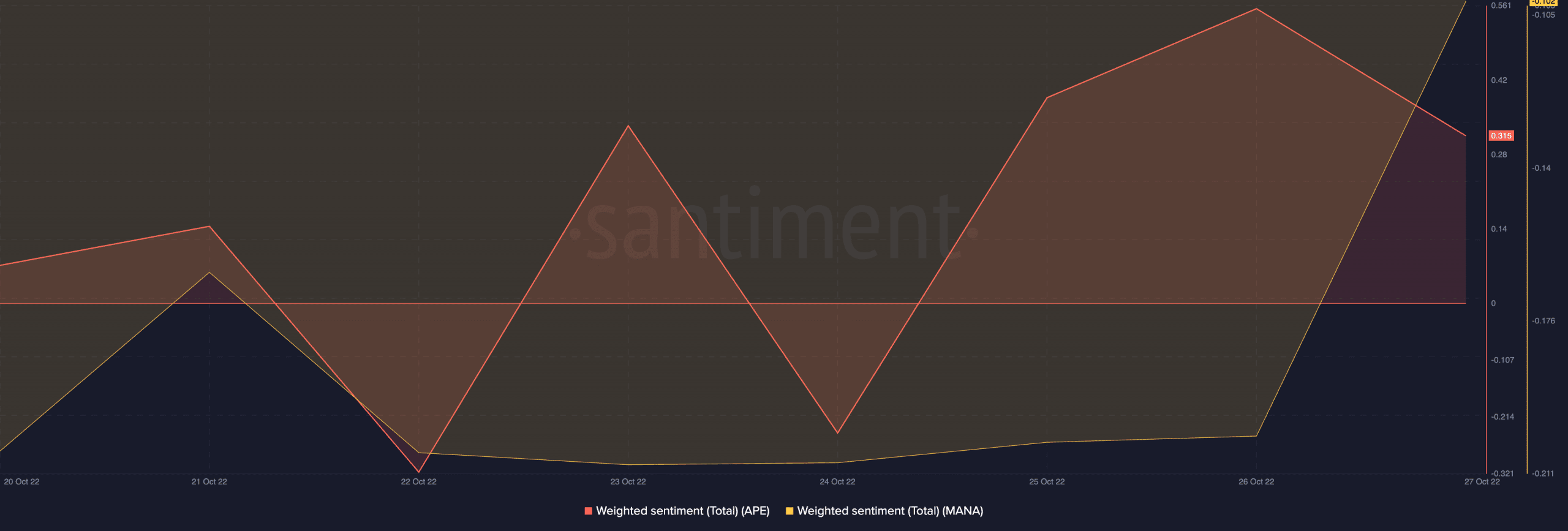

Unsurprisingly, APE loved a constructive bias from its holders, whereas MANA noticed in any other case.

Supply: Santiment