Key Takeaways

- Tokenomics is a area that analyzes typical parts present in economics, equivalent to provide, demand, and utility, and applies it to cryptocurrencies.

- Buyers can simply overestimate provide and demand and underestimate how narratives and memes might also influence a token’s value.

- Phemex, one of many main cryptocurrency exchanges within the business, does intensive tokenomics evaluation earlier than approving tokens for itemizing.

Share this text

When investing in crypto, it’s essential to grasp tokenomics to make knowledgeable selections and keep away from getting rekt.

Tokenomics comes from combining the phrases token and economics and is a area that research the elements that drive demand for tokens. One has to think about elements equivalent to provide and demand, incentive mechanisms, worth accrual, and investor conduct when analyzing a mission’s tokenomics.

An Evaluation of Provide and Demand

The dynamics between provide and demand are the primary issues to research when a mission points a brand new token.

An extra of provide can negatively have an effect on an asset’s worth. We are able to discover examples in fiat currencies which have suffered from hyperinflation and extreme printing (e.g., the Zimbabwean greenback or the Venezuelan Bolivar).

The identical occurs in crypto. You wouldn’t really feel nice if the working provide of the token you’ve simply purchased is barely 30%. Which means the provision has but to extend by one other 70%, probably diluting the value and dropping worth.

On this context, it’s essential to know what Fully Diluted Valuation (FDV) is. FDV is the value of a token multiplied by the full quantity that may ever be in existence, together with tokens not but in circulation. The metric is used to measure if the token is overvalued or undervalued.

If a mission has a excessive FDV throughout its early days, you wish to ask your self who the most important token holders are, at what value they purchased their luggage, and to whom they are going to promote them.

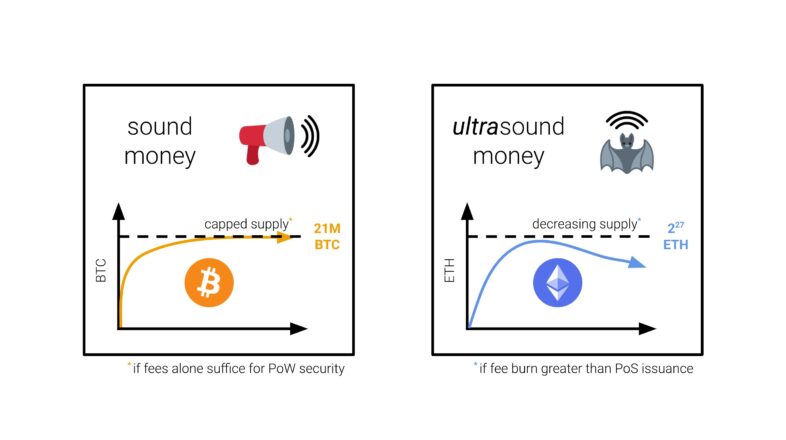

An uncapped provide just isn’t appropriate for the worth of a token both. Tokens like Bitcoin are onerous capped, which means that after the protocol has issued all its tokens, the worth will proceed rising so long as there’s demand.

To maintain a stability between provide and demand, some tokens characteristic fee-burning mechanisms that may trigger the token to turn into deflationary relying on how broadly the community is used. Ethereum, after the implementation of EIP 1559, is an instance of such a mechanism.

Different tokens embrace buyback and burn mechanisms to designed to manage provide and demand. Such is the case for the BNB token.

One other essential component to research is provide relative to market capitalization. If a token has a price of $0.002 and its market cap is round $600,000, have you ever ever thought what the market cap can be if the value elevated to $0.50?

Misperceiving a token’s value relative to its market cap can result in unit bias. This time period describes the idea that holding extra items of a much less priceless coin will ship higher funding outcomes than holding a fraction of a extremely valued coin. That is, partially, why meme cash have been so widespread in current occasions. Consider holding 10,000 canine cash vs. ⅕ of a BTC—one sounds higher than the opposite, however provided that you don’t take note of the costs.

On the opposite facet, we’ve demand. Demand is what drives folks to purchase a token and the way a lot they pay for it. Demand is usually pushed by the token utility, development in worth, and narratives.

Tokens like Ethereum or BNB derive their utility from getting used as a forex to execute software program on these networks. Whether or not it’s to approve an inventory of an NFT assortment or take away your tokens from a liquidity pool, you’ll want the native cryptocurrency of those blockchains to pay for so-called fuel (execution) charges.

One other use case that will increase token utility is when these property are used as a means of exchange for products and services in the true world, like a restaurant accepting crypto in change for menu objects.

Concerning worth accrual, staking is a trait of many tokens that fuels demand and helps enhance the value. When customers stake their crypto in search of rewards, many circulating tokens get locked, reducing promote stress.

Protocols goal to seek out methods to incentivize long-term holding. We see an instance in veTokens (ve=vote escrow), a system that offers voting energy to long-term holders. DeFi protocols usually set up votes to resolve which swimming pools get essentially the most rewards in an try to draw liquidity. Your vote carries extra weight when you maintain a considerable amount of a protocol’s governance tokens.

Some protocols even go as far to penalize unstaking by taking away customers’ veTokens to trigger much less promote stress.

Lastly, tokens can enhance in worth because of having robust narratives or memes. Consider the canine coin frenzies in October 2021. Many NFT tasks got here to life as pure speculative memes with utility from their utilization as profile pics.

With time, tasks like JPEG’d are arising with new methods to mix the world of NFTs with DeFi increasing their utility.

Whereas understanding tokenomics is key to understanding funding selections in crypto, it’s not the all-important component. Narratives may also create pleasure or apathy in the direction of a token, influencing its value.

Phemex, one of many main cryptocurrency exchanges within the business, rigorously evaluates every token’s financial mannequin earlier than itemizing on the platform. For instance, the change gives excessive staking rewards from the particular options of a listing of tasks which have undergone deep tokenomics evaluation. You possibly can study extra about these tasks by visiting the Phemex Launchpool site.