AMC has introduced a 22% acquisition in Hycroft Mining Holdings for a $27.9 million funding. Commenting on the deal, AMC CEO Adam Aron mentioned he noticed parallels between Hycroft’s present scenario and AMC a 12 months in the past, including that the funding might prove mutually useful.

“It, too, has rock-solid belongings, however for a wide range of causes, it has been dealing with a extreme and fast liquidity difficulty. Its share worth has been knocked low consequently. We’re assured that our involvement can significantly assist it to surmount its challenges — to its profit, and to ours.”

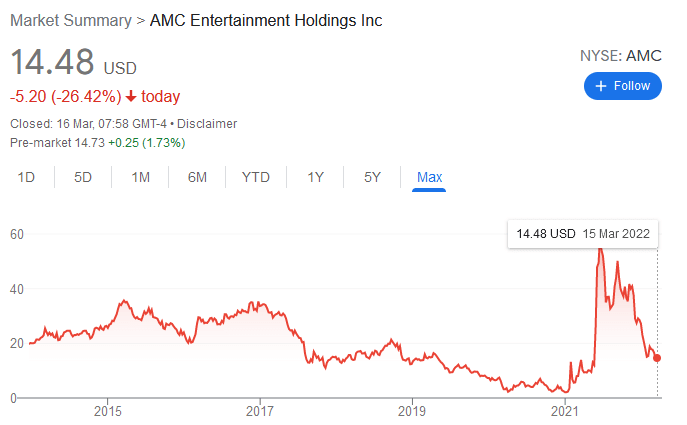

AMC, and fellow meme inventory GameStop, have did not recapture the keenness of final 12 months’s WallStreetBets motion, no less than from a share worth perspective. Contemplating the macro image, it seems that AMC is hedging with treasured metals over cryptocurrency.

For an organization that has championed the crypto trigger since its meme inventory revival, for instance, in accepting Shiba Inu and Dogecoin as cost strategies, the funding in Hycroft is one thing of a letdown.

Analysts predict extra ache for AMC

Final 12 months, each AMC and GameStop had been the beneficiaries of the WallStreetBets motion, which sought to show grasping institutional short-sellers a lesson.

AMC inventory surged, attaining an all-time excessive of $59.26 in June 2021. However since then, it’s been downhill for the cinema chain as buyers look elsewhere.

Evaluation of AMC’s annual monetary outcomes exhibits income for the 12 months ending December 31, 2021, is up 103% to $2.53 billion. Nevertheless, that is nonetheless lower than half that of 2017, 2018, and 2019.

Equally, web earnings is up 72% for 2021 however nonetheless working at a lack of $1.27 billion. In brief, whereas the WallStreetBets motion supplied a jolt to the underside line, the corporate remains to be unprofitable. And towards a backdrop of tightening spending, the outlook is gloomy.

Forbes says, regardless of the drawdown, die-hard buyers are nonetheless holding on for a return to the fervor of final 12 months. This gives “a superb setup for the shares to endure a meltdown.” They add that commonsense and actuality are making a comeback, which spells doom for corporations which can be massive on easy-money hypothesis.

“GameStop and AMC Leisure even have dropped and diminished features considerably. Nevertheless, every remains to be above its preliminary, decrease share worth. Judging by the Reddit commentary, the meme-stock troops nonetheless have hopes that final 12 months’s pleasure will return.”

Why put money into treasured metals over cryptocurrency?

Regardless of the lifting of restrictions, cinema-goers, significantly these aged 40+, which made up 40% of frequent filmgoers pre-pandemic, are much less smitten by gathering in indoor areas with strangers for prolonged intervals.

Coupled with the provision of all kinds of house streaming providers, AMC is up towards it by way of convincing folks to return. Add to that surging inflation and the related minimize in pointless expenditure, and the scenario is all of the extra precarious.

Whereas many had anticipated AMC to increase its digital asset operations in response, Bloomberg says the crypto secure haven narrative has come into query of late. For that purpose, it’s not stunning AMC snubbed crypto in favor of gold.

In any case, gold has confirmed itself with hundreds of years of historical past, whereas there is no such thing as a information with which to mannequin Bitcoin’s habits throughout an financial collapse.

AMC’s funding in Hycroft may very well be referred to as the secure play.