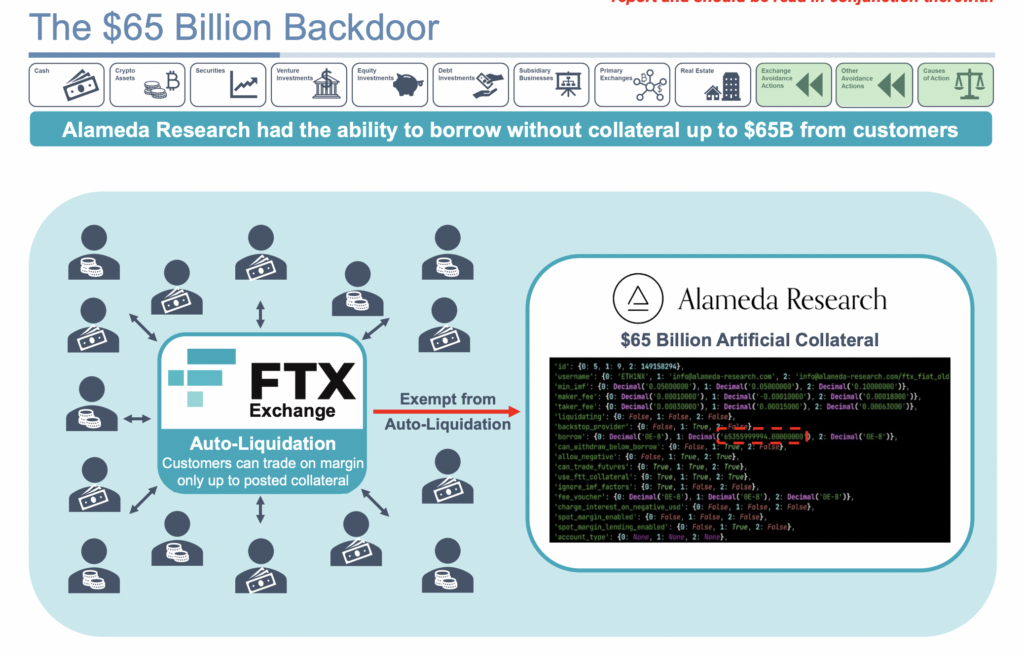

A latest court docket submitting within the FTX chapter case has revealed a “$65 billion backdoor” between Alameda and FTX. The submitting features a deck detailing the present findings relative to FTX group funds.

The deck consists of an illustration of the FTX liquidation course of alongside a code pattern that allegedly represents the Alameda backdoor.

Whereas clients had been auto-liquidated based mostly on the margin phrases supplied by FTX, Alameda was allegedly exempt from auto-liquidation. Additional, Alameda was not required to publish any actual collateral for trades. As a substitute, it was allowed to commerce with “synthetic capital.” If confirmed true in court docket, this offense alone can be certainly one of historical past’s most vital examples of fraud.

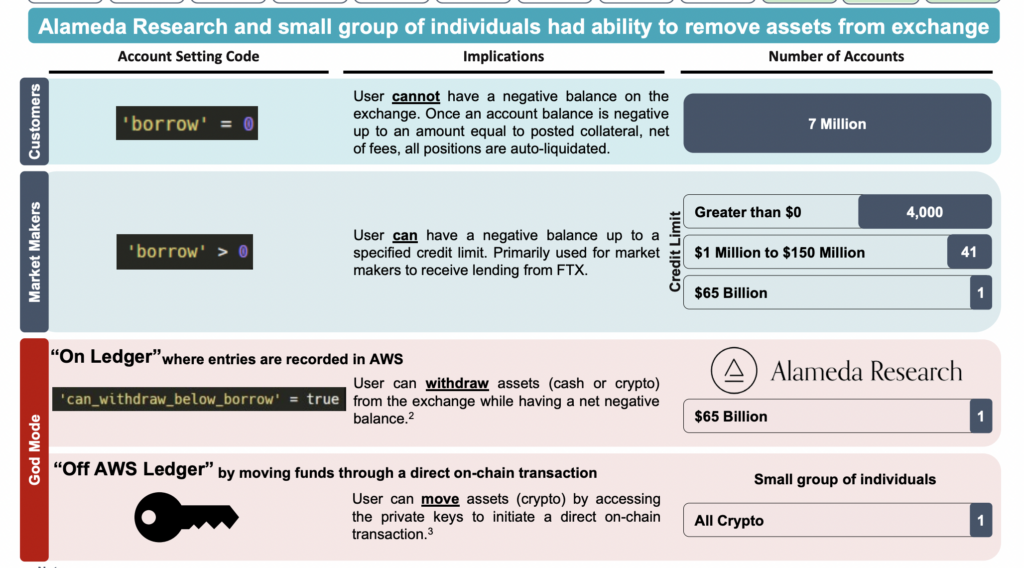

Much more damningly, the deck additionally confirms the existence of a ‘god mode’ by which a small group of people had been in a position to transfer funds off the alternate. Examples of the code for every group had been illustrated by way of a selected “account setting code” within the alternate’s codebase.

Seven million customary clients’ entry codes had been set so they may not borrow if their balances had been zero. Market makers for the corporate had credit score limits of as much as $150 million. Seemingly, 4,000 market markets had credit score limits as much as $1 million, with an extra 41 between $1 million and $150 million.

Nevertheless, Alameda had entry to $65 billion, some 43,000% greater than the most important credit score restrict given to different market makers. As well as, Alameda’s credit score line was categorized as part of the ‘god mode’ that allowed particular privileges. The ability additionally allowed Alameda to withdraw money or crypto whereas having a unfavourable steadiness. All of those transactions had been recorded on FTX’s Amazon AWS servers.

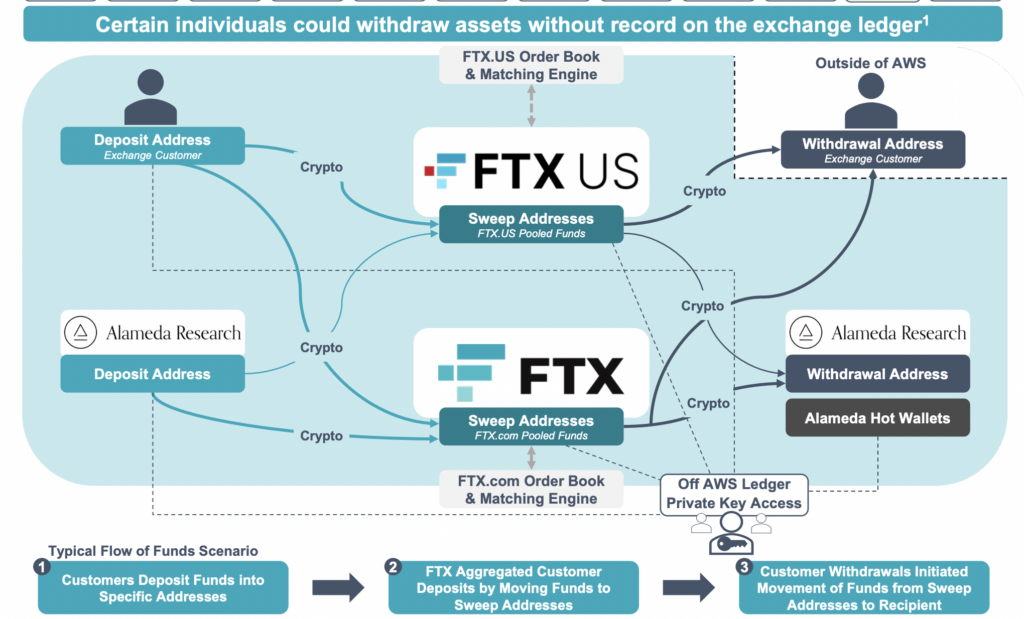

Moreover, a “small group of people” had an “off AWS Ledger” switch capacity permitting them to maneuver funds and not using a hint. These transfers had been accessible throughout any crypto held by FTX however not money. Customers with this degree of clearance had entry to particular wallets’ personal keys, permitting them to provoke on-chain transactions immediately.

The flowchart of FTX’s AWS cash move can also be illustrated throughout the deck. The chart under reveals how funds had been coming throughout a number of events between FTX and FTX.US.

Throughout his look earlier than the Home of Representatives in December, FTX CEO John Ray III described the monetary document conserving at FTX as among the worst he’d seen in his profession and famous unacceptable administration practices, together with the commingling of belongings and lack of inner controls