After the earlier week, which noticed the deterioration of one of many largest crypto exchanges, this one was considerably much less risky when it comes to worth actions however fairly eventful for experiences popping left and proper that exposed intriguing data concerning SBF, FTX, Alameda, and different concerned events.

Let’s begin with the value developments. The first cryptocurrency had already suffered rather a lot from the FTX meltdown, dropping from over $21,000 to a two-year low of $15,500 final week. It tried to get better some floor in the course of the weekend and briefly hopped to $17,000 earlier than it plummeted beneath $16,000 on Monday.

After one other risky buying and selling day, BTC returned to $17,000 and spent a lot of the subsequent few days there. It tried to beat that line on a couple of events however to no avail, with the most recent rejection coming simply hours in the past.

Most of bitcoin’s worth actions have been associated to new data associated to FTX, Alameda, or the particular person behind each entities – Sam Bankman-Fried. Equally, initiatives extremely associated to them have been additionally affected, even worse. Such is the case with Solana, which noticed corporations like Tether tried to distance themselves. In the end, this pushed SOL’s worth additional south.

The general state of affairs with the crypto market is quite gloomy on a weekly scale, although. Ethereum is down by 5%, Binance Coin by 8%, Cardano by virtually 10%, whereas MATIC has seen an 18% decline.

The cumulative market cap of all crypto property has gone all the way down to $833 billion on CoinMarketCap. BTC’s dominance stands at 38.5%, whereas its personal market cap is struggling to stay above $320 billion.

Market Knowledge

Market Cap: $833B | 24H Vol: 49B | BTC Dominance: 38.5%

BTC: $16,630 (-2%) | ETH: $1,212 (-5%) | BNB: $271 (-8%)

Can’t-Miss Crypto Headlines From This Week

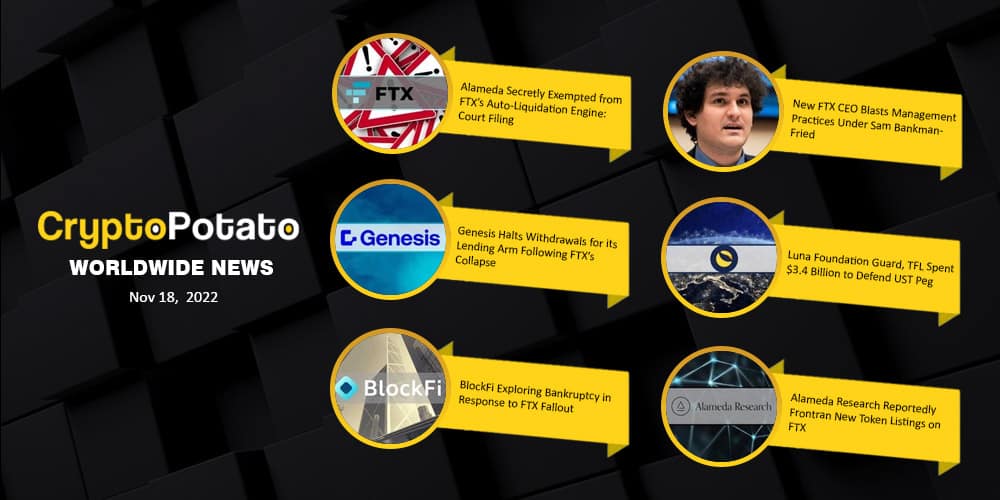

Alameda Secretly Exempted from FTX’s Auto-Liquidation Engine: Courtroom Submitting – The brand new CEO of FTX, who stepped as much as take cost in the course of the firm’s troubled instances, revealed some stunning particulars about how each entities have been run. One in every of them indicated that Alameda was secretly exempted from FTX’s auto-liquidation engine.

New FTX CEO Blasts Administration Practices Underneath Sam Bankman-Fried – The CEO went into extra element in regards to the failed practices at FTX and mentioned he had by no means “seen such a whole failure of company controls and such a whole absence of reliable monetary data as occurred right here.”

Genesis Halts Withdrawals for its Lending Arm Following FTX’s Collapse – Being one of many largest crypto exchanges with relations to many different business corporations, FTX’s collapse meant that many different contributors will ultimately get damage. One of many first to cease withdrawals for its lending arm was Genesis.

Luna Basis Guard, TFL Spent $3.4 Billion to Defend UST Peg: Report – A uncommon non-FTX information from this week got here from a report claiming that the Luna Basis Guard and Terraform Labs had spent over $3 billion making an attempt to defend UST after it misplaced its peg towards the greenback.

BlockFi Exploring Chapter in Response to FTX Fallout: Report – One other firm with ties to FTX that’s affected by the opposed developments is BlockFi. Though the rumors are nonetheless unconfirmed, some experiences declare that the crypto lender has begun exploring chapter following the FTX collapse.

Alameda Analysis Reportedly Frontran New Token Listings on FTX – Extra stunning information about Alameda and FTX – this time, WSJ reported that SBF’s buying and selling arm – Alameda Analysis – frontran new token listings on FTX, which is very unlawful.

The publish Alameda, FTX within the Highlight, BTC Loses $17K as Contagion Spreads: This Week’s Recap appeared first on CryptoPotato.