Mining

Ethereum’s long-awaited transition to a proof-of-stake (PoS) consensus mechanism kicked off on Sept. 15, thus lastly placing its long-standing transaction woes within the rearview mirror. Thus far, the community is now able to processing anyplace between 20,000–100,000 transactions per second (tps) versus its earlier charge of simply 30 tps.

Moreover, the Merge additionally noticed the Ethereum community change into as much as 99.9% extra power environment friendly as in comparison with its earlier iteration, thus allaying fears of its extreme power consumption, a criticism that also lingers fairly closely in relation to Bitcoin (BTC).

Amid these developments, nonetheless, a query that has continued to pique the curiosity of many crypto lovers: “What occurs to the graphics processing unit market now that the transition has concluded?”

It’s price noting that following the Merge, the blockchain transitioned from its energy-intensive proof-of-work (PoW) mechanism to a PoS framework. In consequence, miners that used to course of transactions and produce blocks had been changed by ecosystem individuals who can now stake their Ether (ETH) holdings to change into community validators. In consequence, Ethereum-centric graphics processing unit (GPU) mining has been fully eradicated from the image.

The numbers don’t lie

After the conclusion of the improve, the worth of quite a few sought-after GPUs has dropped fairly drastically. For instance, stories point out that the worth of Nvidia’s extremely fashionable RTX 3080 has dipped from $1,118 to roughly $700 (over the past three-month stretch) inside China. Equally, the value of GPUs manufactured by corporations like MSI has dropped by $280 since late July.

Current: Is Bitcoin an inflation hedge? Why BTC hasn’t faired nicely with peak inflation

To get a greater concept of whether or not these worth drops might have been influenced by the hype surrounding the Ethereum Merge, Cointelegraph reached out to Crypto White, the pseudonymous chief technical officer for ZK.Work — a mining platform for zero-knowledge proofs. He identified that earlier than the Merge, ETH had a complete of 860 TH/s hashing energy, of which lower than 200TH/s went to Ethereum Traditional (ETC) and ETHW, a PoW fork of ETH that went stay after the improve, alongside different mining initiatives, whereas 660TH/s was shut down quickly.

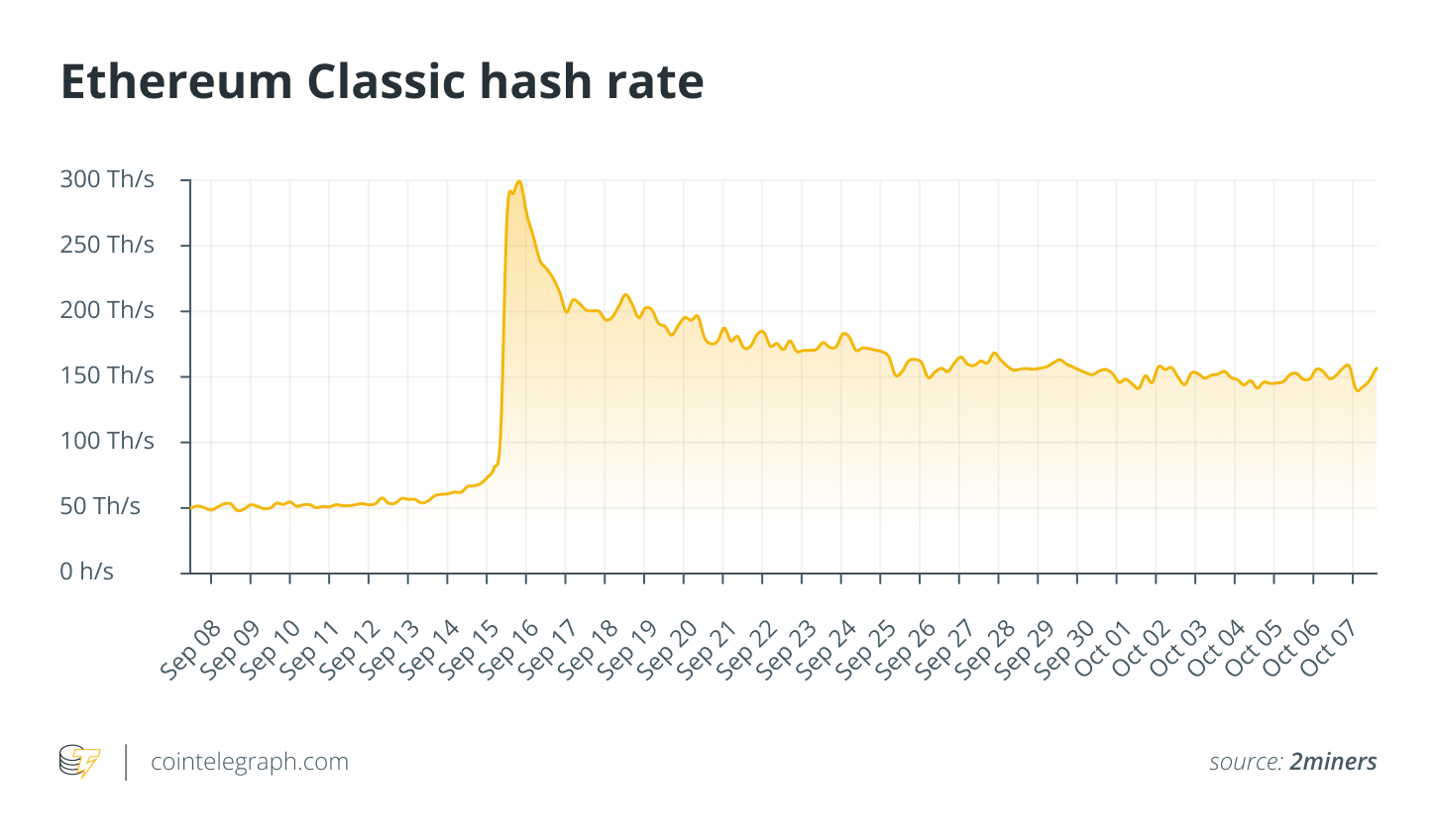

Alluding to ETC’s above-shown hash charge chart, White famous that the incoming hashing energy appears to have been exiting the community steadily since mid-Sept i.e., the time of the Merge. On this regard, it’s speculated that the value of ETC didn’t rise as anticipated, with the inflow of this computing energy main a number of miners to close down their operations completely. White added:

“This exhibits that the cryptocurrency mining market has an enormous variety of idle GPUs and the income from conventional mining can not help their working prices, so they’re shutting down and dealing with the selection of ready for brand spanking new mining alternatives or promoting them second-hand.”

He additional claimed that many used NVIDIA 30 collection GPUs have not too long ago entered the secondary marketplace for sale, lowering the value of GPUs much more. Nonetheless, as probably profitable minable cash proceed to enter the market within the close to time period, White believes that these GPUs could as soon as once more discover utility.

What lies forward for the GPU market?

As is clear by now, the Ethereum Merge has served as a serious technical and industrial improve for the cryptocurrency mining sector as a complete. Offering his tackle the matter, Ilman Shazhaev, founder and CEO for blockchain gaming metaverse Farcana, informed Cointelegraph that regardless of this obvious setback, the GPU trade is now an evergreen area of interest, particularly with the continued emergence of various PoW protocols with every passing day:

“Regardless of the transition, there isn’t a discount within the variety of protocols that wants GPUs, and this may assist maintain the demand for these gadgets within the close to future. Additionally, with the gradual embrace of metaverse-centric improvements, the demand for GPUs, that are a key part of most gaming consoles, will probably be sustained.”

In White’s opinion, GPUs won’t change into less expensive anytime quickly, with their costs more than likely having stabilized round their present charges. In reality, he believes that the value adjustments we’re witnessing now had “already been factored” in earlier than the Merge, including that to construct momentum for the launch of their upcoming GPUs, producers like Nvidia had already began clearing out their inventories someday in the past. He mentioned:

Current: The blue fox: DeFi’s rise and the beginning of Metamask Institutional

“I imagine the value of used GPUs will slowly decline, and low-end GPUs will most likely go extinct from the market altogether. Then again, I imagine demand for high-end GPUs will improve.”

Lastly, it needs to be famous that, in a situation the place there are not any tokens to mine, it stands to purpose that GPU prediction charges will even be affected, with most producers more than likely reverting again to their “order-based manufacturing” processes for the reason that mining increase of the previous few years had led to huge stockpiling.

ETH worth motion lackluster regardless of effectivity improve

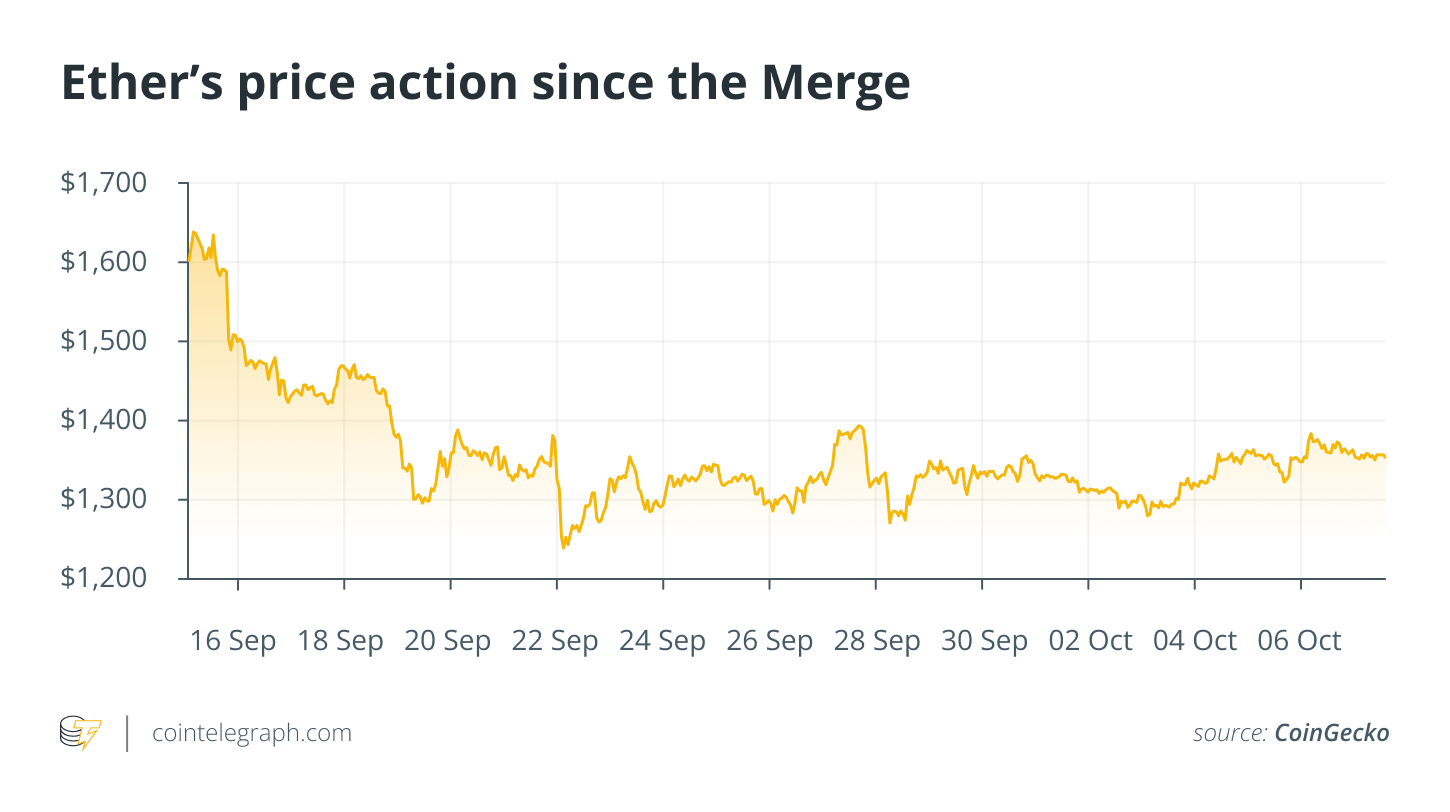

As famous beforehand, with the conclusion of the Merge, Ethereum’s power consumption has gone down by a staggering 99.9%, leading to a 0.2% discount in world energy consumption. Regardless of these important developments, nonetheless, ETH’s worth motion has been extraordinarily poor, nearly sudden within the eyes of many.

As might be seen from the chart above, since Sept. 16, the altcoin has slipped from $1,630 to its present worth level of $1,330, showcasing a lack of roughly. 22%. On this regard, consultants imagine that this lack of constructive worth momentum might be as a result of upward actions having already been priced into the forex’s worth a few weeks earlier than the improve.

Thus, though the Ethereum community has gotten rid of GPU mining fully, some sections of miners should still try and preserve their cash-cow working, as is made evident by the truth that a number of proposals to repeat the Ethereum blockchain, similar to ETHW — whereas retaining mining capabilities — have gained some traction. That being mentioned, whereas it’s fairly simple to develop such a token, this can be very laborious to persuade folks to make use of it. Due to this fact, it is going to be attention-grabbing to see how the way forward for Ethereum’s varied PoW laborious forks and the GPU market continues to unfold from right here on out.