A extensively adopted crypto analyst is waiting for 2023 after a troublesome 12 months of Bitcoin (BTC) buying and selling in 2022.

Pseudonymous crypto dealer Rekt Capital is offering their 331,700 Twitter followers phrases of encouragement and hope following a serious bear market 12 months for BTC.

“2022 was a troublesome 12 months for BTC traders

Just about uninterrupted drawdown, with very room for reduction to quickly get pleasure from

Emotionally difficult

2023 nevertheless can be completely different

It can take a look at the endurance of traders, some could develop into disinterested.”

The analyst then seems to be at BTC’s “macro triangles” on a chart displaying Bitcoin’s broader value actions since 2014. In keeping with Rekt’s analysis, the king crypto is nearing the value ranges that, traditionally, point out a reversal is nigh.

“In keeping with the BTC Three Macro Triangles:

BTC retraces between -50% to -65% upon triangle breakdown

To date, BTC is down -50% from the triangle breakdown

BTC has entered that historic vary.”

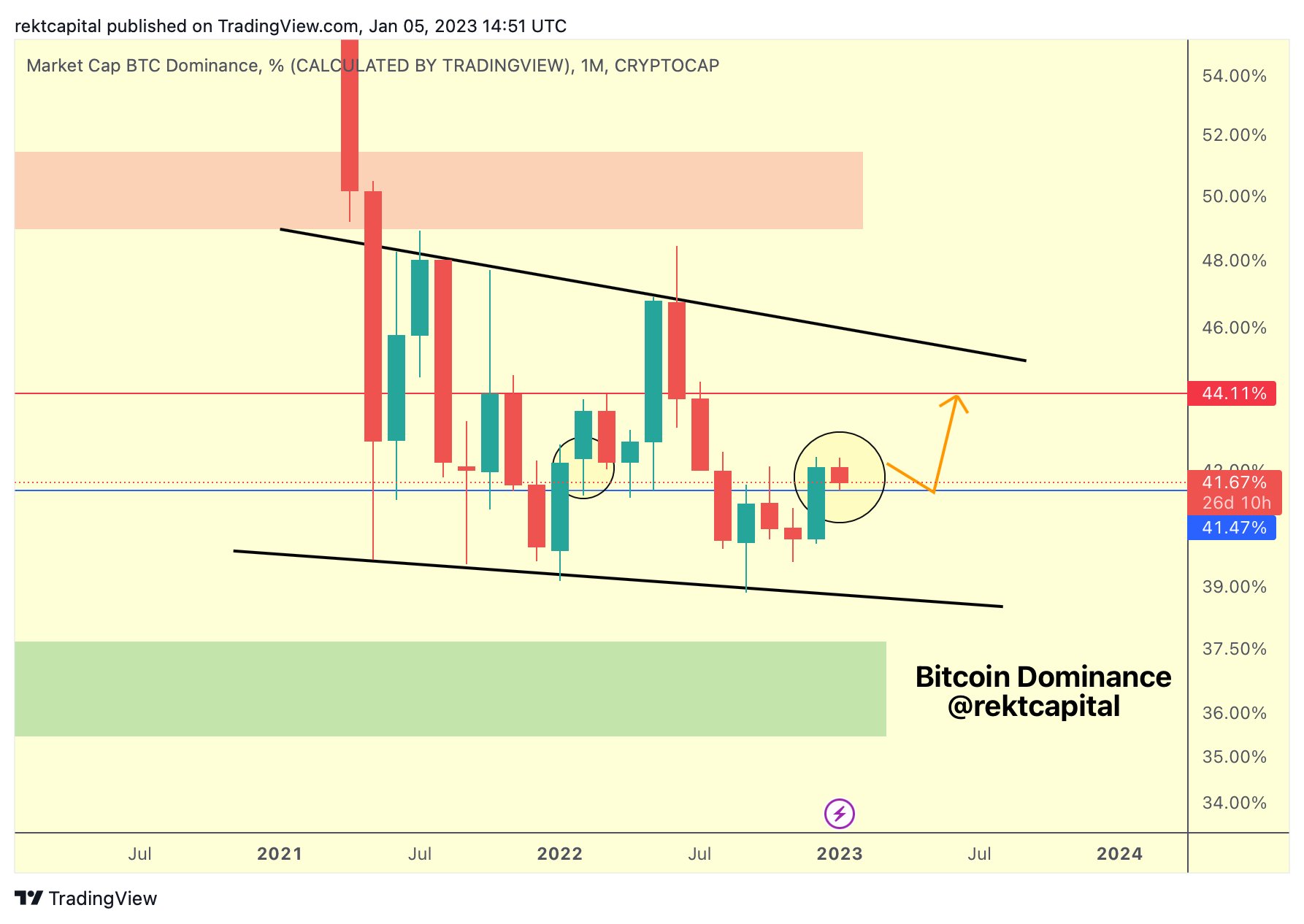

Subsequent, Rekt Capital looks at Bitcoin dominance (BTC.D). The BTC.D chart tracks how a lot of the overall crypto market capitalization belongs to Bitcoin. A bullish BTC Dominance suggests Bitcoin is rising sooner than different crypto property, or altcoins are dropping worth whereas the main crypto surges. In keeping with Rekt, BTC’s dominance is on the rise.

“Preliminary indicators that BTC Dominance is efficiently retesting the blue stage as assist

Altcoins are at present experiencing some pullbacks

These Altcoins pullbacks will proceed, particularly if BTC Dominance begins to extend from right here by way of the orange pathway.”

Bitcoin is buying and selling for $16,819 at time of writing, down 75% from its November 2021 all-time excessive.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney