Crypto authorized professional Jeremy Hogan says that the attainable misappropriation of consumer funds by disgraced crypto change FTX might quantity to a prison offense.

Hogan tells his 243,300 Twitter followers that FTX’s phrases of service forbade the crypto change from utilizing its prospects’ digital property for any function in any way.

FTX filed for chapter 11 chapter on November eleventh amid accusations that its founder Sam Bankman-Fried misused buyer funds.

Says Hogan,

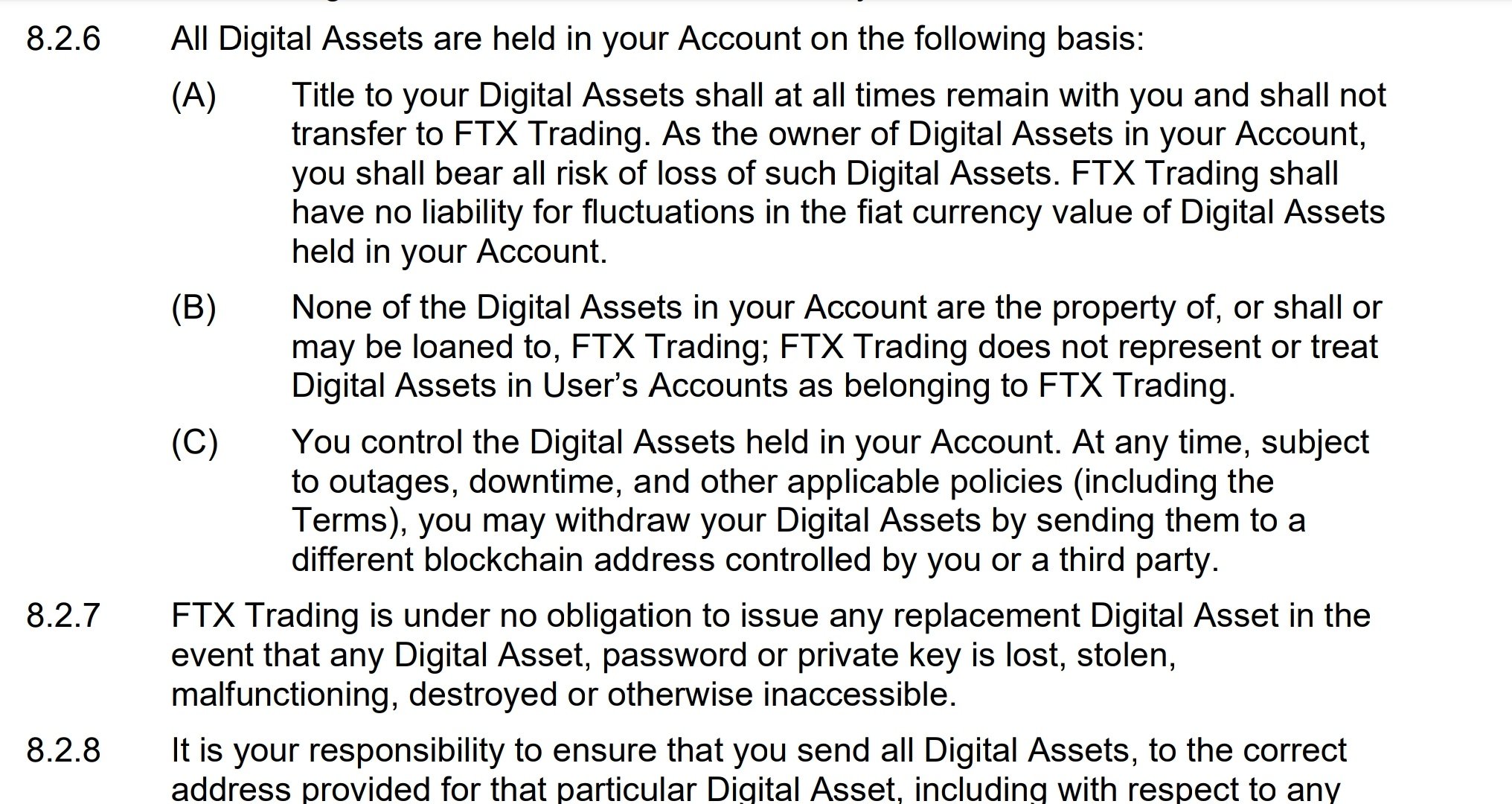

“The FTX phrases of service are VERY clear.

All digital property had been to be held in customers’ accounts and NOT be utilized by FTX for any function (e.g. speculative investments).

There’s no wiggle room. It’s what I might name a ‘gran problema’ for them.”

Amongst different issues, FTX’s phrases of service states that the crypto change won’t ever assume possession of customers’ digital property.

“Not one of the Digital Belongings in your Account are the property of, or shall or could also be loaned to, FTX Buying and selling; FTX Buying and selling doesn’t symbolize or deal with Digital Belongings in Consumer’s Accounts as belonging to FTX Buying and selling.”

Contrasting FTX with collapsed digital asset lender BlockFi, the crypto authorized professional says the latter had a distinct language in its phrases of service.

“BlockFi, alternatively, was very clear in its phrases of service that it was not custodian or fiduciary of any buyer property.

And that, in authorized fallout phrases, may very well be the distinction between a ‘cash’ downside and a ‘jail’ downside.”

In response to BlockFi’s phrases of service for personal purchasers, the crypto lender assumes full possession rights of customers’ digital property which might be underneath a mortgage.

“Besides the place prohibited or restricted by relevant regulation, BlockFi has the correct, with out additional discover to you, to pledge, repledge, hypothecate, rehypothecate, promote, lend, or in any other case switch, make investments or use any quantity of such cryptocurrency supplied by you underneath a Mortgage, individually or along with different property, with all attendant rights of possession, and for any time period and with out retaining in BlockFi’s possession and/or management a like quantity of cryptocurrency, and to make use of or make investments such cryptocurrency at its personal threat.”

BlockFi filed for chapter 11 chapter earlier this week

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/NeoLeo