Abstract:

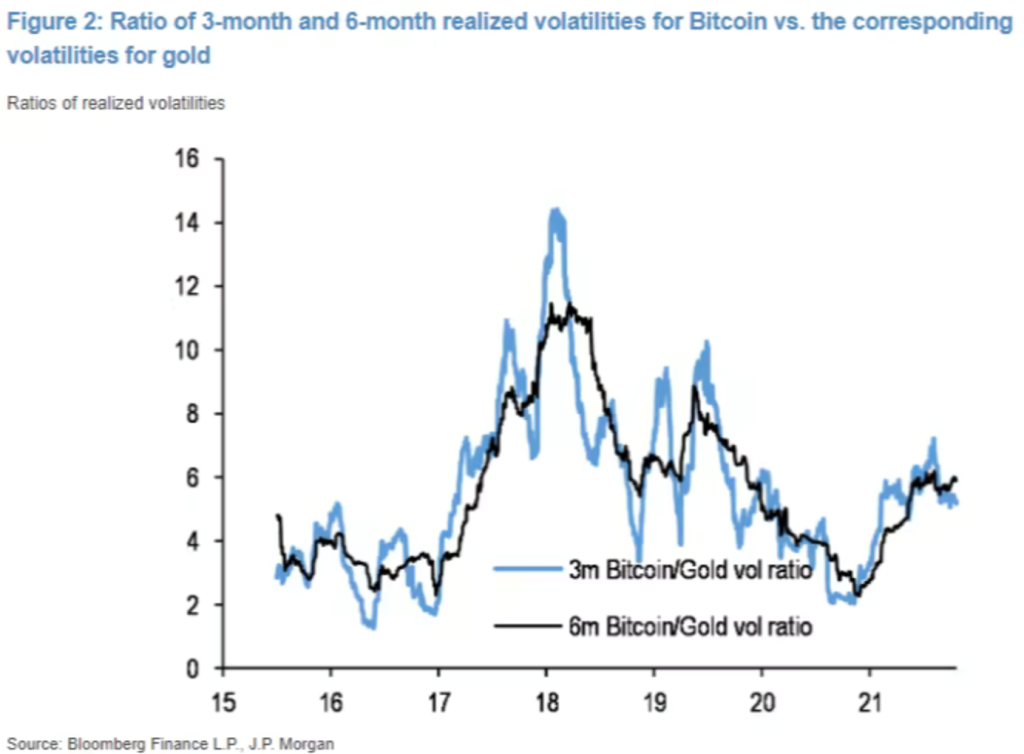

- A chart by the staff at JP Morgan Chase superimposes Bitcoin’s and Gold’s ratios of realized volatilities and hints that BTC is performing so much just like the latter asset.

- Bitcoin’s market cap and that of Gold may ultimately equalize as they serve the identical objective.

- However Bitcoin’s volatility hinders its market cap from rising to the extent of Gold.

- Analysts forecast that Bitcoin may retest $20k or decrease this yr.

- Guggenheim’s Chief Funding Officier sees Bitcoin retesting $8k or decrease because it has but to show itself as a reputable institutional funding.

A chart by the staff at JP Morgan Chase hints that Bitcoin is at the moment performing so much like Gold. The chart, shared under and courtesy of the staff at Fortune journal, exhibits the ratio of the three-month and six-month realized volatilities of Bitcoin versus that of Gold.

Bitcoin’s and Gold’s Market Cap may Equalize as they Serve the Similar Function.

Moreover, the report by the staff at Fortune additionally forecasts that the whole market cap of Bitcoin and Gold may ultimately equalize as they serve the identical objective. However, the market cap of Bitcoin held by institutional traders won’t improve quickly until its volatility stabilizes to comfy ranges, as defined within the following assertion.

…as a result of volatility is so important in relation to institutional traders’ danger administration, the market cap of Bitcoin held by establishments possible received’t attain gold’s degree till its volatility subsides.

Guggenheim’s Chief Funding Officer sees Bitcoin retesting $8k

With respect to Bitcoin’s short-term value motion, the report by the Fortune MAgazine staff hinted that BTC may fall to under $20k earlier than the top of this yr.

The potential of Bitcoin buying and selling under $20k was additionally shared by Guggenheim’s Chief Funding Officer, Scott Minerd, in a Bloomberg interview on the World Financial Discussion board in Davos, Switzerland. Throughout the interview, Mr. Minerd said that he anticipated Bitcoin to fall to $8,000 and that the crypto market is stuffed with ‘a bunch of yahoos.’

In accordance with his evaluation, Bitcoin, on a elementary degree, must be price $400,000 primarily as a result of US Fed’s ‘rampant cash printing.’ Nonetheless, a flash to $8k is perhaps needed to permit for additional progress. Moreover, he said that the Bitcoin and Crypto markets have but to go the take a look at as credible institutional investments. He said:

Bitcoin and any cryptocurrency at this level has probably not established itself as a reputable institutional funding.

Every thing is suspect. Nobody has cracked the paradigm in crypto. We’ve 19,000 digital currencies … most of them are junk.