- Litecoin beat different high cryptos to register probably the most features within the final 24 hours

- The most recent rally is much less prone to be sustained contemplating unimpressive circulation and attainable sell-offs

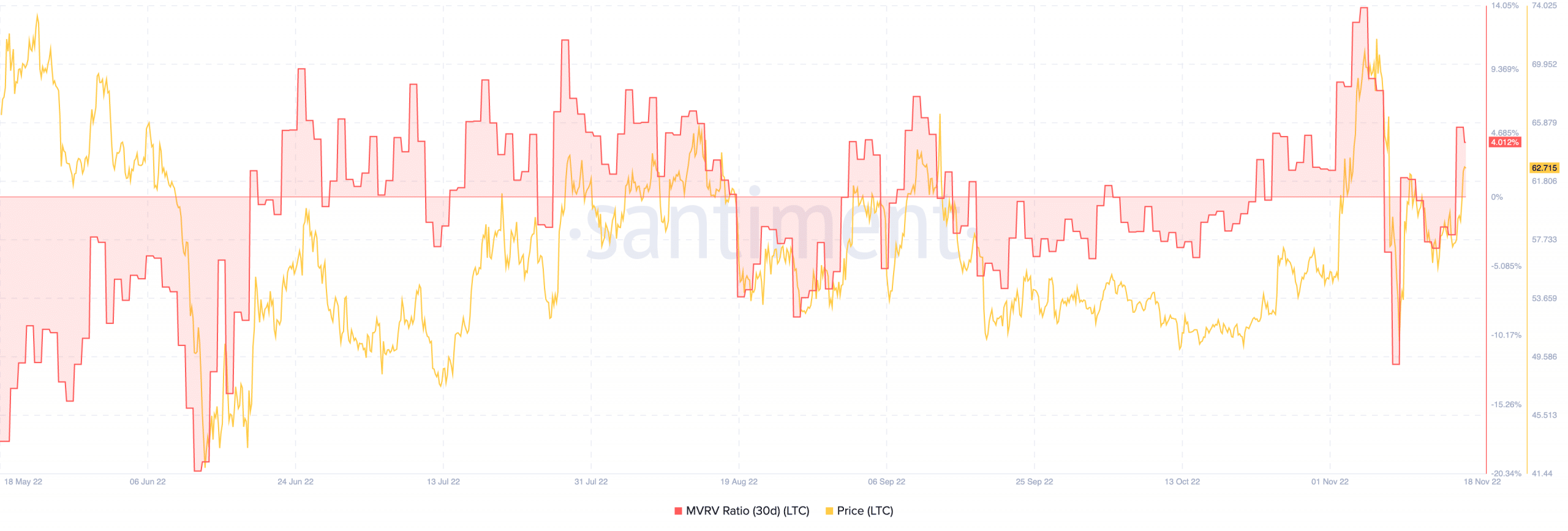

Litecoin [LTC] recorded the very best features within the final 24 hours out of the market’s top-20 cryptos. In accordance with CoinMarketCap, the altcoin was buying and selling at $62.21 at press time, having appreciated by 7%. Following the uptick, Santiment famous that buyers who accrued some LTC over the past thirty days have been on the point of including 50% features to their asset worth. This inference was due to the standing revealed by the Market Worth to Realized Worth (MVRV) ratio.

Right here’s AMBCrypto’s Worth Prediction for Litecoin for 2023-2024

In all probability a one-off

In accordance with the identical, LTC’s thirty-day MVRV rose to 4.651%. Apparently, the identical metrics had plunged to -12.30% on 9 November, leaving buyers and long-positioned merchants in ruins. Nevertheless, the most recent upturn meant LTC appeared dogged sufficient to resist the strain the market has confronted not too long ago.

Supply: Santiment

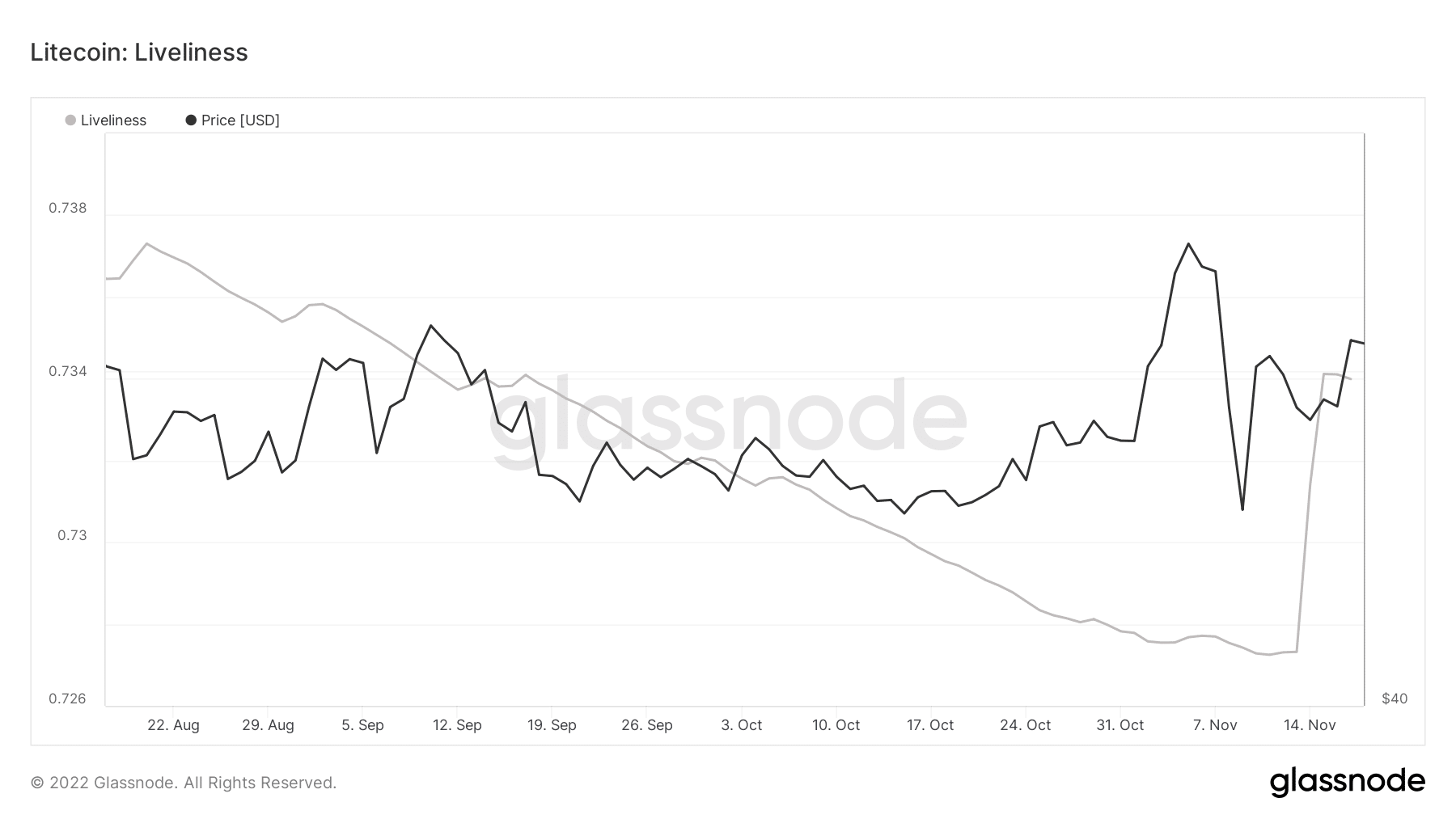

Nevertheless, LTC gave the impression to be recording a lot decrease accumulation, based on Glassnode information. Moreover, Litecoin’s liveliness was as excessive as 0.733.

This state implied that an enormous variety of LTC long-term buyers is likely to be liquidating their positions. As well as, this might additionally imply that buyers could possibly be cautious of an impending worth reversal.

Supply: Glassnode

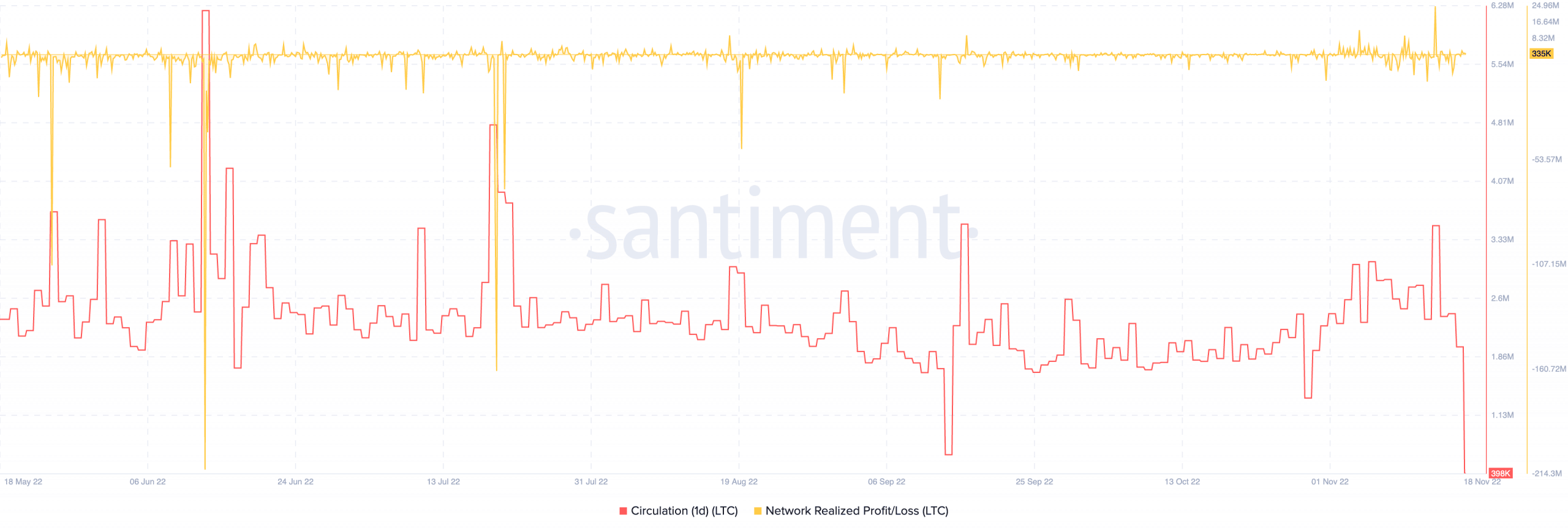

Regardless of the recorded worth incline, short-term buyers would possibly should be cautious of holding on to the coin. This, as a result of the one-day LTC circulation was nothing in need of gloomy. In accordance with Santiment, the one-day circulation had considerably fallen to 398,000. Apparently, this fall didn’t immediately start over the past 24 hours.

Knowledge from Santiment revealed that it has been declining because it final hit a excessive of three.5 million on 14 November. Due to this fact, the standing aligned with that of liveliness. This, as a result of lowering circulation meant fewer distinctive LTC cash have been concerned in transactions because the aforementioned date.

Moreover, the community realized revenue and loss at 335,000 urged that long-term buyers remained within the gray.

Supply: Santiment

The place does LTC go from right here?

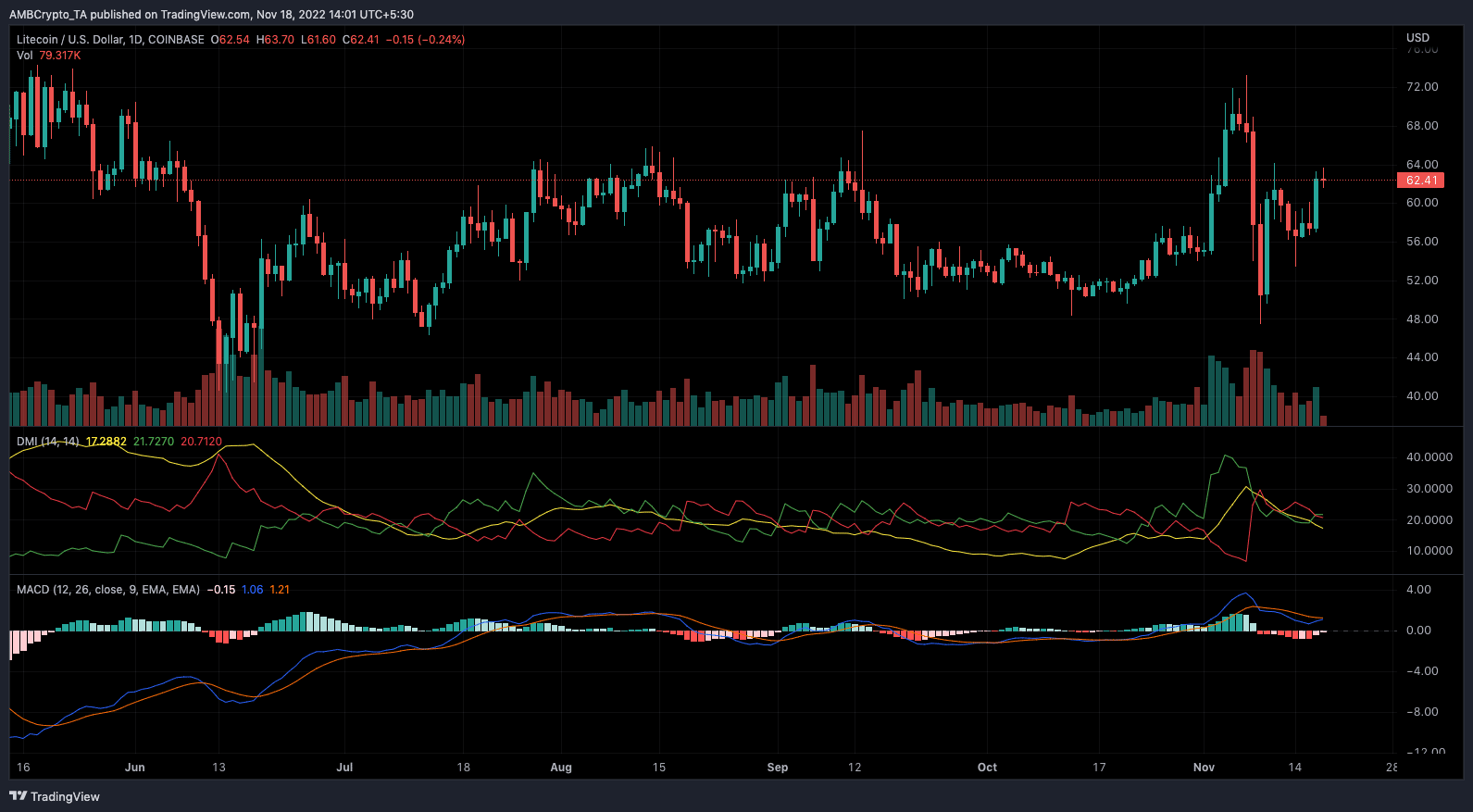

LTC won’t have the ability to maintain its current momentum. This, as a result of alerts proven by the Directional Motion Index (DMI). In accordance with the DMI, the optimistic DMI (inexperienced) has been unable to uphold its place above the detrimental (crimson). Whereas the Common Directional Index (yellow) had fallen to 17.28, there have been nonetheless indicators that LTC might select a bearish route.

It was the same scenario with the Transferring Common Convergence Divergence (MACD). At press time, sellers (orange) have been in management regardless of makes an attempt from the shopping for momentum to overhaul them. Therefore, it’s possible that LTC would decline within the short-term, particularly if Bitcoin [BTC] doesn’t lead a rally.

Supply: TradingView