A number one crypto intelligence agency is revealing the quantity of Ethereum (ETH) torched because the rollout of the London arduous fork in August.

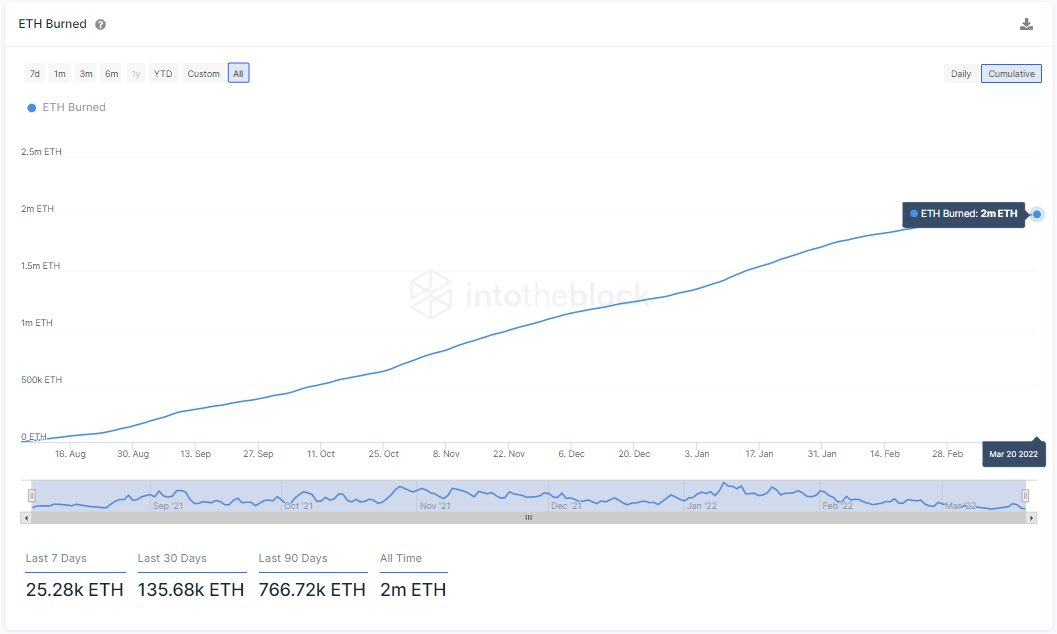

IntoTheBlock says that the main sensible contract platform has burned over two million Ethereum value $5.86 billion because the improve, including that 766,720 ETH ($2.27 billion) have been destroyed within the final three months.

The London arduous fork launched the EIP-1559 protocol that completely destroys sure quantities of ETH each time a consumer processes a transaction to create strain on the provision of the main sensible contract platform.

IntoTheBlock says transactions involving non-fungible tokens (NFTs) are the most important gasoline supply of Ethereum’s fee-burning mechanism.

“NFT buying and selling exercise has been the most important burner of Ether because the introduction of EIP 1559:

- OpenSea exercise alone has led to 230k ETH now not being in circulation as per ultrasound.cash

- As NFT volumes peaked in January, Ether’s internet issuance dropped to historic lows of practically -2%

- Following The Merge, the quantity of ETH issued is projected to drop by 90%, which might result in related ranges of charges to scale back Ether’s provide by as a lot as 5% a 12 months.”

Because the circulating provide of Ethereum continues to drop, extensively adopted pseudonymous analyst Sensible Contracter predicts that ETH will outperform Bitcoin (ETH/BTC) within the coming months.

“ETH/BTC weekly appears prefer it’s placing in a pleasant excessive timeframe increased low. Not a nasty spot to rotate some BTC into at these ranges, for my part.”

Sensible Contracter’s chart, the analyst predicts that ETH/BTC will rise to 0.09 BTC ($3,811) by June, suggesting an upside potential of practically 30% from the pair’s present worth of 0.07 BTC ($2,964).

Test Worth Motion

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/Zelenov Iurii