The 9% decline in Bitcoin’s (BTC) value in August has negatively impacted the manufacturing outcomes reported by publicly listed cryptocurrency miners. That is confirmed by Riot Platforms, which produced 333 BTC final month, 19% lower than in July. In distinction to the general market pattern, HIVE Digital has barely improved its mining outcomes.

Nonetheless, each corporations are in search of income away from the mining enterprise. Riot is specializing in vitality gross sales, which is bringing the corporate document revenues, whereas HIVE is wanting in the direction of supporting the factitious intelligence business.

Finance Magnates reported yesterday (Wednesday) that the Texas heatwaves (together with excessive vitality costs) and the low valuation of Bitcoin have negatively impacted the manufacturing of Marathon Digital Holdings (NASDAQ: MARA). The report confirmed a 9% month-over-month decline in BTC manufacturing to 1,072 BTC.

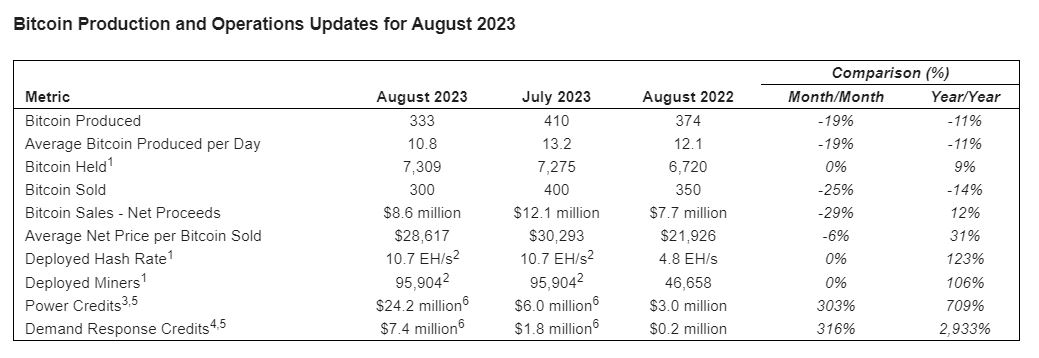

Following Marathon’s lead, Riot Platforms (NASDAQ: RIOT) noticed its month-over-month (MoM) manufacturing shrink by 19%, from 410 BTC reported in July to 333 in August. 12 months-over-year (YoY), the manufacturing declined by 11%.

Riot Produces 333 Bitcoin Whereas Realizing Expanded Advantages of Energy Technique.

“August was a landmark month for Riot in showcasing the advantages of our distinctive energy technique,” stated @JasonLes_ , CEO of Riot. “Riot achieved a brand new month-to-month document for Energy and Demand Response…

— Riot Platforms, Inc. (@RiotPlatforms) September 6, 2023

Each entities have their information facilities in Texas. As Riot stories, the area recorded document heatwaves in August, inflicting vitality demand and costs to skyrocket. Riot lowered its vitality utilization by over 95% through the hottest durations, transferring vitality to the Electrical Reliability Council of Texas (ERCOT).

The corporate didn’t earn money on Bitcoins, nevertheless it did earn a document $31.7 million for ‘Energy Credit’ and ‘Demand Response Credit’ (a 303% month-to-month improve and 709% annual improve). It is a program run by ERCOT, which pays corporations for giving again electrical vitality throughout instances of highest community load.

“Riot achieved a brand new month-to-month document for Energy and Demand Response Credit, totaling $31.7 million in August, which surpassed the full quantity of all Credit obtained in 2022,” Jason Les, the CEO of Riot, commented. “Based mostly on the typical Bitcoin value in August, Energy and Demand Response credit obtained equated to roughly 1,136 Bitcoin.”

HIVE Digital Will increase BTC Mining

On the similar time, HIVE Digital Applied sciences (NASDAQ: HIVE) additionally revealed its August mining report. In its case, month-to-month Bitcoin manufacturing elevated to 274 BTC in comparison with 263 BTC reported in July 2023. Evaluating the outcomes year-over-year, nonetheless, we see a decline of practically 6 BTC from 279.9 BTC.

On common, HIVE produced 8.8 BTC per day all through August or 74.7 BTC per Exahash.

“Our focus has been to improve our fleet of ASICs, in addition to discover new technology ASICs out there for speedy supply, to allow them to be shortly put in to comprehend money circulate return on invested capital,” Aydin Kilic, the President and CEO of HIVE, commented.

The corporate additionally admits that it more and more desires to give attention to utilizing its high-performance Supermicro servers to offer computational energy within the synthetic intelligence (AI) sector.

“The place HIVE has been a expertise chief in crypto-mining, our group with the information and expertise of working a fleet of roughly 150,000 GPUs through the Ethereum mining period, now aspires to use their experience to the Firm’s long-term blue-sky imaginative and prescient to implement our 38,000 Nvidia GPUs for HPC and AI workloads,” Kilic added.

As AI functionality and adoption develop, many workloads will shift from native machines to GPU cloud pic.twitter.com/W0ImtqnBBX

— HIVE Digital Applied sciences (@HIVEDigitalTech) September 6, 2023

Decrease Revenues = New Instructions

A number of years again, many corporations listed on inventory exchanges underwent vital transformations to faucet into the burgeoning cryptocurrency mining sector. Nonetheless, because the returns from these ventures begin to diminish, these companies are exploring new avenues for income. One rising pattern is the availability of high-performance computing assets to the fast-expanding AI business.

Riot Platform (previously Riot Blockchain) and Hive Digital Applied sciences (previously Hive Blockchain Applied sciences), have even rebranded to sign their evolving enterprise fashions. The cryptocurrencies they’ve mined and stockpiled have been instrumental in funding their forays into new markets, notably these pushed by the AI increase.

A latest report from JPMorgan signifies that the shift may very well be profitable. If the promising outcomes from preliminary assessments maintain up at scale, providing high-performance computing (HPC) companies to the AI sector may show to be extra worthwhile than Bitcoin mining.

“With the fast development of AI, the elevated demand for high-performance computing is now opening a brand new and maybe extra worthwhile avenue for using GPUs beforehand used for ether mining,” JPMorgan commented within the analysis.

The event path shouldn’t shock anybody, particularly contemplating that in 2022, the mining business earned $6 billion lower than in 2021.