intermediate

Hardly anybody who has any form of involvement within the crypto area hasn’t a minimum of heard about DeFi.

Whereas decentralization has been the primary focus of all issues crypto, there’s no different subject within the blockchain business that embraces it in addition to DeFi does. Its foremost aim is to offer customers with totally useful and environment friendly decentralized options to all mainstream monetary providers similar to loans, storage, and so forth.

Why do we’d like DeFi? Effectively, for a similar purpose we’d like blockchain know-how — there’s a severe lack of privateness and transparency within the fashionable world. Decentralized finance goals to remove third-party involvement in individuals’s companies and private lives by creating totally safe and nameless monetary providers.

What Is DeFi?

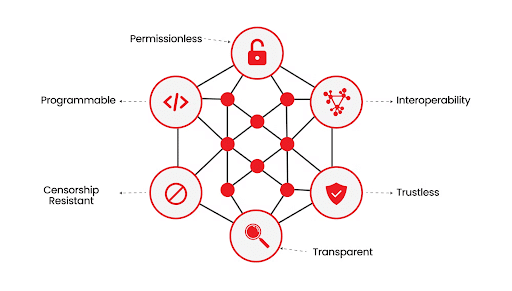

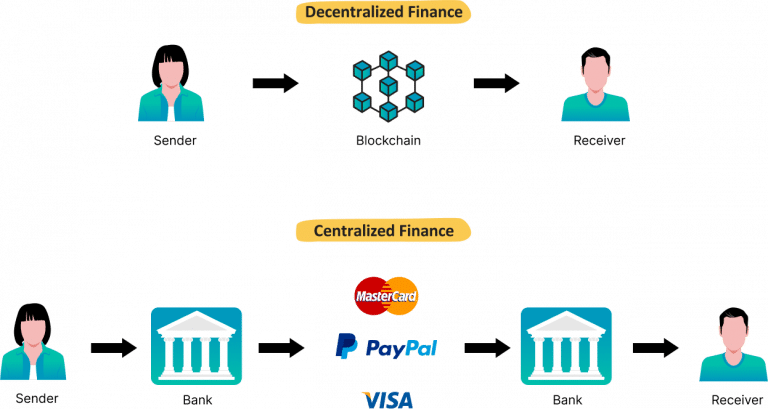

DeFi, additionally known as decentralized finance, is a quickly rising sector of the cryptocurrency business. It’s a monetary system that runs on a community with out central management. DeFi differs from the centralized monetary system in that it makes use of good contracts on blockchain know-how, which permits customers to hold out monetary transactions with out having to rely on centralized establishments.

DeFi is a brand new sort of economic system that isn’t managed by centralized monetary establishments. As a substitute, it’s constructed on decentralized networks that enable for finishing up advanced monetary transactions with none intermediaries. This permits for higher accessibility to capital and monetary providers, in addition to trustless transactions and direct negotiation of rates of interest.

DeFi permits customers to lend, borrow, commerce, and put money into digital belongings with out having to undergo conventional financial institution techniques. Because of this customers can entry any monetary product similar to loans, insurance coverage, derivatives, and extra with out having to undergo a financial institution or different monetary establishment.

How Does DeFi Work?

DeFi works by utilizing good contracts on blockchain know-how to allow decentralized monetary transactions. Sensible contracts are self-executing digital agreements which might be saved on the blockchain and can be utilized to facilitate transactions between two events with out the necessity for a 3rd social gathering middleman.

Customers can entry capital and monetary providers immediately via DeFi purposes, similar to financial savings accounts, peer-to-peer funds, and borrowing and lending platforms. DeFi protocols mitigate the necessity for a checking account, permitting customers to borrow cash and earn curiosity with out going via the standard monetary system.

Makes use of of Decentralized Finance

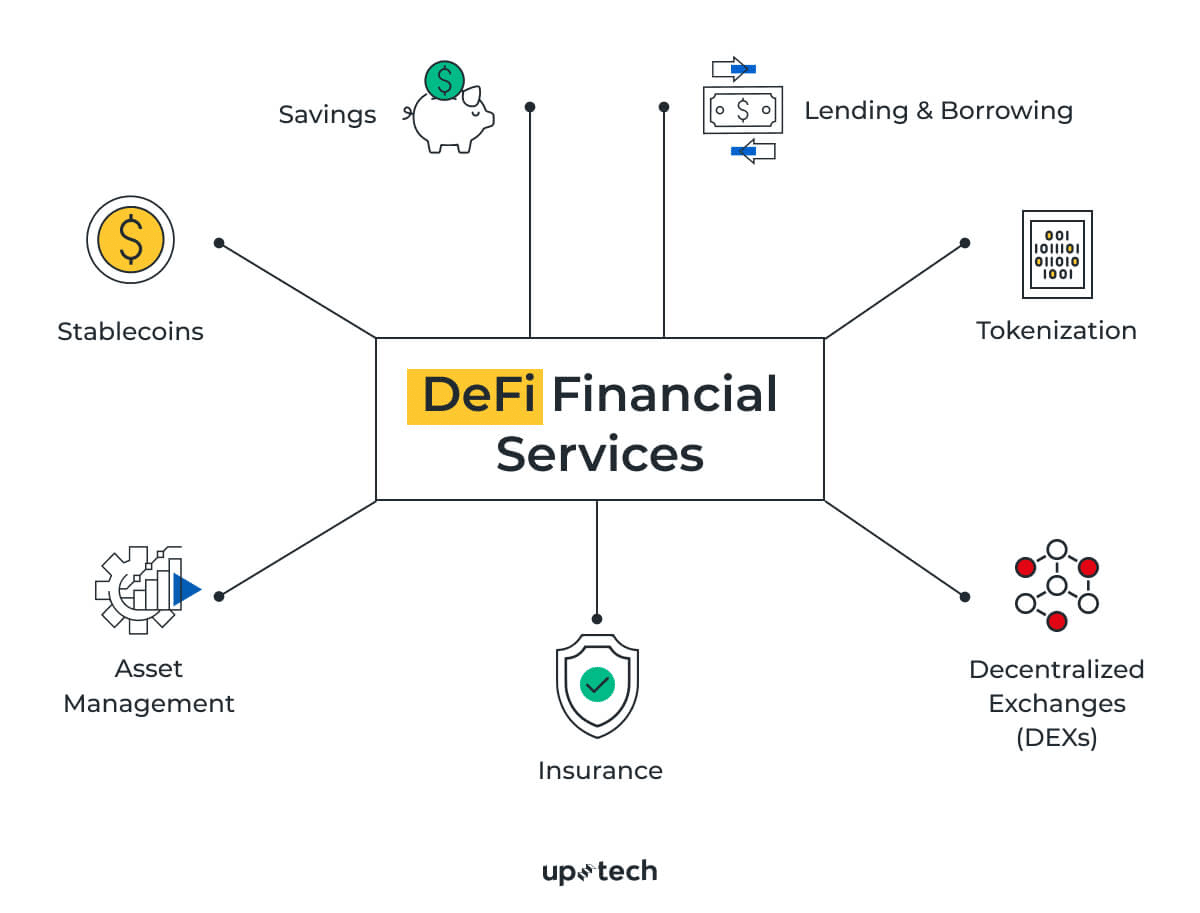

DeFi purposes use good contracts and the distributed ledger know-how (DLT) to supply decentralized variations of a variety of conventional monetary services.

Funds

DeFi allows customers to ship funds immediately to one another with out involving middlemen like banks or fee processors. With this, transactions are carried out faster and extra successfully, in addition to with decrease charges.

Stablecoins

A stablecoin is one other important entity that helps and improves the decentralized monetary business. Stablecoins are cryptocurrencies aimed toward lowering the volatility of the worth of a standard or digital asset. They are often pegged to fiat currencies just like the USD (USDT, USD Coin), the EURO (Stasis EURO), or different change commodities like gold (DGX) or perhaps a crypto asset like BTC (imBTC).

The mechanism and significance of stablecoins within the DeFi business are vividly demonstrated by the MakerDAO DeFi protocol and its stablecoin DAI. DAI goals to convey monetary freedom with no volatility to everybody. You possibly can immediately generate the stablecoin in your phrases whereas getting earnings for holding DAI.

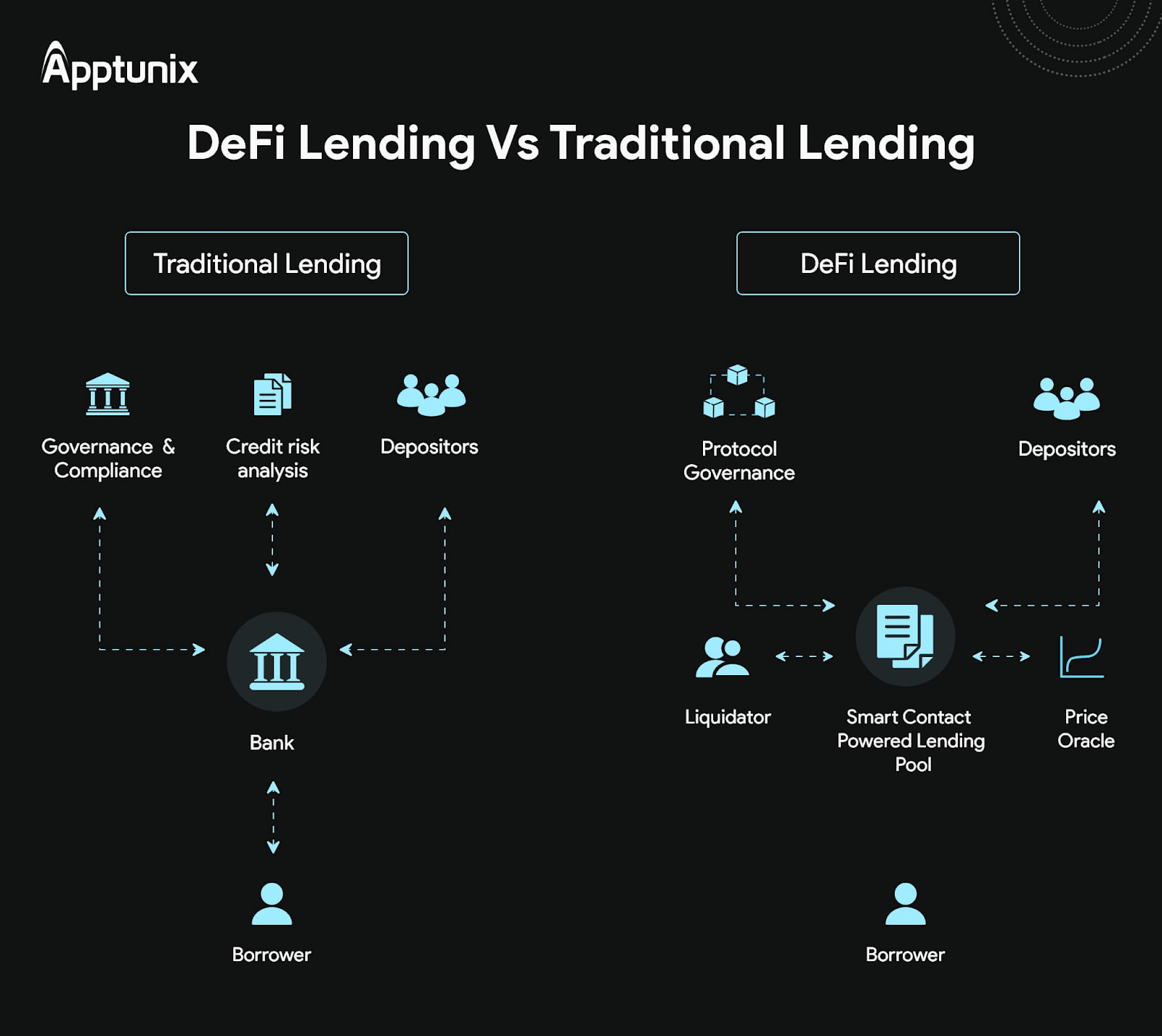

Lending and borrowing

DeFi borrowing and lending platforms allow customers to entry capital without having to work with a standard monetary establishment. For these with out entry to conventional banking providers, this may be extremely useful.

One of many best benefits of decentralized lending marketplaces (apart from the shortage of any third events) is that they supply an assurance within the type of cryptographic verification strategies. Decentralized lending platforms supply not solely loans but additionally a possibility to earn curiosity.

DeFi platforms — dApps and DEXs

Ethereum-based DeFi allows builders to create decentralized apps (dApps) on the Ethereum blockchain, facilitating several types of monetary transactions. Comparable DeFi apps additionally exist on all kinds of different networks, like Solana. A DeFi utility is a way more democratic various to conventional platforms and video games. They’re usually powered by utility DeFi tokens.

Decentralized exchanges or DEXs have been in the marketplace for nearly 3 years. Being constructed predominantly on prime of the Ethereum blockchain (the most well-liked platform for a dApp deployment), every decentralized change supplies real-time digital cash buying and selling together with excessive transaction throughput. They’ve many benefits, like lack of central authority, whole transparency, accessibility, and so forth.

Prediction markets

DeFi know-how additionally makes it doable to construct oracles and prediction markets, serving to to generate extra correct knowledge for monetary transactions.

Standard centralized prediction markets have all the time been in nice demand. At present, with the assistance of DeFi, we’ve acquired an opportunity to make them extra open and decentralized. Listed here are three foremost benefits of decentralized prediction markets over centralized ones:

- No restrictions. Anybody from Alaska to South Africa can take part in a decentralized prediction market.

- Open-source code. Not like closed-source centralized prediction markets, peer-to-peer markets are publicly out there, and all of the transactions might be seen within the blockchain.

- Belief. Customers don’t have to belief anybody however the code and themselves. There isn’t any third social gathering that holds your funds. You’re liable for and accountable for your digital belongings.

Centralized Finance vs. Decentralized Finance

When individuals say centralized finance, they normally imply conventional monetary establishments like banks, not the centralized exchanges on the crypto market. Conventional finance is often managed by centralized monetary establishments, whereas decentralized finance is predicated on distributed networks.

Centralized techniques are one thing that just about everyone seems to be conversant in and is aware of tips on how to navigate — what grownup, or perhaps a child, doesn’t have a debit or bank card as of late?

In the meantime, decentralized finance is a way more novel idea — most individuals would most likely go “Huh? What’s DeFi?” whether it is ever talked about in a dialog. Nevertheless, because it supplies options to numerous key points individuals usually have with the standard establishments, like one’s native financial institution, it has a spot within the present world and the long run.

The decentralized nature of dApps and DEXs makes them so much much less weak to assaults and far cheaper in comparison with their conventional counterparts since blockchain ensures the immutability of all knowledge recorded on it.

What are the Advantages of DeFi?

DeFi is a quickly creating system that’s revolutionizing conventional finance by delivering loads of benefits to customers. improved effectivity and entry to a wider pool of buyers. One benefit of DeFi contains elevated effectivity and entry to a broad vary of buyers.

- DeFi gives unprecedented accessibility to monetary providers to people who don’t have a checking account or restricted entry to banking providers, as a result of its decentralized community which might be accessed by way of any web connection.

- With DeFi, customers can get pleasure from elevated management over their belongings by managing them immediately without having to depend on third-party intermediaries like banking establishments.

- The usage of DeFi eliminates intermediaries and reduces the prices of economic transactions, resulting in decrease total prices.

- DeFi supplies further security measures via the utilization of distributed ledger know-how (DLT), which is resilient to hacking and fraudulent actions.

- With DeFi, transactions and actions inside the blockchain community might be verified by customers simply which will increase belief and accountability via transparency.

- Progressive DeFi monetary merchandise enable customers to reap the benefits of alternatives similar to yield farming and prediction markets.

DeFi Investing Dangers

DeFi supplies numerous benefits, but there are additionally inherent dangers to be conscious of, particularly for crypto buyers. Cryptocurrency investments are all the time dangerous as a result of their volatility, the potential lack of non-public keys related to digital wallets, and a scarcity of shopper protections and laws.

What Makes DeFi So Necessary?

DeFi is so important as a result of it supplies a extra accessible and complete strategy to entry and make use of monetary providers. This disruptive know-how has the facility to upend conventional monetary organizations and create a extra distributed monetary system.

The democratization DeFi apps supply to customers can present substantial advantages to small and large companies alike, and the elevated integrity of decentralized purposes will help to fight manipulation and tax evasion. Decentralized finance will help to construct a safer, accessible monetary system that can profit all of its members (excluding criminals, in fact!).

The Way forward for DeFi

The prospects for DeFi seem promising with elevated motion in direction of decentralized purposes and progressive monetary providers. DeFi platforms and merchandise should be correctly regulated so as to guarantee shopper safety and safety; nevertheless, there are ongoing debates relating to the necessity for such laws.

DeFi has a a lot wider attain than simply crypto — it democratizes all the weather of finance, providing customers from everywhere in the world higher entry and autonomy relating to their funds. With the rise of providers like VPNs, it’s clear that customers have gotten more and more involved in regards to the security of their private info, so we predict that DeFi will solely proceed to realize recognition as time goes on.

FAQ

What’s the objective of Decentralized Finance?

DeFi leverages blockchain and good contract know-how to ascertain decentralized purposes which might be liable for offering decentralized monetary providers, eliminating the necessity for typical centralized banking.

What’s the whole amount of cash locked in DeFi initiatives?

The Complete Worth Locked in DeFi is a measure of the cryptocurrency belongings held in decentralized finance platforms, protocols, and lending providers. On the time of writing, the Complete Worth Locked in DeFi was 48 billion USD.

What are the methods to generate earnings with DeFi?

Earning money with DeFi might be completed in a number of methods, similar to yield farming, lending platforms, and prediction markets. Folks can entry monetary providers similar to incomes curiosity or borrowing cash shortly and with out being restricted by geographical boundaries or needing a checking account. It is very important be conscious of the potential dangers and different points that include investing in DeFi.

When will DeFi go mainstream?

As rising numbers of individuals grow to be conversant in blockchain know-how and DeFi, it’s anticipated that the cryptocurrency phenomenon will proceed to realize traction amongst buyers, leading to widespread acceptance. Nonetheless, it may be troublesome to pinpoint a precise timeframe for when it will happen. It’s difficult to find out an correct timeline of when it will occur.

The best way to become involved with DeFi?

To become involved with DeFi, customers want an web connection, a digital pockets, and, ideally, crypto tokens to entry capital and use DeFi purposes (DeFi dApps). Customers can use decentralized exchanges to commerce cryptocurrencies or entry a DeFi platform to earn curiosity or borrow cash. It is very important perceive the dangers concerned and to make use of warning when investing in DeFi initiatives.

How does DeFi problem conventional banking?

DeFi seeks to disrupt conventional banking by offering decentralized monetary providers and merchandise impartial of centralized monetary suppliers. Using good contracts and blockchain know-how, DeFi seeks to facilitate trustless monetary transactions, with the intention of providing customers a higher diploma of transparency, privateness, and management.

How do you earn a living with DeFi?

People can generate earnings by using yield farming, lending platforms, or investing in any DeFi app via the decentralized finance ecosystem. Traders ought to concentrate on the potential excessive returns in addition to the dangers related to investing in these belongings earlier than committing.

Is it secure to put money into DeFi?

Inserting cash in DeFi comes with inherent risks, together with doable good contract flaws and different challenges associated to blockchain know-how. Nonetheless, there are shopper protections and decentralized insurance coverage out there via many DeFi protocols and initiatives to scale back these dangers. One ought to all the time do their due diligence and train warning when investing in DeFi.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.