Bitcoin misplaced steam the day prior to this and appears poised to re-test its assist ranges within the coming days. The cryptocurrency rallied on the again of favorable macroeconomic winds and excessive upside liquidity from overleveraged brief merchants.

As of this writing, Bitcoin trades at $20,800 with a 3% loss within the final 24 hours. BTC remained constructive in the course of the earlier seven days and recorded a 16% revenue. The primary crypto by market capitalization is the most effective performer within the high 10.

The Largest Impediment For Bitcoin In The Quick Time period

NewsBTC reported that brief positions had been piling up as Bitcoin trended to the upside. The market took out over half a billion {dollars} briefly positions. Because the market trended upside, these positions had been liquidated, permitting BTC to proceed climbing.

In that sense, Bitcoin would possibly preserve trending upwards however at a slower tempo. Because the market ate off these shorts in the course of the previous week, over-confident lengthy positions would possibly grow to be the goal. This shift would possibly push BTC again to the important helps at $19,600 to $19,700.

These ranges have confluence with the 200-Day Easy Transferring Common (SMA) and 50x leverage longs. Thus, there’s a excessive liquidity pool sitting at these ranges, able to be taken by market movers.

On increased timeframes, a current report from QCP Capital claims the macroeconomic winds would possibly change and will negatively affect crypto. 2023 kicked off with a constructive outlook on important metrics, reminiscent of inflation, and excessive expectations of a financial pivot by the U.S. Federal Reserve.

The monetary establishment has been mountaineering rates of interest and unloading its stability sheet to fight inflation. This metric has been at its highest stage within the final 40 a long time.

Markets Will Take A “Impolite Shock?”

Latest knowledge exhibits inflation is declining; this pattern would possibly assist the Fed’s slowdown on its financial coverage and supply room for Bitcoin and danger on belongings to rally. Nevertheless, QCP Capital believes that whereas Q1, 2023 is likely to be constructive for these belongings, Q2 might see some hurdles:

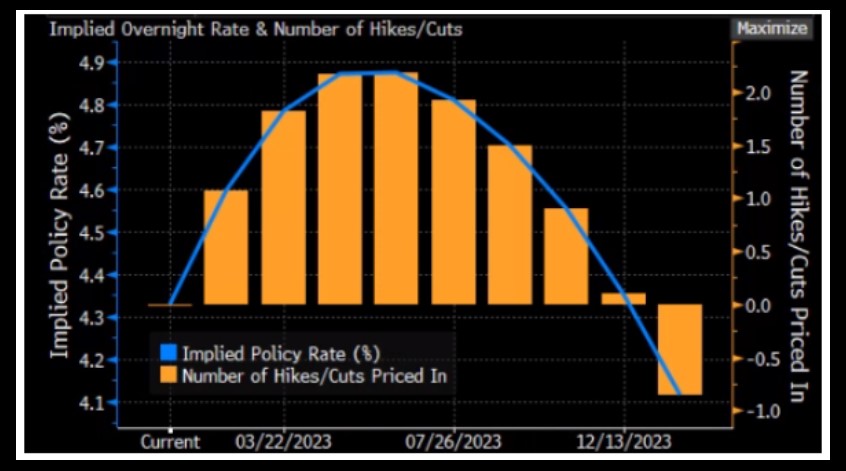

Whereas we count on the 1 February FOMC to push again strongly in opposition to this pricing, we imagine the 22 March FOMC would be the second of reality, when up to date charge forecasts might be launched. Ought to there be no adjustment to the median 2023 dot, then we count on markets might be in for a impolite shock.

The truth that Bitcoin and a few shares have been rallying is proof of “how rapidly monetary situations have loosened,” the agency believes. The Fed has been preventing in opposition to this financial setting, so its return might push the monetary establishment to tighten its financial coverage.

For this time subsequent 12 months, the market is anticipating a lot decrease rates of interest, as seen within the chart above. It stays to be seen if the Fed will indulge these expectations or if inflation will persist, resulting in extra ache throughout the crypto and the legacy monetary market.