Traditionally, 2022 may find yourself being the second-worst 12 months for Bitcoin since 2011. On the present value, BTC has a year-to-date (YTD) efficiency of -65%, topped solely by 2018 when the worth misplaced -73% in a single 12 months.

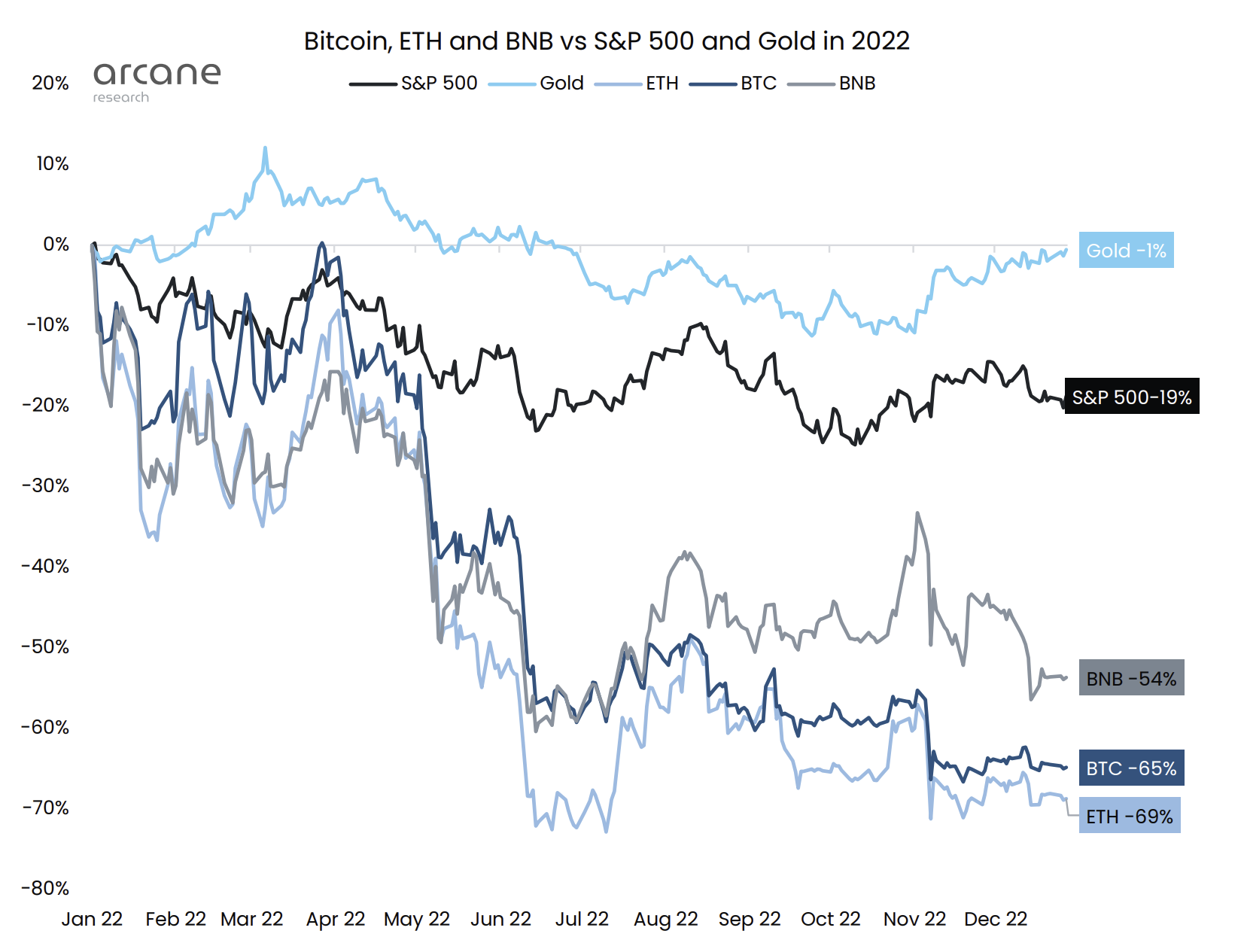

As Arcane Analysis notes in its year-end report for 2022, bodily gold (-1% YTD) has considerably outperformed digital gold, Bitcoin, in a interval of excessive inflation. In consequence, the analytics agency notes that the digital gold narrative was untimely.

As Arcane Analysis notes, the crypto winter was primarily fueled by tightening macroeconomic situations and crypto-specific leverage and depressing danger administration by core market individuals. BTC had adopted the U.S. fairness markets as a consequence of its excessive correlation.

“Other than two distinct occasions in 2022, BTC adopted U.S. equities very carefully. The 2 outliers of June (3AC, Celsius and so forth.) and November (FTX), are answerable for your complete underperformance of BTC vs. the U.S. equities,” the report states, displaying the next chart.

Bitcoin Predictions For 2023

For the approaching 12 months 2023, Arcane Analysis expects that contagion results will “in all probability” proceed in early 2023. “[B]ut we view it as probably that almost all of 2023 might be much less frantic and borderline uneventful in comparison with the final three years,” Arcane Analysis predicts.

With that in thoughts, the agency expects Bitcoin to commerce in a “principally flat vary” in 2023, however to complete the 12 months with the next value than it did firstly.

Bitcoin’s present drawdowns carefully resemble the bear market patterns of earlier cycles, Arcane Analysis elicits. Whereas the 2018 bear market lasted 364 days from peak to finish, the 2014-15 bear market lasted 407 days. The present cycle is on its 376th day. This places the continued bear market precisely between the length in each earlier cycles.

“If a brand new backside is reached in 2023, this would be the longest-lasting BTC drawdown ever,” the agency stated and additional elaborated that there are fairly a couple of potential catalysts for a famend bull market:

The FTX proceedings could incentivize extra fast progress with laws, and we view each constructive indicators associated to U.S. spot BTC ETF launches and extra coherent classifications of tokens as a believable final result by the tip of the 12 months, with change tokens being notably uncovered for potential safety classifications.

Relating to Grayscale’s Bitcoin spot ETF utility, February 3 might be an necessary date for the business when the three-judge panel will rule on the SEC grievance.

As well as, Arcane Analysis expects one other catalyst from Europe: specifically, the passage of the MiCA Act by the European Parliament in February 2023. The core prediction for 2023 stays that Bitcoin will get well regardless of the tightening macroeconomic scenario and that now could be “a superb space to construct gradual BTC publicity.”

Nonetheless, the beginning of 2023 might be bumpy as buying and selling volumes and volatility decline in a a lot duller market than prior to now three years. In abstract, Arcane Analysis subsequently estimates:

As we advance into the following 12 months, persistence and long-term positioning might be key.

At press time, the BTC value traded at $16,497, dealing with additional downward stress, in all probability as a consequence of tax harvesting by year-end.