A preferred crypto analyst says that Bitcoin (BTC) will defy all conventional theories of its market cycles subsequent 12 months.

The pseudonymous analyst often called TechDev tells his 402,000 Twitter followers that BTC will problem typical knowledge that its worth cycles are pushed by the halving cycles.

Halving cycles are the four-year intervals when Bitcoin miners’ block rewards are lower in half, which many traders consider have been enjoying a task in placing strain on the value. TechDev predicts that BTC largely ignores the following halving, more likely to occur in mid-2024, and as a substitute flip bullish early subsequent 12 months.

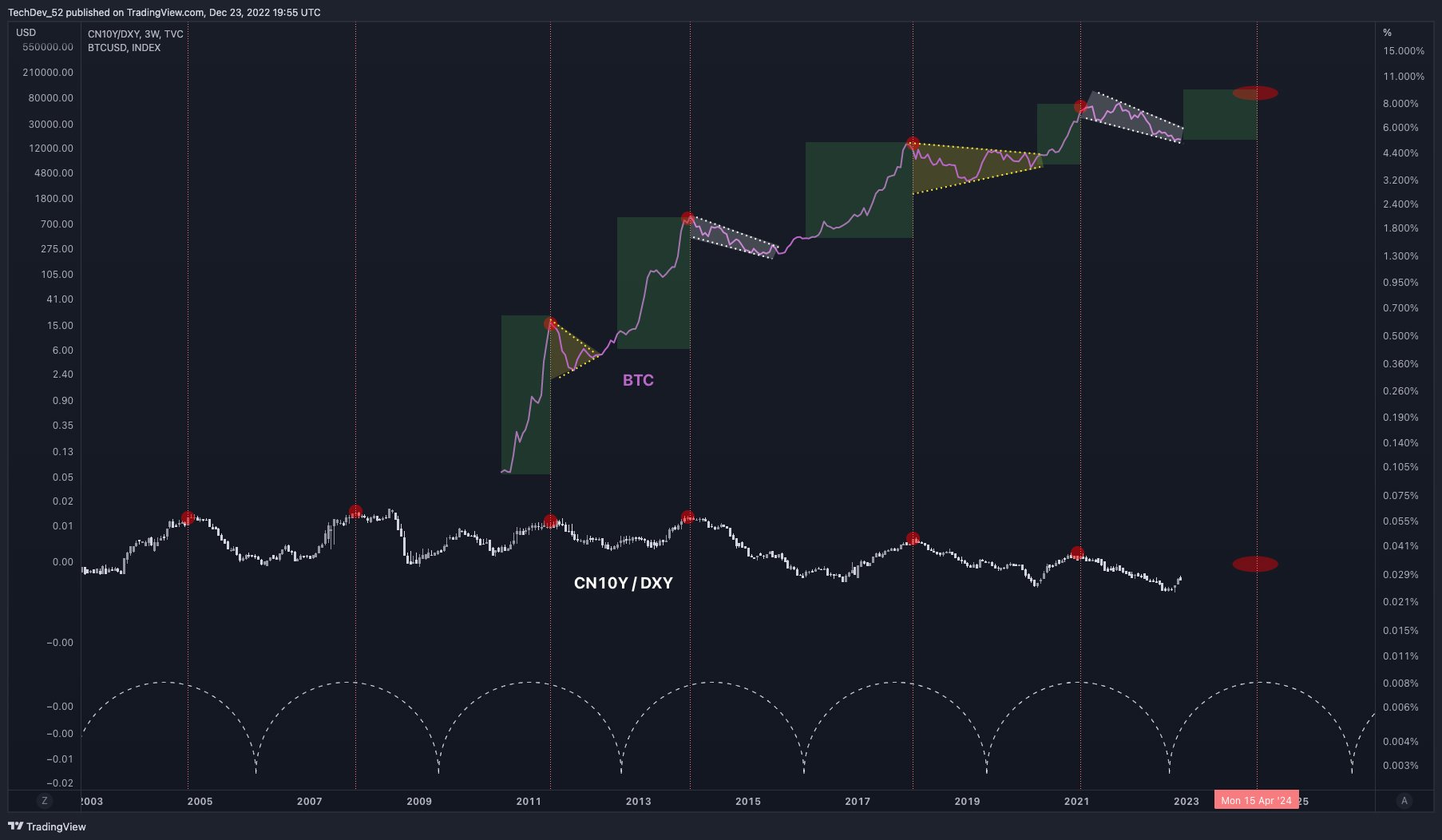

TechDev predicts {that a} bounce in Bitcoin subsequent 12 months will coincide with a weakening of the US greenback, which he pins in opposition to Chinese language ten 12 months bonds to depict a cycle of world liquidity.

“2023 to problem halving principle.”

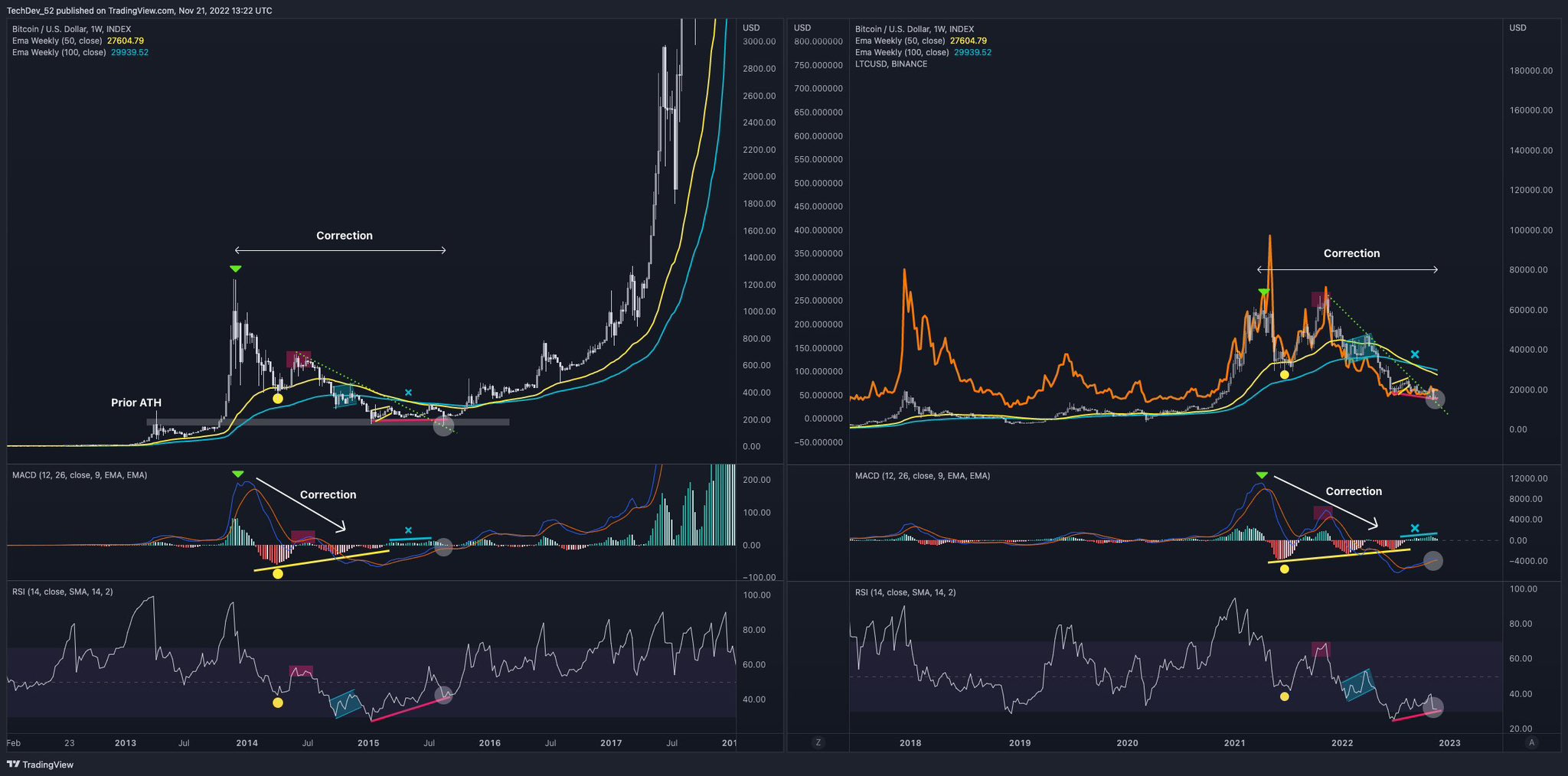

The analyst additionally argues that Bitcoin reached its prime in April of 2021, quite than November, implying that the bear market is deeper than many consider and subsequently nearer to a reversal. He makes use of Litecoin (LTC) for instance of a coin that made a decrease excessive in November, quite than the anomalous, barely increased excessive seen in Bitcoin.

“BTC ‘topped’ April 2021 imo.

LTC‘s construction (orange) simpler for many to digest.

Parabolic prime vs. distributive, making Nov ‘21 a decrease excessive.

Majority nonetheless doesn’t appear to know corrective waves could make new highs.

Was a part of majority.”

At time of writing, Bitcoin is buying and selling at $16,798.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Macrovector