Key Takeaways

- Binance has introduced its Business Restoration Initiative, a $1 billion fund to assist crypto corporations in want.

- Different corporations together with Polygon Ventures and Animoca Manufacturers have additionally contributed $50 million.

- Binance’s plan comes after the collapse of FTX and that occasion’s detrimental impact on the crypto business.

Share this text

Binance stated immediately that it’s committing $1 billion to assist corporations within the crypto business stay operational.

Binance Launches Restoration Initiative

Binance desires to revive the crypto business.

The main change wrote on Thursday that it has a “accountability to steer the cost relating to defending shoppers and rebuilding the business.”

To that finish, it has established the Business Restoration Initiative (IRI), which can enable struggling cryptocurrency corporations to request monetary assist.

Binance has contributed $1 billion price of crypto to the initiative and will improve that quantity to $2 billion if wanted. The corporate said that it has already acquired 150 assist purposes from numerous corporations in want.

The IRI can also be taking contributions from different corporations. A number of members have already dedicated a complete of $50 million into this system, together with Polygon Ventures, Animoca Manufacturers, Bounce Crypto, Aptos Labs, GSR Markets, Kronos, and Brooker Group.

Binance stated that it expects extra members to enlist quickly, including that it’s engaged on offering a manner for conventional monetary corporations to affix the initiative with out utilizing crypto.

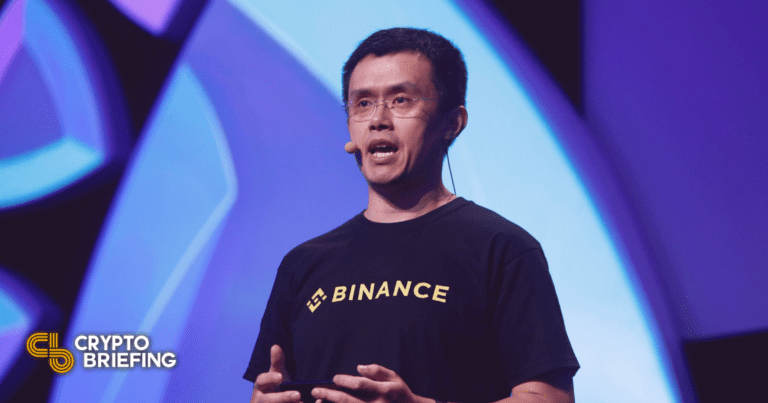

Binance CEO Changpeng “CZ” Zhao commented on the initiative on Twitter, writing: “We do that transparently.” He posted the hyperlink to Binance’s preliminary dedication of 1 billion BUSD, which is saved at an handle beginning 0x043a on BNB Chain.

This system is anticipated to final for six months. Those that contribute funds that stay unused will be capable to withdraw these funds on the finish of the initiative.

Binance specified that the initiative was not an funding fund, drawing a distinction between the initiative and Binance Labs—the VC arm that the change makes use of to put money into new startups.

Binance didn’t explicitly point out FTX in its announcement immediately. Nonetheless, given the timing, it’s clear that the change’s collapse (and its ensuing ripple impact on different companies) led to the fund’s creation.

This isn’t Binance’s sole effort to bail out the crypto business. Current experiences point out that the agency intends to accumulate bankrupt lending agency Voyager Digital and presumably purchase mortgage belongings belonging to Genesis Capital.

Binance additionally almost acquired FTX throughout its collapse however walked away from the deal as a result of allegations that FTX had mishandled buyer funds.

Disclosure: On the time of writing, the writer of this piece owned BTC, ETH, and different digital belongings.