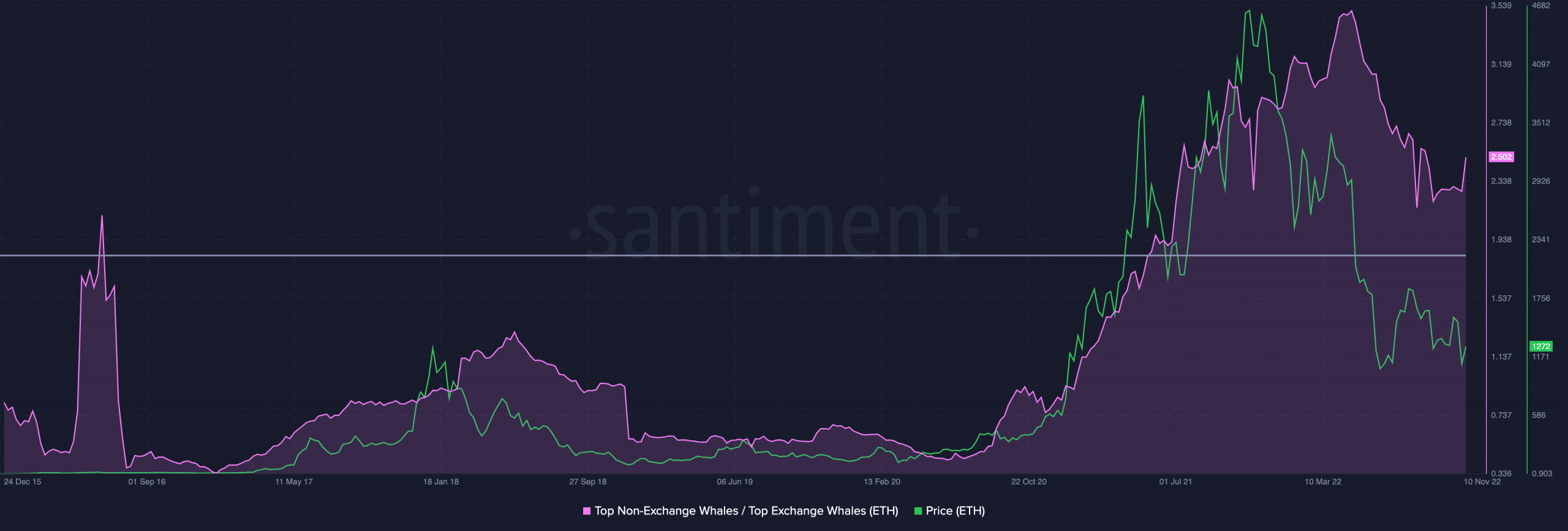

- Prime Ethereum whales had been accumulating in a method that would lead the altcoin king to a value correction

- Based mostly on the price-DAA divergence, ETH was removed from being undervalued. Therefore, the belief could possibly be legitimate

The current market turbulence ensured that crypto costs confronted a downturn, from which Ethereum [ETH] was not exempted. Nonetheless, buyers who might need anticipated some respite could possibly be dealt a blow as a result of current whale motion.

Right here’s AMBCrypto’s Worth Prediction for Ethereum for 2023-2024

In a 14 November perception put up, Santiment analyst, Sanr_King pointed out that ETH high whales had been accumulating the altcoin in an “irregular” method in distinction to the actions on exchanges.

Supply: Santiment

Worth changes and a connection to…

The analyst opined that the whale exercise was not simply one thing to disregard. In keeping with him, ETH confronted a value correction regardless of just lately plunging to $1,200.

In additional protection of his place, Sanr_King famous that the happenings had been just like the interval the crypto-friendly nation, El Salvador, introduced the choice to legalize Bitcoin [BTC]. The aura round that point pushed for an ETH purchase name. Nonetheless, that was not the case because the occasion led to a value correction. Particulars from the perception learn,

“This goes to say that ETH buyers believe for the general pattern of the worth motion and they’re diamond fingers which is one other bearish signal. (if we evaluate VWAP with Variety of Addresses Accumulation because the similar interval)”

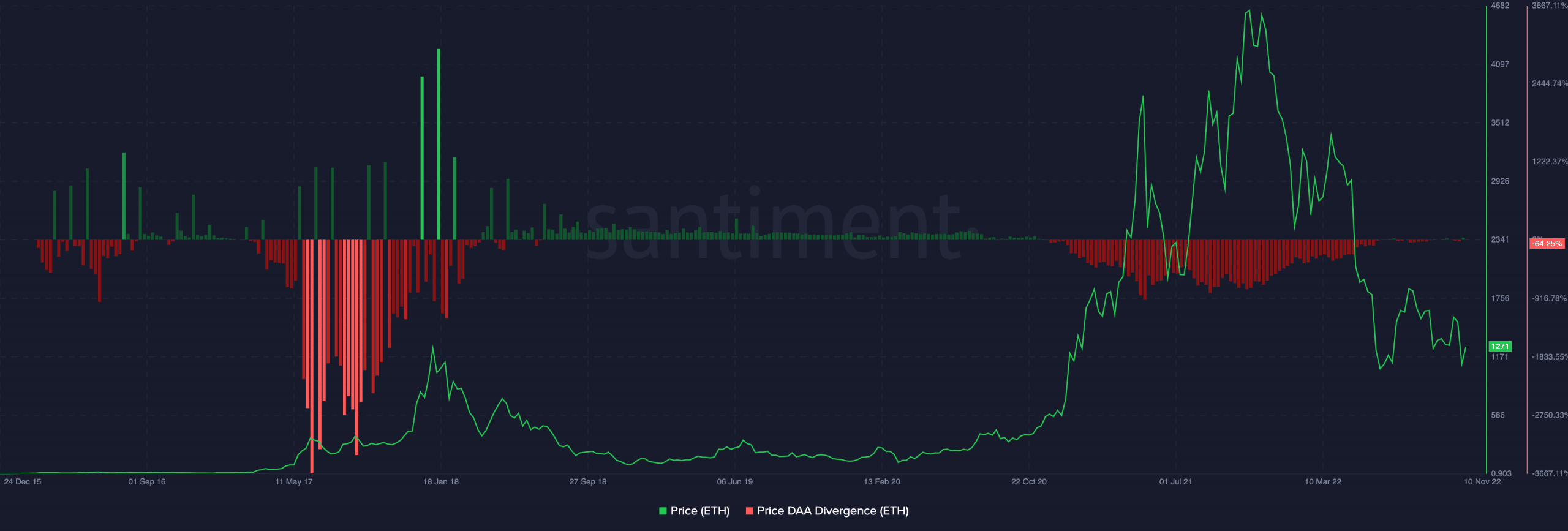

Additional evaluation of this opinion confirmed that the projected end result could possibly be viable. This was as a result of position of the worth -Day by day Energetic Addresses (price-DAA).

In keeping with Santiment, the price-DAA was -64.25%. At this stage, it indicated that ETH was not near being undervalued. Therefore, there was a chance for the worth to lose maintain of the $1,200 area.

Supply: Santiment

Commotion within the land nonetheless

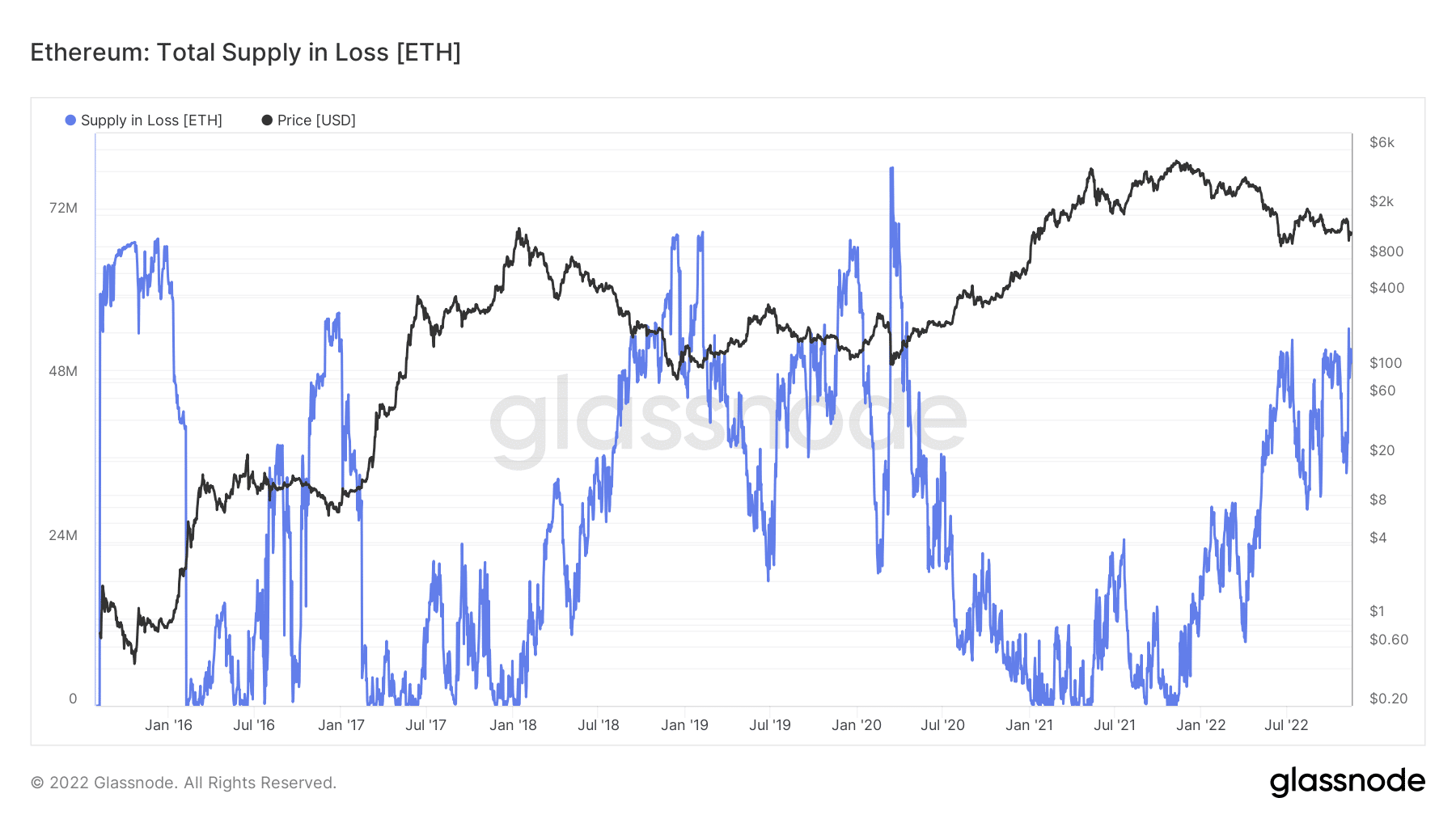

Along with the metrics talked about above, ETH buyers would possibly need assistance to upturn losses incurred just lately. In keeping with Glassnode, the total supply in loss took an upward route regardless of decreasing to 35.69 on 1 November.

At press time, the ETH whole provide in a loss was 55.35 million. This standing implied that a big share of Ethereum holders had been vulnerable to an asset forfeiture than heading nearer to positive aspects.

It additionally aligned with the earlier projection that the altcoin was on the verge of extra draw back. As such, holders would possibly stick with HODLing as an alternative of promoting close to bottoms.

Supply: Glassnode

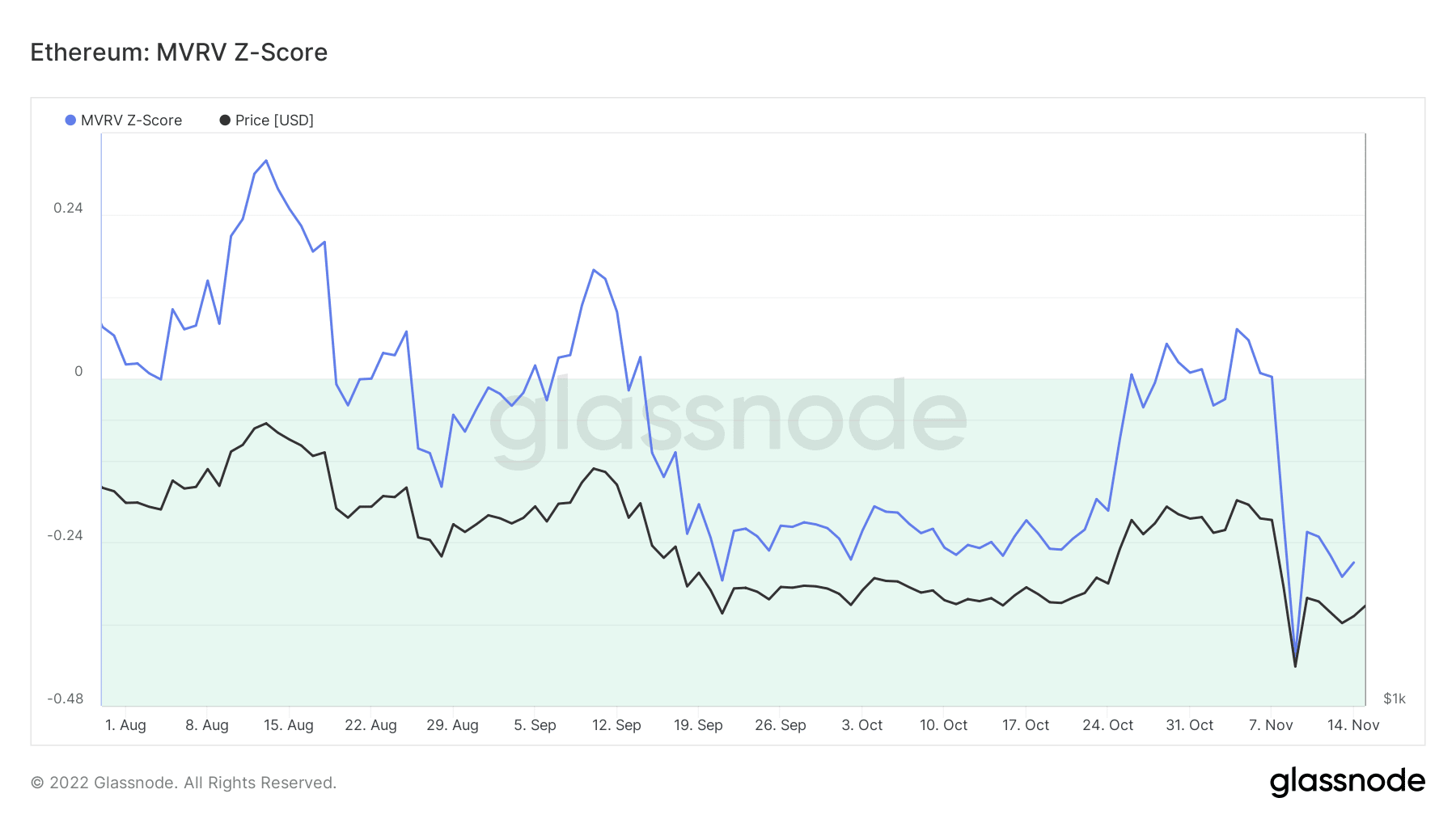

On assessing the Market Worth to Realized Worth (MVRV) z-score, Glassnode revealed that ETH had but to hit backside. With the MVRV z-score at -0.269, it was clear that ETH’s present worth was not a good one. It additionally didn’t counsel a sign to the market high, so it inferred that ETH might go additional decrease.

Supply: Glassnode