Barely per week after finishing up an exploit on Deribit‘s scorching pockets, the perpetrators of this hack moved a portion of the stolen funds into Twister Money, the Ethereum mixer service.

Decoding the Deribit hack

Deribit, a Netherlands-based crypto-exchange, reported the exploit on its scorching pockets on 2 November. The precise hack was carried out late on 1 November, the place the hackers made away with $28 million in BTC, ETH, and USDC.

Deribit made it clear that solely its scorching pockets was affected by the hack, not the chilly pockets. The change additional supplied to reimburse any losses confronted by its clients.

Deribit scorching pockets compromised, however consumer funds are secure and loss is roofed by firm reserves

Our scorching pockets was hacked for USD 28m earlier this night simply earlier than midnight UTC on 1 November 2022.

— Deribit (@DeribitExchange) November 2, 2022

As soon as the information of the hack rolled out, the platform instantly suspended all withdrawals. By means of the tweet above, Deribit clarified that for their very own security, customers ought to chorus from making any deposits or trades by means of the platform till the mandatory safety checks had been accomplished.

The string of hacks and exploits continued into November, after a number of hundred million price of cryptos had been stolen final month.

$2.5 million moved to Twister Money

In line with knowledge from Etherscan, the perpetrators transferred 1610 ETH to the Ethereum mixer service. This switch was unfold throughout 17 completely different transactions, with all however one price 100 ETH every.

At press time, the transferred ETH was price $2.5 million.

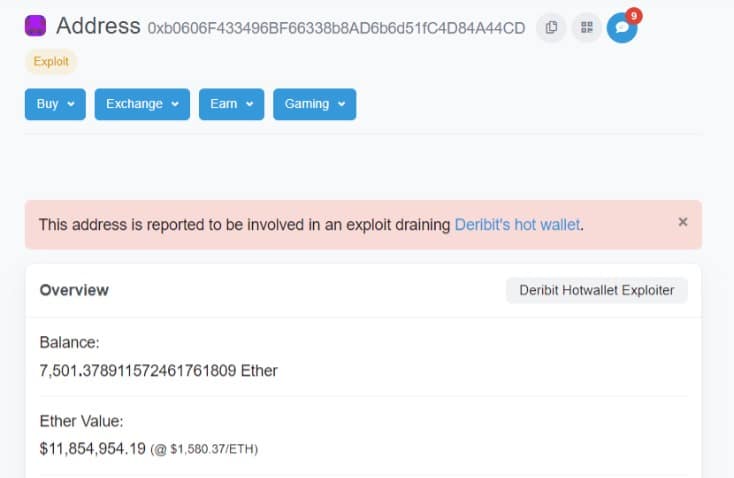

Supply: Etherscan

On the time of writing, the hacker’s pockets had 7501 ETH left, which was price $11.8 million. This pockets initially obtained 9080 ETH following the hack final week and the remaining quantity was seemingly held in BTC.

Twister Money was sanctioned earlier this 12 months in August by the U.S Division of Treasury’s Workplace of Overseas Property Management (OFAC). Authorities cited the mixer’s position in aiding with the laundering of billions of digital currencies with illicit origins.

Nevertheless, the ban was broadly criticized by the crypto-community for being unjust and infringing upon the consumer’s proper to privateness.