The FTX change goes by its roughest phases in latest historical past. Its native token FTT suffered a significant crash in the previous few days following rumors that the change may be on the blink of insolvency.

Right here’s AMBCrypto’s worth prediction for FTT

The insolvency rumors caught fireplace following a significant transaction wherein roughly 23 million FTT was bought. Upon additional inspection, it was revealed that Binance was the vendor that offloaded the massive FTT quantity value over $500 million.

First obtained FTT virtually 3 years in the past and will get occasional massive transfers from FTX… suggests tackle is managed by an insider or investor in FTX. They despatched 12 million #FTT to Binance over that point.

The 23 million FTT transferred yesterday had been there for nearly a yr. pic.twitter.com/W8i6dyBiKY

— DIRTY BUBBLE MEDIA: THE ALAMEDA SPECIAL (@MikeBurgersburg) November 6, 2022

Binance CEO CZ launched an official assertion revealing that his change opted to liquidate the remaining FTT in its portfolio.

The assertion by the Binance CEO confirms that Binance cleared the FTT in its portfolio in an try to attenuate publicity.

As a part of Binance’s exit from FTX fairness final yr, Binance obtained roughly $2.1 billion USD equal in money (BUSD and FTT). On account of latest revelations which have got here to gentle, now we have determined to liquidate any remaining FTT on our books. 1/4

— CZ ? Binance (@cz_binance) November 6, 2022

The choice isn’t a surprise on condition that the market has already skilled the affect of crypto corporations going bankrupt.

The newest considerations over Alameda and FTX probably dealing with insolvency have the market on the sting. The large FTT sell-off now we have seen in the previous few days is a testomony to the prevailing buyers’ concern.

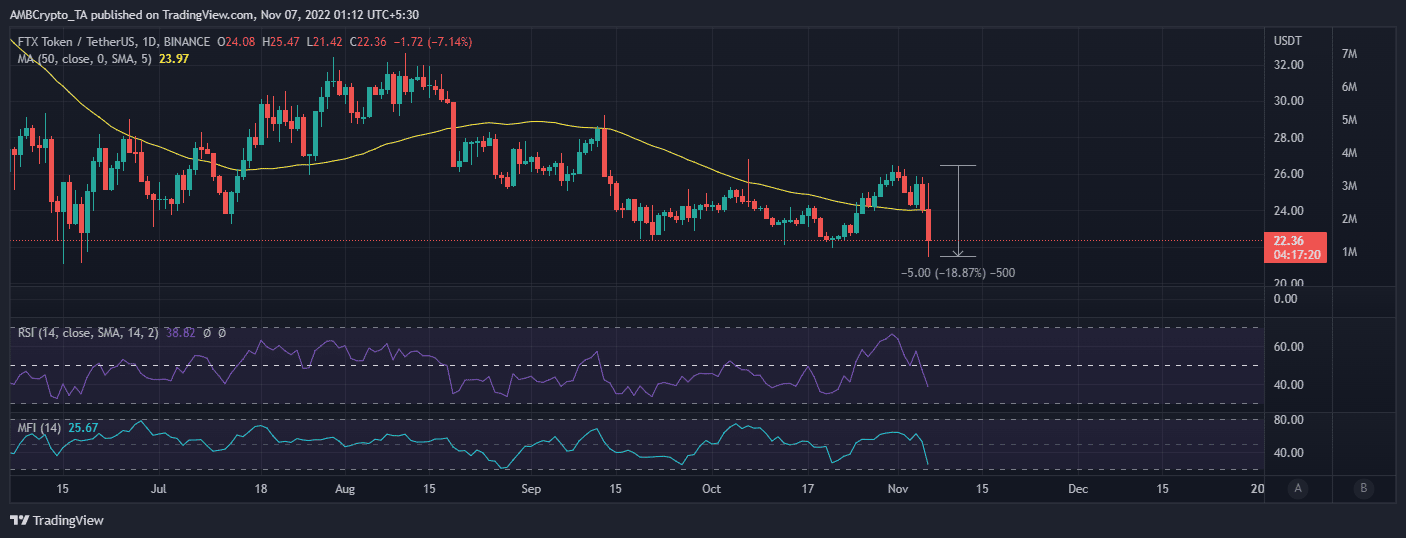

FTT worth motion

FTT peaked at $26.43 at first of November, earlier than embarking on a sell-off by barely over 18% to as little as $21.42.

Its $22.40 press time worth might point out a slight restoration however the ongoing considerations about FTX and Alameda might set off extra draw back.

Supply: TradingView

FTT’s promote stress resulted in a retest of its 2022 backside vary, with the value coming near the present year-to-date low.

However is the FTX native coin out of the woods but? A have a look at its on-chain metrics might assist present a greater view.

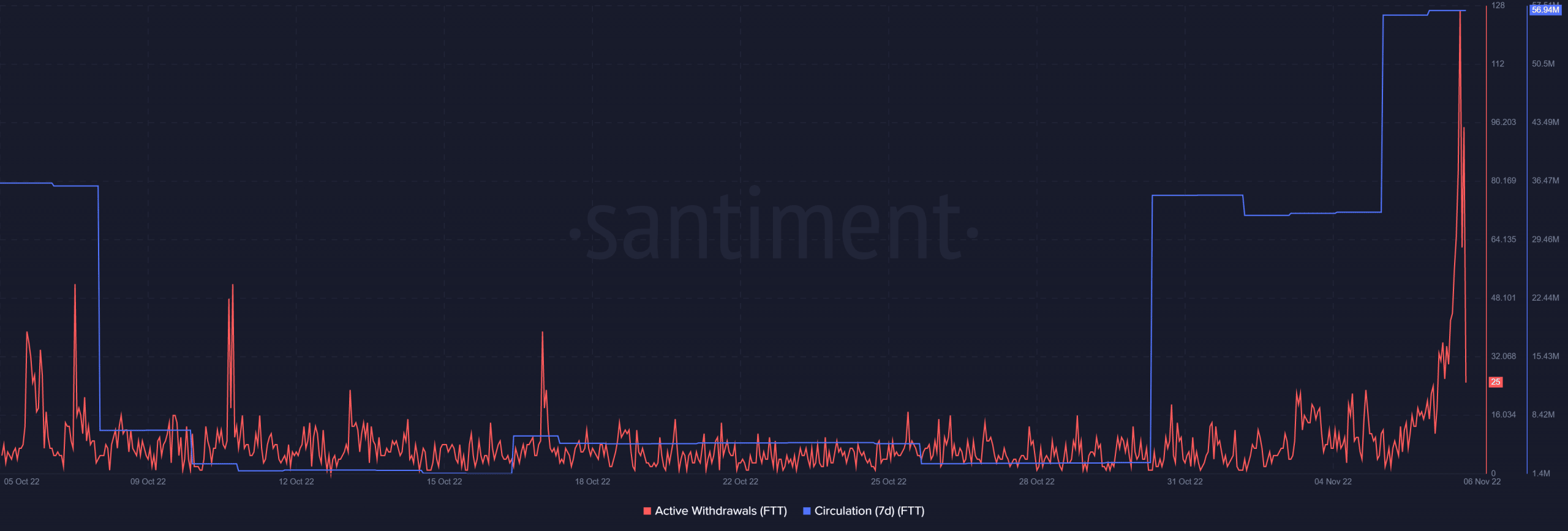

The quantity of FTT in circulation went up in the previous few days as extra cash flooded the market courtesy of the liquidations.

Lively withdrawals additionally skilled the most important month-to-month spike with withdrawals peaking at 127 a number of hours earlier than press time.

Supply: Santiment

The above-mentioned info confirms a rise in exercise particularly oriented in direction of exiting FTX.

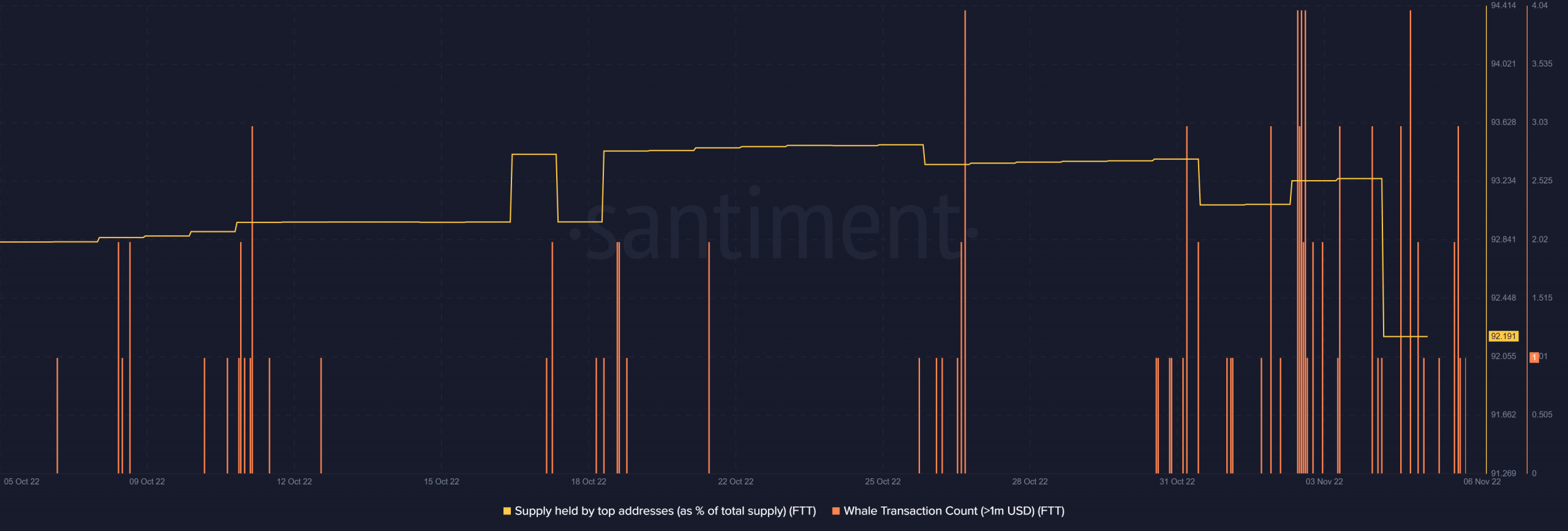

This commentary was additionally confirmed by a spike in whale transaction rely (transactions over $1 million). These transactions notably elevated in the previous few days. On the identical time, the availability held by prime addresses dropped by a considerable margin.

Supply: Santiment

These observations verify that whales have been promoting off their FTT in gentle of the latest considerations.

Conclusion

FTX is without doubt one of the largest crypto exchanges and the continuing state of affairs might severely dent its status. We now have seen crypto corporations crash and burn and it will not be shocking to see FTX undergo the identical destiny. Alternatively, the extent of the hazard stays unsure and should even be exaggerated.

The truth that whales are promoting confirms that the market is spoofed. FTT may be discounted for now however shopping for the dip earlier than the hazard passes may be an excessive amount of of a danger.