Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- Monero has traded inside a spread since mid-September

- XMR is poised for a breakout, however a pullback might additionally materialize

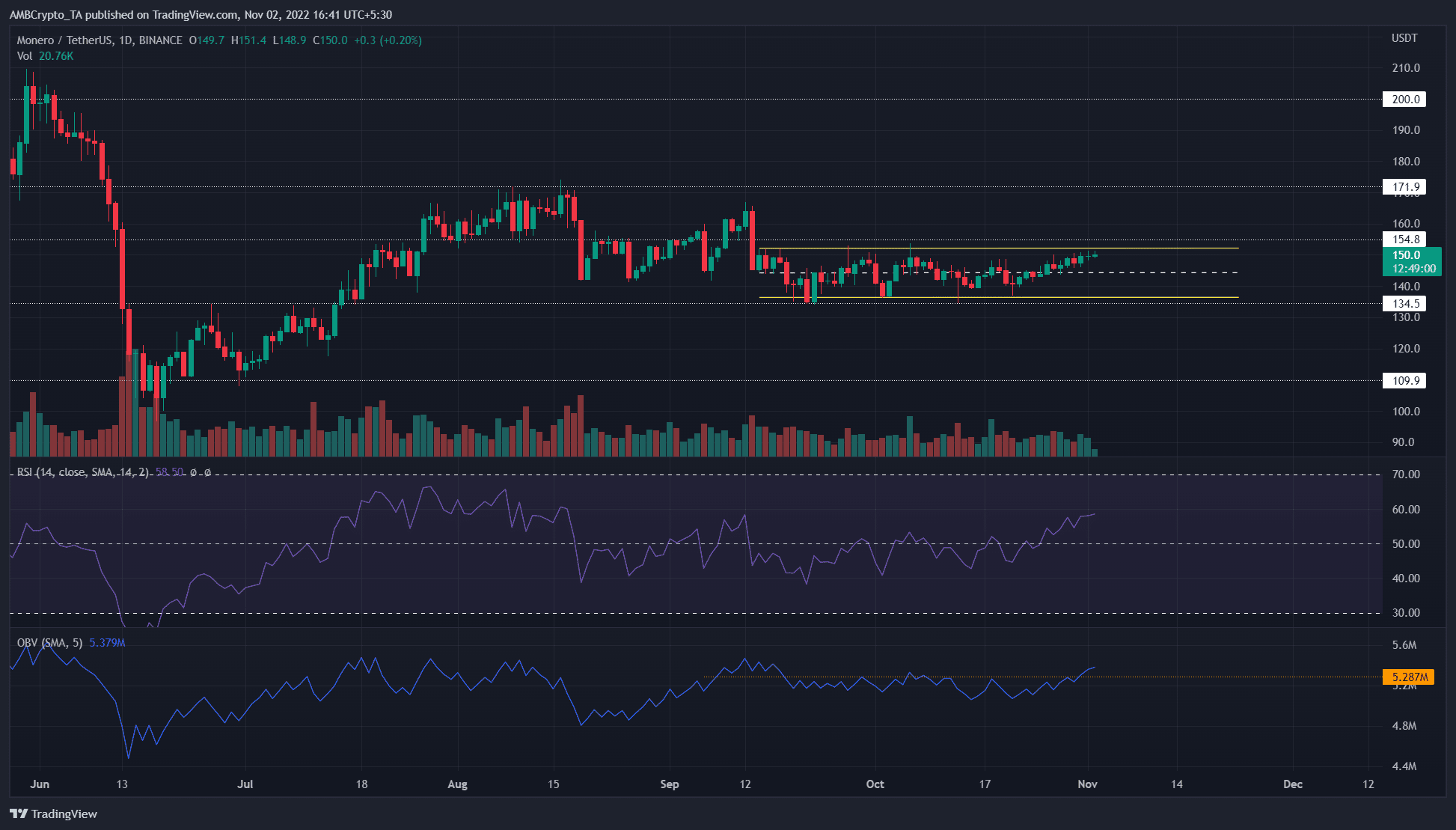

Monero has traded inside a spread between $152 and $136 since September. Technical indicators confirmed good shopping for stress and a probable breakout to the upside.

Right here’s AMBCrypto’s Worth Prediction for Monero [XMR] in 2022-23

A latest article highlighted the bearish indicators that Monero flashed in latest weeks. For example, the transaction rely decreased in September however noticed a restoration in October.

Bulls threaten a breakout however volatility might see a pullback

Supply: XMR/USDT on TradingView

The worth motion confirmed XMR approached the highs of a close to two-month vary. This area of resistance was one which XMR bulls have struggled to crack since late September.

The technical indicators confirmed some bullish indicators. The RSI on the 12-hour chart climbed above impartial 50 to indicate bulls have discovered some energy out there. In the meantime, the OBV additionally climbed above a stage of resistance from mid-September.

Collectively, these findings confirmed that the market started to point out some bullish intent prior to now few days. Nevertheless, the buying and selling quantity has been common in latest weeks. If the value climbed previous $156 and not using a surge in quantity, it could possibly be an early indication of a failed breakout.

Weighted sentiment lastly flips optimistic and a rally might ensue

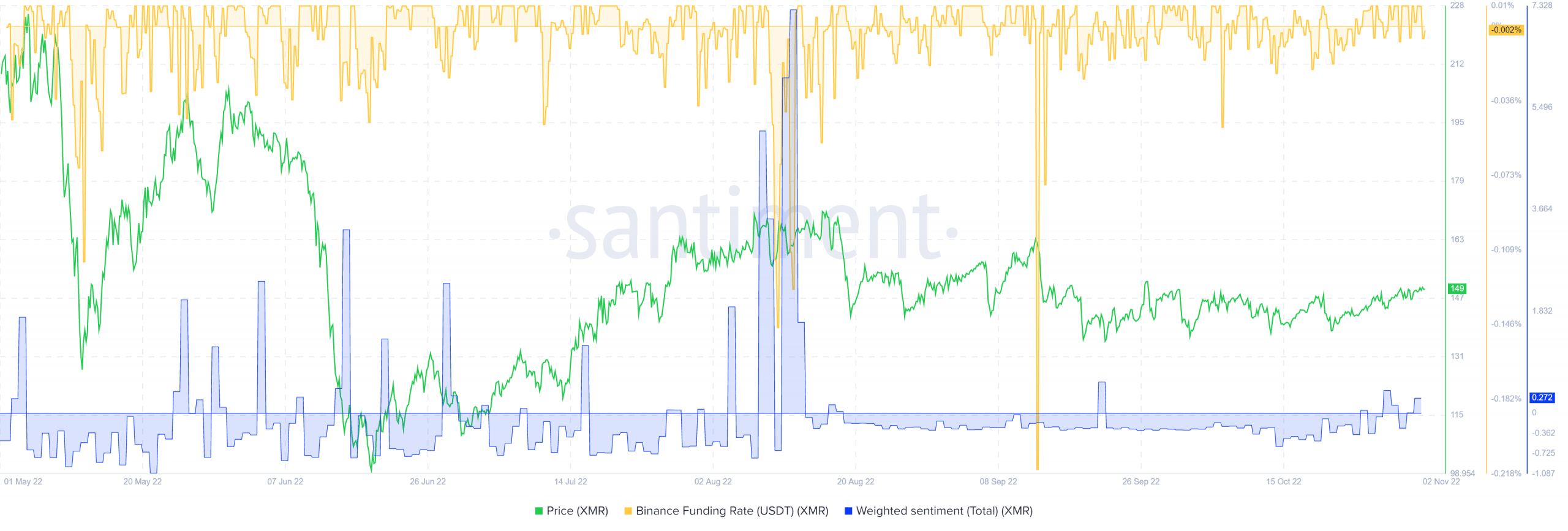

Supply: Santiment

Santiment information confirmed funding price was optimistic in latest days for XMR. At press time, it entered destructive territory. Nevertheless, total the inference is that the futures market individuals have been bullish prior to now few days.

This occurred alongside the rally in worth. Knowledge from Coinglass additionally confirmed funding charges on main exchanges corresponding to Binance to flip to optimistic.

The weighted sentiment has been weakly destructive since August. Nevertheless, this started to alter. The sentiment appeared to have shifted right into a barely optimistic zone. If social interactions proceed to stay so, bullish intent might shortly cascade and a rally upward can materialize.

In summation, merchants may need to await a breakout previous the vary on vital quantity. Thereafter a retest of the vary highs close to $156 can provide a shopping for alternative focusing on $172 and $200. Invalidation of this concept can be a session shut beneath $148.