Ethereum’s [ETH] post-Merge street to restoration didn’t go as per the expectations of many. The king of altcoins struggled to climb the value ladder for a lot of weeks and several other different metrics additionally turned in opposition to ETH. For example, Coinalyze’s data revealed that ETH’s Perpetual FTX open curiosity declined significantly over the past month.

Not solely FTX, however the same pattern was additionally seen on Kraken as open curiosity in perpetual futures contracts lately reached a 22-month low. These developments indicated that ETH was not receiving a lot curiosity and a spotlight from the derivatives market.

? #Ethereum $ETH Open Curiosity in Perpetual Futures Contracts simply reached a 22-month low of $10,579,276 on #Kraken

Earlier 22-month low of $10,607,113 was noticed on 23 October 2022

View metric:https://t.co/WYEahiHnRd pic.twitter.com/Cj1VEVqzpz

— glassnode alerts (@glassnodealerts) October 30, 2022

_____________________________________________________________________________________

Right here’s AMBCrypto’s Worth Prediction for Ethereum [ETH] for 2023-24

_____________________________________________________________________________________

Apparently, after an extended wait, ETH’s worth was pumping because it registered almost 25% weekly positive factors, because of the present bullish crypto market. On the time of writing, Ethereum was trading at $1,629.23 with a market capitalization of greater than $199.4 billion. Nevertheless, a take a look at ETH’s on-chain metrics might need made traders cross their fingers, as most of them steered an upcoming pattern reversal.

Pink sign forward

CryptoQuant’s data revealed that Ethereum’s Relative Power Index (RSI) was in an overbought place. This steered a potential downward motion for ETH’s worth within the coming days. Furthermore, ETH’s change reserves continued to rise, indicating increased promoting stress.

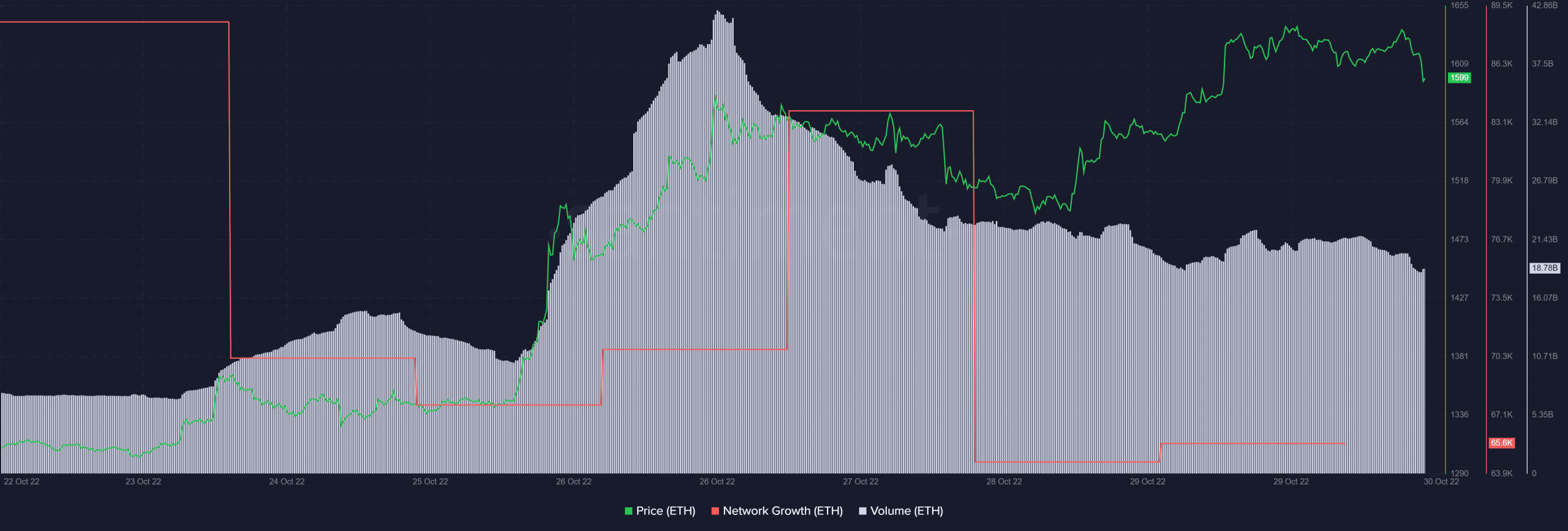

Ethereum’s community development registered a large downtick over the past week. This was one more bearish sign. ETH’s quantity additionally took the identical path and decreased prior to now few days.

Supply: Santiment

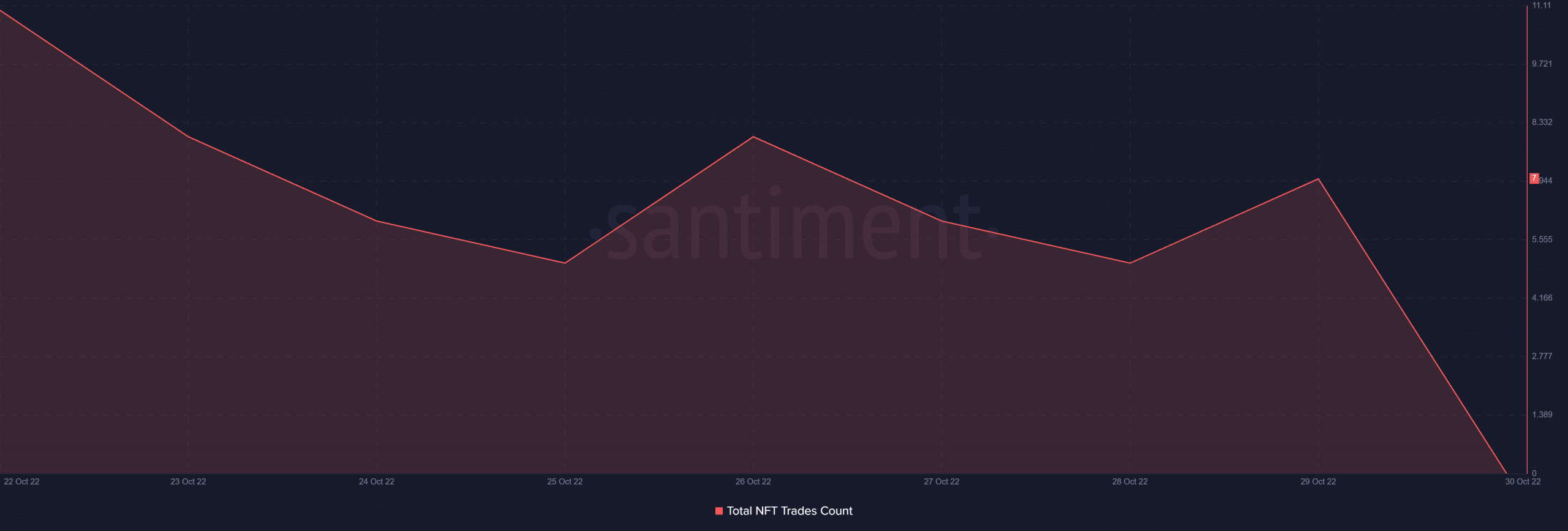

Unhealthy information got here in for Ethereum’s NFT house as effectively, because it didn’t register any development. Ethereum’s complete NFT commerce depend decreased. This indicated much less exercise on the community’s NFT house.

Supply: Santiment

Some incoming reduction

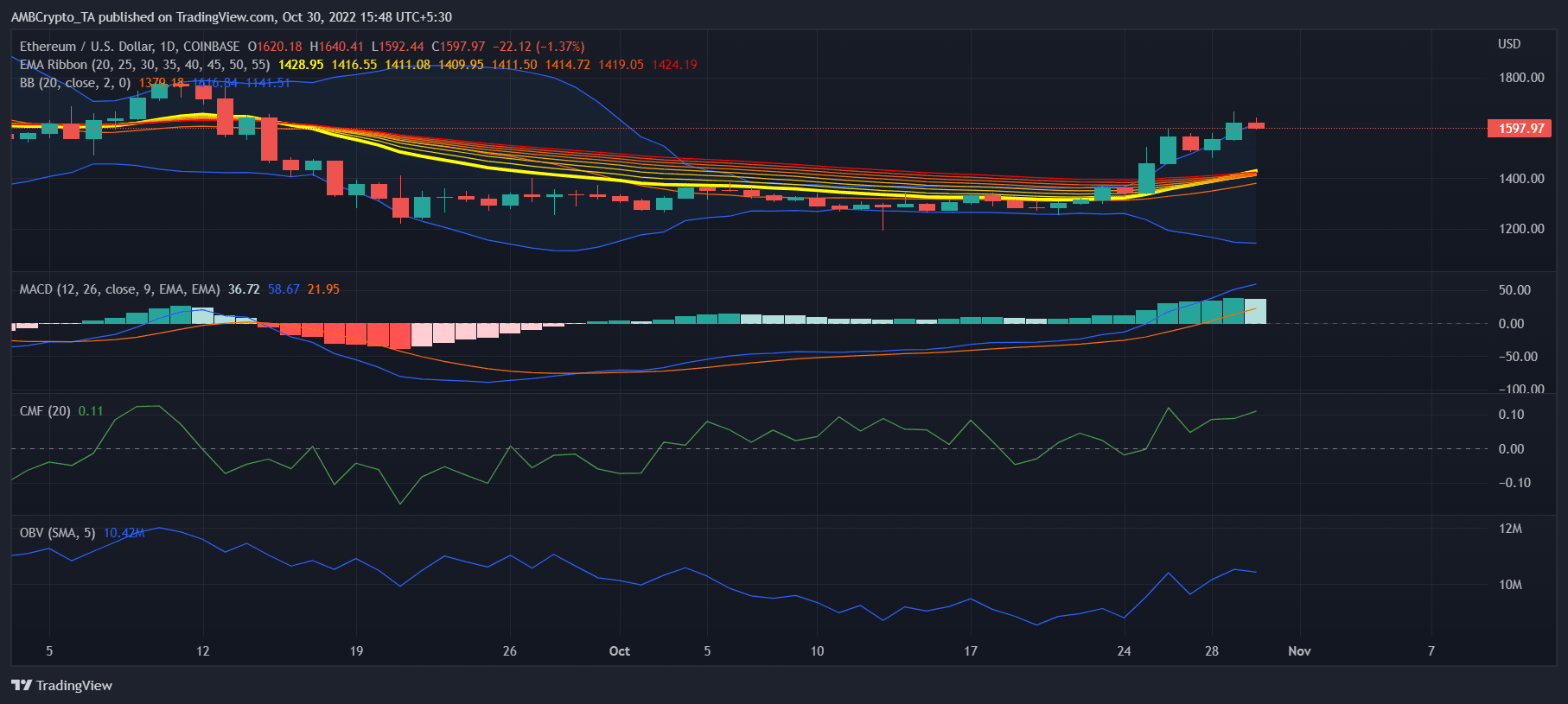

Apparently, Ethereum’s each day chart instructed a totally totally different story, as most market indicators have been in favor of a continued worth surge. The Exponential Shifting Common (EMA) displayed a bullish crossover. The Shifting Common Convergence Divergence (MACD)’s studying additionally supplemented EMA Ribbon’s findings because it too steered the bulls’ benefit out there.

Not solely this, however ETH’s Chaikin Cash Circulation (CMF) registered an uptick, which was a bullish signal. The Bollinger Bands (BB) additionally indicated that ETH’s worth was in a excessive volatility place, additional rising the probabilities of a worth hike within the days to come back. Nonetheless, ETH’s On Stability Quantity (OBV) marked a downtick, which could hinder ETH’s path of going up.

Supply: TradingView