The most important publicly traded Bitcoin miner within the U.S. by hash fee and mining fleet, Core Scientific (CORZ), issued a chapter warning in a submitting with the SEC on Oct. 26.

Shortly thereafter, the inventory took a nosedive. The inventory plummeted from $1.02 to $0.22. Whereas the CORZ inventory was buying and selling at $10.43 initially of the 12 months, it’s now down 97% year-to-date.

Notably, the Bitcoin value was unimpressed by the information. As NewsBTC reported, a Bitcoin miner capitulation is at the moment the largest intra-market danger. Subsequently, it’s questionable whether or not the danger of a capitulation occasion is now over or Core Scientific is the harbinger of an even bigger crash?

Bitcoin Miner Core Scientific On The Ropes

Paperwork filed with the U.S. Securities and Alternate Fee reveal that there’s a chance of chapter. The corporate mentioned it won’t make its debt funds due in late October and early November.

As well as, Core Scientific introduced that holders of its widespread inventory “may endure a complete lack of their funding.” Money may very well be depleted by the top of the 12 months or sooner, partially as a result of Celsius arguably owes the miner $5.4 million.

Nevertheless, answerable for the Bitcoin miner’s state of affairs, nevertheless, in response to administration, are that “working efficiency and liquidity have been severely impacted by the extended lower within the value of bitcoin, the rise in electrical energy prices,” in addition to “the rise within the world bitcoin community hash fee”.

Compass Level analysts imagine chapter is an actual chance, as CNBC quotes:

Nonetheless, with out figuring out how discussions are going with CORZ’s collectors, we predict a state of affairs the place CORZ has to file for Chapter 11 safety must be taken critically, particularly if BTC costs decline farther from present ranges.

For the second, the Bitcoin miner is contemplating numerous choices for elevating further capital.

All-Clear For The Bitcoin Value For Now?

The SEC doc provides the all-clear for the bitcoin value in {that a} sale of Core Scientific’s bitcoin holdings has already taken place. The corporate now holds solely 24 Bitcoins; 1,027 Bitcoins have been already bought final month.

On this respect, Core Scientific’s treasury shouldn’t be extra of a priority, however moderately the general unhealthy state of the Bitcoin mining business. The business is affected by skyrocketing electrical energy prices in addition to the depressed Bitcoin value.

Many bigger Bitcoin mining corporations ordered new {hardware} when the value was a lot greater. Resulting from lengthy supply occasions, they obtained the machines a lot later, at a time when the hash value was already a lot much less worthwhile.

One other well-known Bitcoin miner, Compute North, filed for chapter again in September and owes no less than 200 collectors as much as $500 million,as Bitcoinist reported.

The subsequent few months will due to this fact must reveal whether or not it’s going to take a deeper shakeout to flush unprofitable and over-leveraged miners out of the market. Core Scientific had the best debt to fairness ratio within the business at 3.5x.

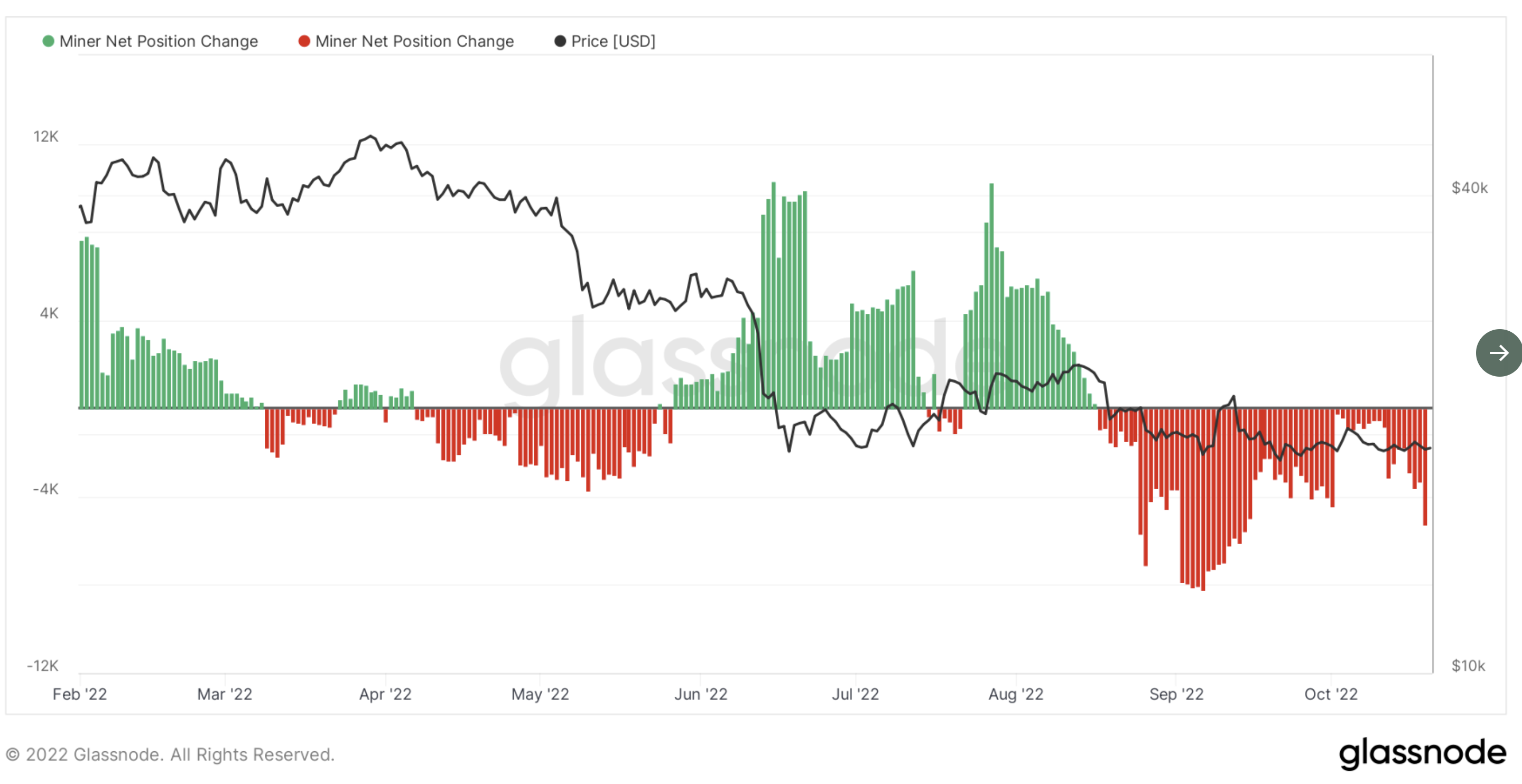

Presently, the miner web place change continues to point that the business is exerting promoting strain in the marketplace. The metric exhibits that the whole variety of Bitcoins bought by miners was greater than the quantity held on on daily basis all through October.

From a technical perspective, BTC seems to be ´poised to achieve lengthy territory’ quickly. For now, the value wants to brush the low and will maintain the extent at $19.9K.