Decentralized alternate (DEX) QuickSwap is ending its lending pool after sustaining losses in a flash mortgage assault.

The Polygon (MATIC) based mostly DEX says $220,000 price of tokens have been stolen following an exploit of DeFi platform Market XYZ.

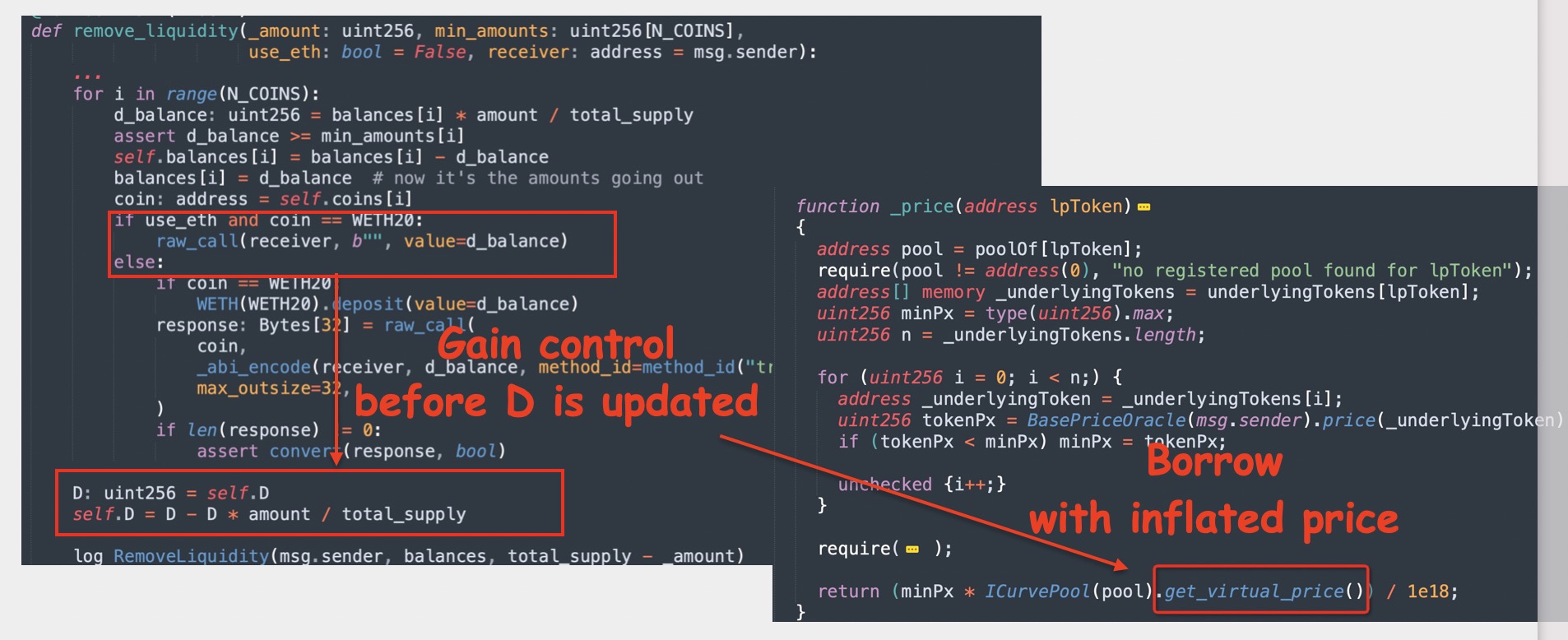

The platform says the incident stems from a flaw in automated market maker (AMM) Curve Oracle, which Market XYZ was utilizing.

“QuickSwap Lend is closing. $220,000 was exploited in a flash loans assault as a consequence of a vulnerability with the Curve Oracle, which Market XYZ was utilizing.”

QuickSwap says the hack didn’t have an effect on any consumer funds and clarifies that the DEX’s contracts haven’t been compromised.

Nonetheless, the platform is terminating help for Market XYZ, and urges the platform to compensate for the losses of stablecoin creator Qi Dao, which offered the pool’s seed funds.

“We’re encouraging customers with funds deposited in Market xyz’s open markets on QuickSwap to withdraw them now, as we’re within the strategy of closing them down.

Blockchain safety agency Peckshield says the assault was achieved by compromising Curve Oracle’s value feed, after which borrowing funds based mostly on the brand new inflated value.

“It’s a value manipulation difficulty. The miMATIC market makes use of CurvePoolOracle for value feed, which is manipulated to borrow funds from the market.”

Peckshield additionally says blockchain safety agency ChainSecurity reported the vulnerability earlier this month.

The DeFi area has already seen a number of giant exploits this month, together with Olympus decentralized autonomous group (DAO) and Mango Markets DAO.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Featured Picture: Shutterstock/Vink Fan/Voar CC