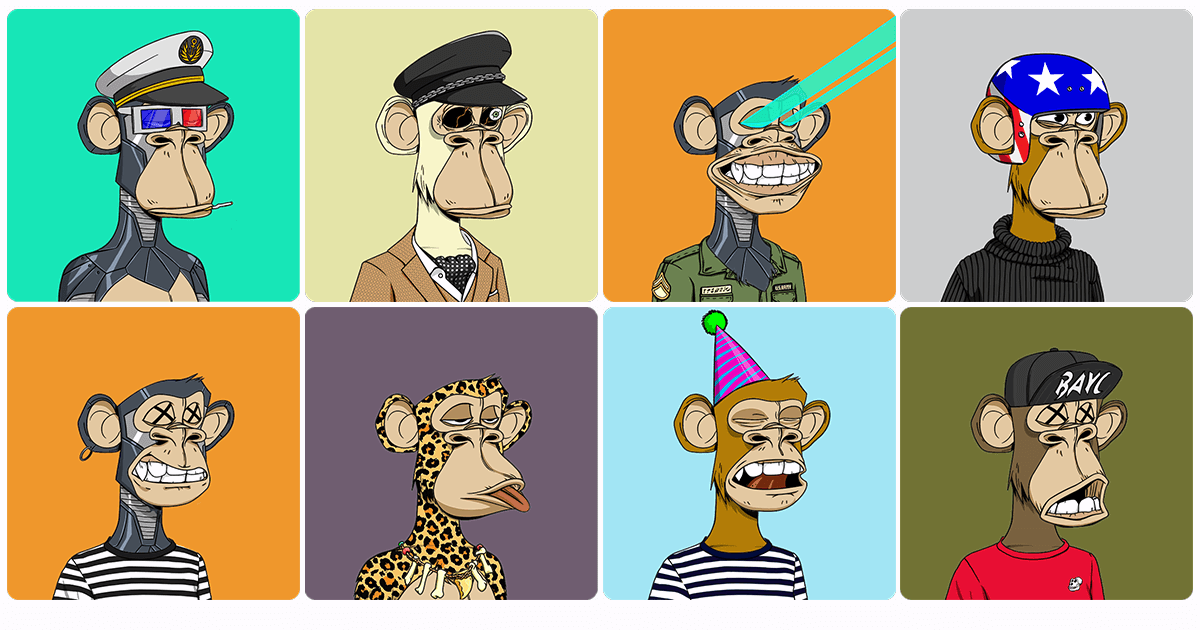

Yuga Labs, one of the vital initiatives within the Web3 area, is below investigation by the US Securities and Trade Fee (SEC), in response to Bloomberg. Apparently, the investigation will search to ascertain if gross sales of Yuga’s digital property violate federal regulation. If that’s the case, there could possibly be monumental implications for Yuga Labs, the creators of the BAYC, and your entire NFT panorama. The information comes from a supply near the matter, who stays unnamed.

The SEC continues to crack down on Web3

The US Securities and Trade Fee – generally often called The SEC – has been working onerous to create a transparent algorithm during which NFT initiatives ought to function. Nonetheless, it’s not as straightforward as that. With an extremely outdated set of legal guidelines, the explosion of web3 and NFTs is a gray space for lawmakers.

The probe into Yuga Labs – the creators of the Bored Ape Yacht Membership ecosystem – is the most recent case introduced ahead by SEC Chair Gary Gensler because the SEC makes an attempt to make sure web3 adheres to present laws.

Beforehand, Gensler said that almost all crypto holdings and property fall below securities regulation legal guidelines set out by the Supreme Court docket in 1946. On this vital ruling, the Supreme Court docket gave the SEC the flexibility to find out if investments are securities when there may be an expectation of revenue.

Different circumstances that the SEC has gained embody a large $50 million advantageous for BlockFi Inc. Yuga Labs will hope this isn’t the case for them.

Why is The SEC concentrating on Yuga Labs?

There are a number of the explanation why the SEC would possibly examine Yuga Labs. Yuga Labs is among the greatest firms in web3, and the probe is undoubtedly pivotal for NFT legal guidelines. Maybe it is usually a message to the broader web3 group to get in line.

One problem that the SEC will try and determine is whether or not NFT tokens are much like shares and, if that’s the case, whether or not they need to comply with the identical guidelines. Shares have a number of legal guidelines in place, together with disclosure legal guidelines. At present, no such guidelines are in place within the NFT area.

The SEC may even take a look at ApeCoin, the BAYC governance and utility token. This was given to NFT holders within the BAYC ecosystem without spending a dime.

Yuga Labs welcomes the probe

In response to the SEC probe, Yuga Labs has mentioned it could assist the federal government company with any inquiries it has. Yuga said, “It’s well-known that policymakers and regulators have sought to study extra concerning the novel world of web3. We hope to accomplice with the remainder of the trade and regulators to outline and form the burgeoning ecosystem. As a pacesetter within the area, Yuga is dedicated to completely cooperating with any inquiries alongside the best way.”

Moreover, in a lighthearted response to the information, @GordonGoner, one of many founders of Yuga Labs, tweeted, “Gm.” It is a well-known phrase within the NFT area, which means good morning.

No proof to recommend Yuga Labs has damaged any legal guidelines

At present, it is a probe into Yuga Labs, and there’s no suggestion of any wrongdoing. If the rumors from the unnamed supply are true, that is to find out a precedent for whether or not NFTs are securities.

Considerably, after the information broke, the worth of ApeCoin additionally fell sharply. In line with stats from CoinMarketCap, the worth dropped round 9%.