The most important information within the cryptoverse for Sept 20 consists of Wintermute shedding $160 million to DeFi operation hack, Ethereum developer confirming that Shanghai improve won’t unlock staked ETH, Specialists arguing that SEC can not declare jurisdiction over Ethereum transactions, MicroStrategy buys a further 301 Bitcoin for $6 million.

CryptoSlate High Tales

Wintermute reveals $160M hack in DeFi operations

A hacker attacked about 90 crypto belongings belonging to main market maker Wintermute. The agency’s DeFi operation misplaced over $160 million to the incident.

Wintermute’s CEO Evgeny Gaevoy stated that market-making funds are protected, because the CeFi and OTC operations weren’t affected by the hack.

Ethereum vainness handle exploit could also be reason behind Wintermute hack

Blockchain safety agency Certik confirmed claims by the Ethereum group {that a} vainness handle exploit might be the basis reason behind the Wintermute assault.

Here’s what we all know so removed from the @wintermute_t exploit ?

We’ve got recorded that $162,509,665 have been stolen.

The exploit is probably going because of a brute drive assault on Profanity pockets compromising a non-public key.

Keep vigilant! pic.twitter.com/zVRd3e5TbS

— CertiK Alert (@CertiKAlert) September 20, 2022

1nch contributor k06a famous that since Wintermute’s handle had 7 main 0’s, it might have taken solely 50 days to brute drive hack the handle utilizing a 1,000 GPU mining rig.

Ethereum developer confirms Shanghai improve won’t unlock staked tokens

In a chat with CryptoSlate, Ethereum developer Micah Zoltu affirmed that the Shanghai improve won’t allow the withdrawal of staked ETH tokens, however will deal with decreasing fuel payment.

Zoltu added that there isn’t any specified timeline for enabling withdrawal, as Ethereum core devs are but to debate the modalities to unlock staked ETH.

Specialists argue SEC can not declare jurisdiction over Ethereum transactions

Etherenodes knowledge reveals that roughly 43% of Ethereum validator nodes function from the U.S. Consequently, the SEC is laying claims that Ethereum transactions occurred in its jurisdiction.

Crypto consultants have differed with the SEC on the problem stating that it’s an unacceptable precedent that the crypto group has to combat towards.

Voyager urges Alameda Analysis to repay $200M mortgage

Again in July, Alameda Analysis stated it was joyful to return its mortgage and retrieve its collateral “every time works for Voyager.”

The appointed time is right here, as Voyager has filed a movement requesting Alameda to repay its $200 million mortgage. Voyager additionally agreed to launch Alameda’s $160 million collateral.

Vitalik Buterin argues that extremely decentralized DAOs will probably be extra environment friendly than firms

Vitalik has argued that decentralized autonomous organizations (DAOs) will probably be extra environment friendly than conventional firms in the event that they keep the ethos of decentralization whereas incorporating parts from firms.

To design an efficient DAO, Vitalik proposed that protocols ought to learn to make choices in a well timed method from firms and look as much as political sovereigns when designing their succession system.

MicroStrategy buys further 301 Bitcoin for $6M

Michael Saylor-led MicroStrategy has topped its asset holding by buying 301 Bitcoin, at the price of $6 million.

To this point, MicroStrategy has amassed a complete of 130,000 BTC and plans to inject as much as $500 million to purchase extra.

U.S. Treasury requests public touch upon curbing crypto-related crimes

The Treasury has known as on the general public to supply suggestions that may information its method in drafting a regulatory invoice aimed toward curbing illicit financing perpetrated utilizing cryptocurrencies.

The Treasury can also be open to studying the way it can apply blockchain analytics instruments to enhance its AML/CFT compliance course of.

Crypto promoter Ian Balina labels SEC cost ‘frivolous,’ turns down settlement

The SEC filed a case towards Ian Balian for selling the SPRK token in 2018. The fee categorised the tokens as an unregistered safety, stating that Balina unduly fashioned an funding pool to resale the token.

Balina stated that he declined to settle with the SEC for what he considers a “frivolous’ cost.

Analysis Spotlight

State of Ethereum derivatives market post-Merge

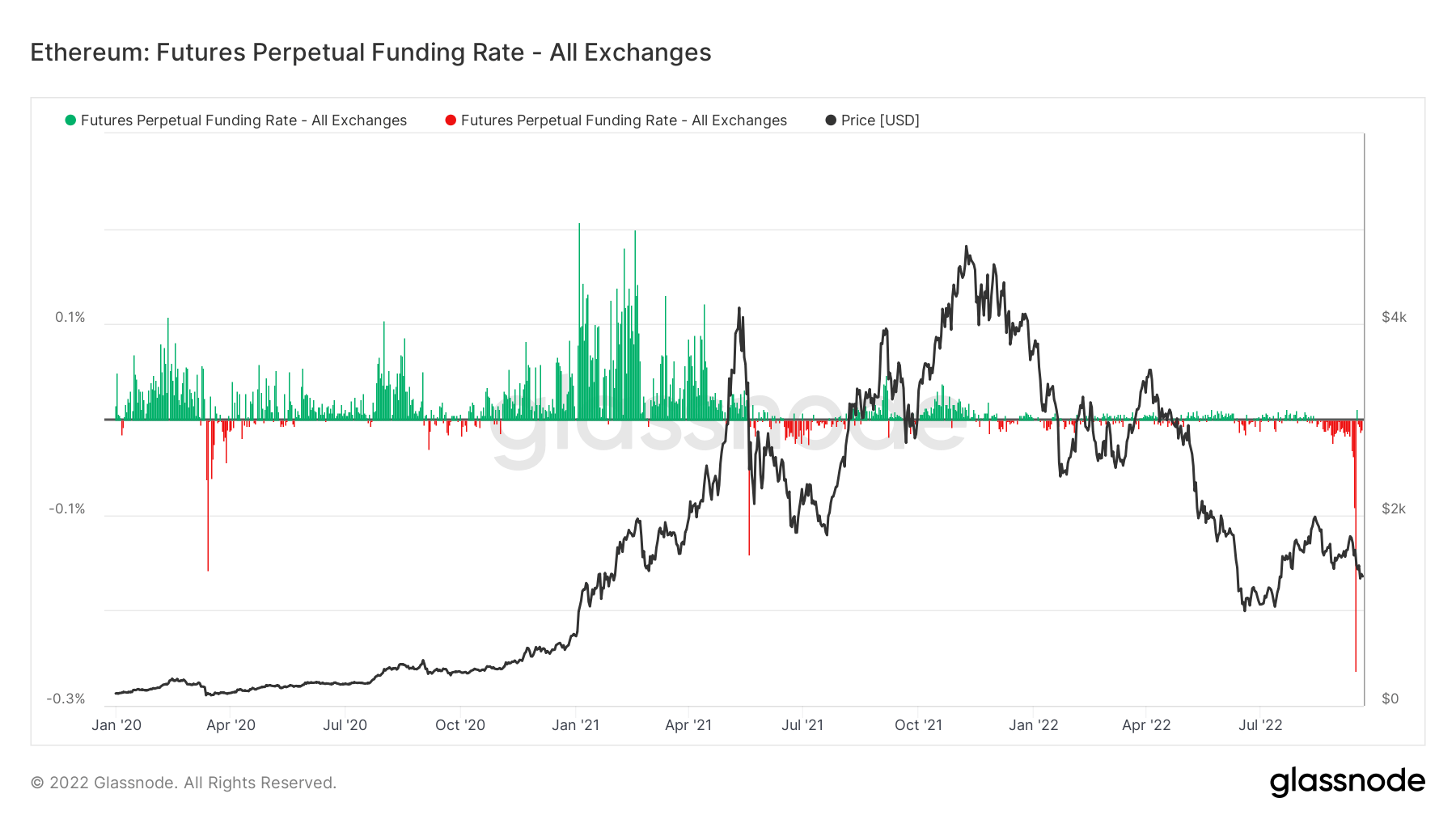

CryptoSlate analyzed Ethereum’s futures perpetual funding charge and open curiosity to disclose that though speculations across the Merge are over, traders are prepared to go lengthy.

In line with the funding charge knowledge, ETH merchants have been paying up about 1,200% to quick Ethereum, which noticed ETH decline over 20% during the last seven days.

As of press time, the development is reversing, suggesting that short-term hypothesis is over, and merchants need to reinvest.

Information from across the Cryptoverse

Robinhood brings USDC to its customers

USDC was listed as we speak as the primary stablecoin on Robinhood’s inventory buying and selling platform. The transfer signifies the corporate’s dedication to increasing its crypto buying and selling enterprise mannequin.

Crypto Market

Within the final 24 hours, Bitcoin declined under the $19k assist degree to sit down at $18,913, recording a lower of -3.19%. Over the identical interval, Ethereum declined by -3.95%, to commerce at $1,324.