New information from crypto analytics agency Messari reveals that cash is pouring into crypto tasks in defiance of falling markets.

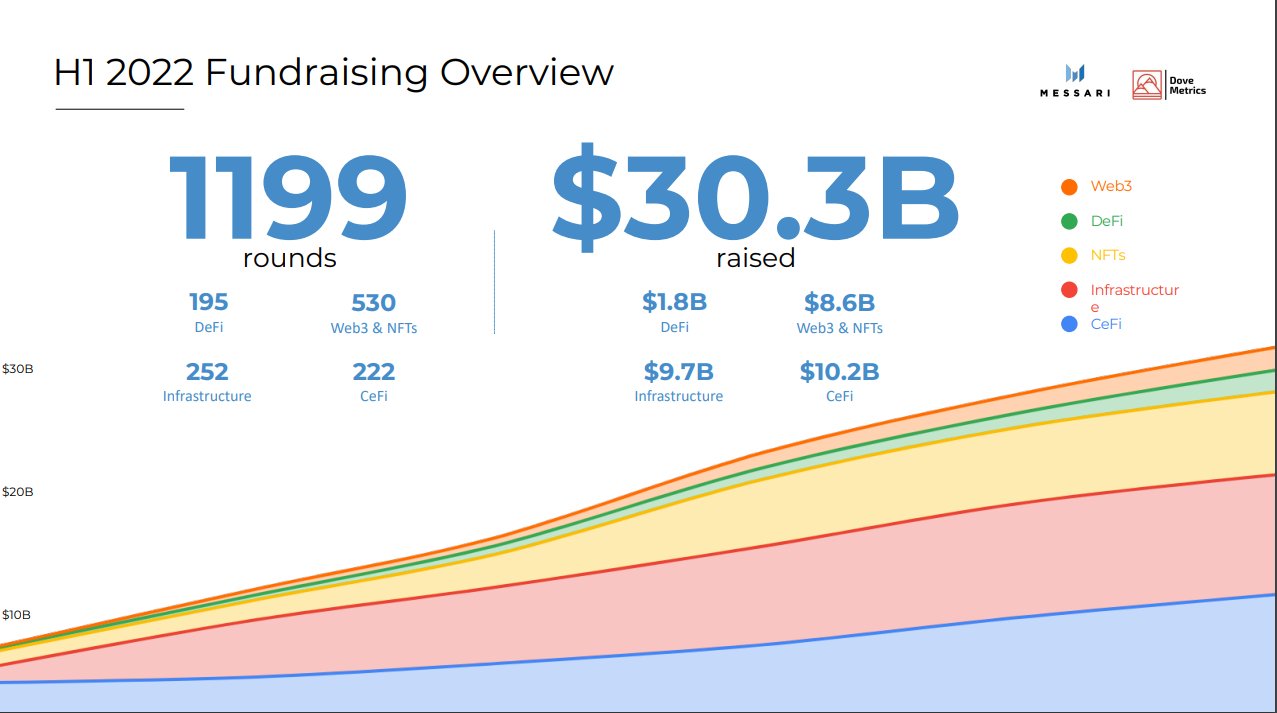

In keeping with a brand new report compiled with fundraising tracker Dove Metrics, Messari shows that crypto companies raised over $30 billion in practically 1,200 rounds through the first half of 2022.

The report highlights a number of key sectors of the business as receiving huge money infusions regardless of the bear market, which has stored buyers annoyed since final November.

Messari’s senior analysis analyst Thomas Dunleavy provides extra particulars concerning the survey, first noting that,

“The largest spotlight: regardless of the bear market there was extra invested in H1 2022 than all of 2021.”

Dunleavy subsequent dives into a number of crypto niches, starting with decentralized finance (DeFi) and the affiliated decentralized exchanges (DEXs).

“Regardless of an epically tough Might, offers accelerated for DeFi in June. DEXs led the best way.

Nearly all of offers and {dollars} raised was on Ethereum-based ecosystems.”

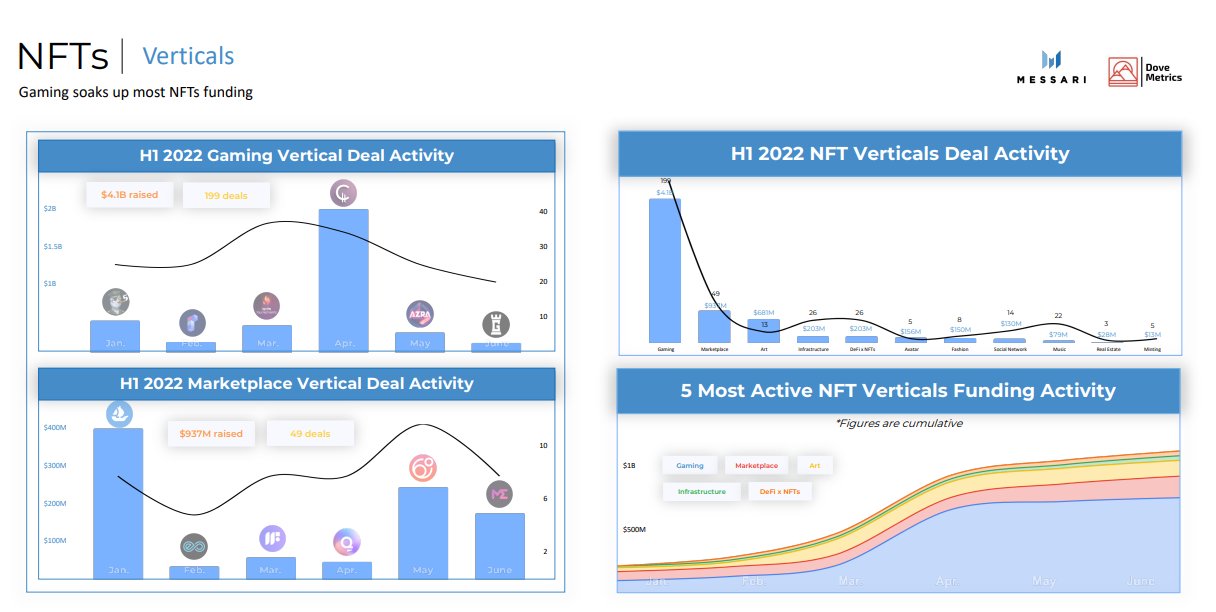

Additionally seeing a big boost in funding was the non-fungible token (NFT) area of interest, which focuses each on distinctive digital artwork items in addition to belongings for blockchain-based video video games.

“Gaming bought $4 billion in funding, dwarfing all different segments.

Many of the deal quantity was on Ethereum however cash truly skewed in direction of different chains.”

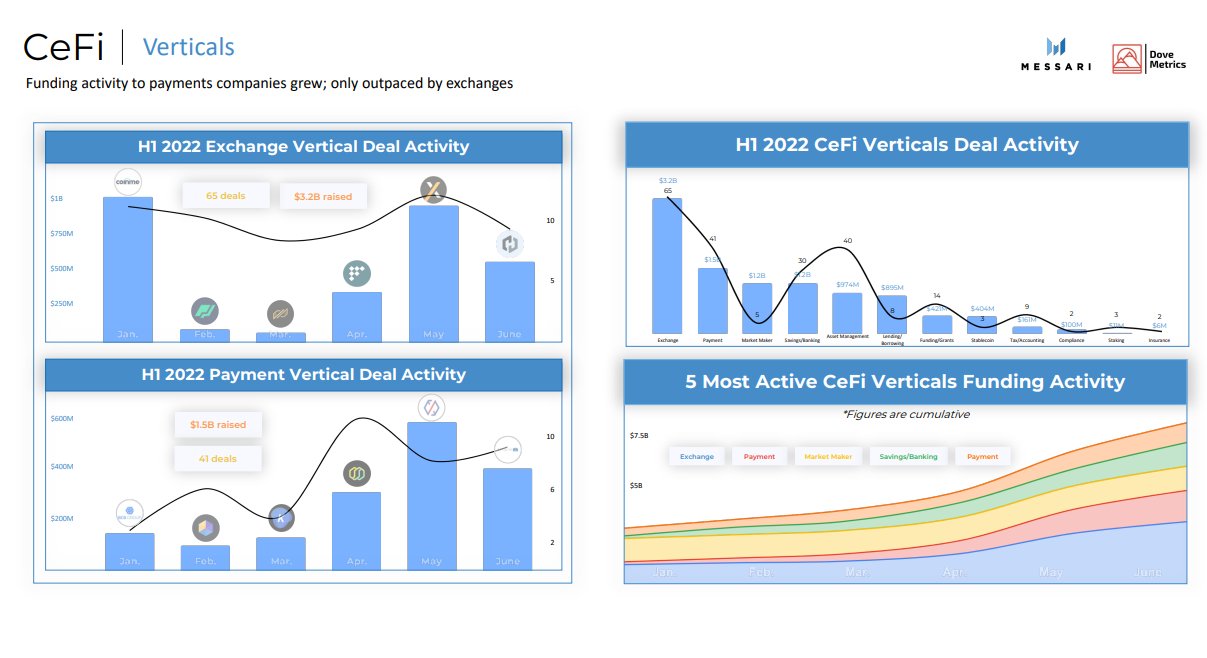

In terms of centralized finance (CeFi), Dunleavy says the sector captured a few third of the funds raised within the first half of the 12 months.

“CeFi exchanges led the best way right here as effectively. CeFi introduced in $10.3 billion within the first six months of the 12 months, with nearly half of all funding rounds totaling greater than $10 million.”

Along with the practically $20 billion the previous three sectors raised, normal blockchain infrastructure accounted for $9.7 billion in capital raised through the first six months of 2022.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/eliahinsomnia