Key Takeaways

- Ripple launched its second quarter markets report Thursday, revealing it elevated XRP gross sales by round 50%.

- The gross sales had been attributed to a spike in demand for its On-Demand Liquidity service.

- XRP now seems sure for a short correction earlier than advancing additional.

Share this text

Whereas many crypto giants collapsed within the second quarter, together with Terra, Three Arrows Capital, Celsius, and BlockFi, Ripple has affirmed that it made important strides to extend the utility of the XRP ledger and its On-Demand Liquidity service.

Ripple Will increase XRP Gross sales

Ripple released its second quarter markets report Thursday, revealing a considerable improve in XRP gross sales and the utility of its On-Demand Liquidity (ODL) service.

The U.S.-based agency affirmed that its second quarter was a hit. In line with the report, the quantity of its ODL recorded 800% year-to-year development due to a number of partnerships that helped speed up demand. One of many agency’s most vital partnerships was with the Lithuanian cash switch supplier FINCI, which geared toward delivering on the spot and cost-effective retail remittances.

With the worldwide growth of ODL, Ripple additionally elevated XRP gross sales by round 50%. The agency offered round $408.9 million value of XRP within the second quarter, including to the $273.27 million it minimize from its holdings within the earlier quarter. In the meantime, the corporate reported that volumes declined by 22% quarter-to-quarter to a mean each day quantity of $862 million, down from $1.1 billion.

Within the report, Ripple famous that XRP’s second quarter worth efficiency was affected by “broader macroeconomic cues and idiosyncratic developments.” Nonetheless, the token has managed to slice by an important resistance space previously 48 hours. Additional improve in bullish momentum may assist XRP advance increased.

XRP to Retrace Earlier than Increased Highs

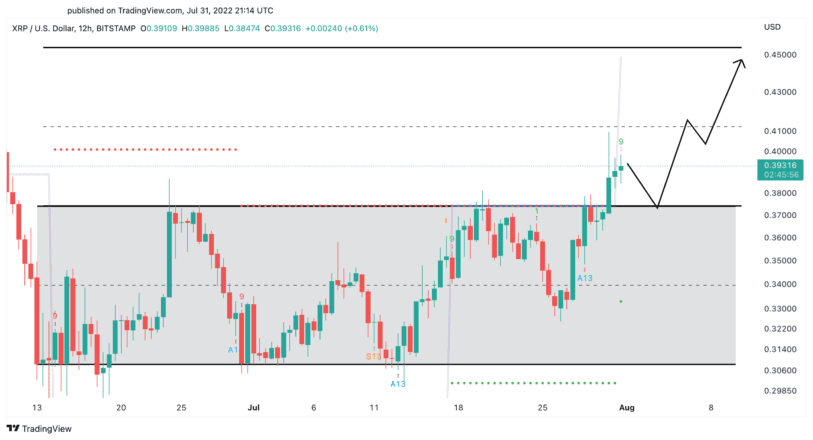

From a technical perspective, XRP seems to have damaged out of a parallel channel on its 12-hour chart. The Tom DeMark (TD) Sequential indicator is at present presenting a promote sign within the type of a purple 9 candlestick. The bearish formation anticipates a short retracement to $0.37, at which level XRP may accumulate liquidity earlier than making one other bullish impulse towards $0.45.

Given the spike in Ripple’s XRP gross sales, the $0.37 help degree is essential in case of a downswing. If XRP fails to carry above this important demand zone, it may endure a sell-off and plummet to $0.34.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

For extra key market tendencies, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.