Key Takeaways

- Bitcoin and Ethereum have jumped greater than 4% within the final six hours.

- The upswing coincides with information that the U.S. economic system contracted.

- BTC and ETH now commerce round essential resistance ranges.

Share this text

The highest two largest cryptocurrencies by market cap, Bitcoin and Ethereum, seem to have entered a brand new uptrend regardless of information that the U.S. economic system has entered a so-called “technical recession.”

Bitcoin and Ethereum Head Larger

Bitcoin and Ethereum have loved vital positive aspects over the previous few hours after the most recent U.S. GDP print.

The whole cryptocurrency market capitalization elevated by roughly $40 billion following experiences that the U.S. economic system contracted for the second consecutive quarter. The Bureau of Financial Evaluation affirmed that the U.S. Gross Home Product (GDP) fell 0.9% at an annualized tempo.

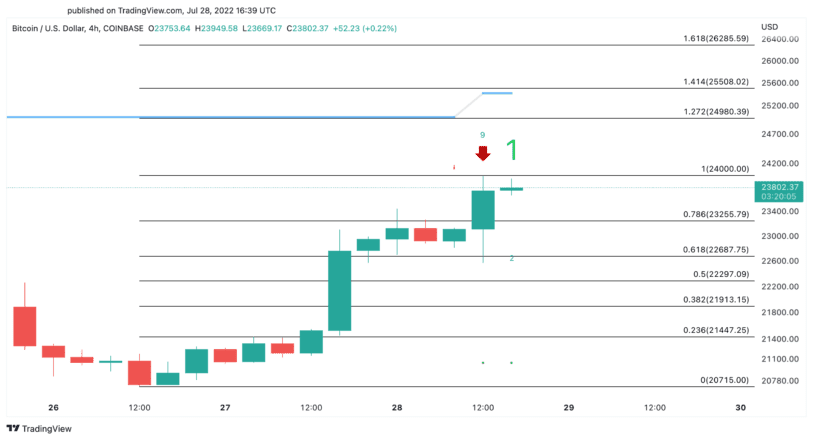

With the U.S. economic system now technically in a recession, Bitcoin seems to be taking the highlight. The flagship cryptocurrency gained greater than 900 factors in market worth because the GDP numbers had been launched. Now that Bitcoin’s bullish momentum has been affirmed, the highest cryptocurrency is displaying early indicators of wanting to maneuver larger.

The Tom DeMark (TD) Sequential introduced a promote sign on the four-hour chart. Though the bearish sign anticipates a retracement to $23,260 and even $22,690, BTC exhibits power because it edges nearer to $24,000. A four-hour candlestick shut above this significant space of resistance might invalidate the short-term pessimistic outlook and lead to an upswing to $25,500.

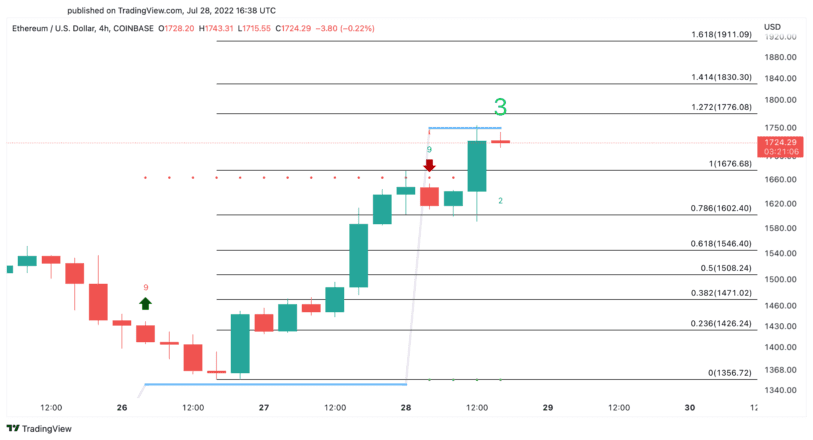

Likewise, Ethereum loved a virtually 7% value improve previously six hours. The upswing allowed ETH to slice by an essential space or resistance at $1,650. Now, the TD’s threat line at $1,750 seems to be the subsequent hurdle that ETH should overcome to advance additional.

A decisive four-hour candlestick shut above $1,750 might generate sufficient bullish momentum to push Ethereum to $1,830 and even $1,900. Nonetheless, ETH should maintain above $1,680 to validate this bullish thesis. Failing to take action might set off a spike in profit-taking that pushes Ethereum again to $1,600 and even $1,550.

Whereas macroeconomic situations proceed to deteriorate, market individuals might consider that the most recent U.S. GDP numbers have been priced in. Detrimental development may pressure the Fed to modify to a extra easing financial coverage earlier than anticipated. Even with a lot uncertainty within the world economic system, it seems that crypto property are discovering the power to recuperate within the brief time period.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

For extra key market developments, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.