salarko/iStock Editorial through Getty Photos

“Lettuce arms” is an expression some folks use to explain an investor who sells their Bitcoin (BTC-USD) on the first signal of bother, typically at a loss. An instance of its use in a sentence may be: “Elon Musk has lettuce arms as a result of he offered 75% of Tesla’s (TSLA) Bitcoin holdings within the second quarter.”

The above sentence is greater than an instance; it occurs to be the reality. Throughout Tesla’s quarterly outcomes webcast final week, Musk admitted to dumping some $936 million of Bitcoin to lift money out of concern of an financial pullback resulting from pandemic lockdowns in China. The chief government mentioned he offered for a “realized acquire,” however some folks on-line have some critical doubts.

To be truthful, Musk added that he was open to purchasing extra sooner or later. However to many Bitcoin followers and advocates, his choice to promote looks like a betrayal-especially since he continues to carry the meme coin Dogecoin (DOGE-USD), created in 2013 as a joke.

When Tesla initially introduced in February 2021 that it had purchased $1.5 billion in Bitcoin, the crypto neighborhood noticed this as signaling the beginning of a pattern of huge corporations and different institutional traders holding the digital asset on their stability sheets. The keenness solely mounted the next month when the electrical automobile (EV) maker introduced it might start accepting Bitcoin as fee.

These plans lasted little greater than a month earlier than Musk suspended Bitcoin funds. The explanation? Mining the asset, he claimed, consumed an excessive amount of vitality and emitted a great deal of greenhouse gases.

We now know that Musk’s issues, whereas legitimate, have been and aren’t grounded in fact. Some may name them FUD, or worry, uncertainty and doubt.

Bitcoin Miners Are The “Patrons Of Final Resort” When It Comes To Sustainable Vitality

Musk is correct in a single respect: Bitcoin mining is vitality intensive, little doubt about it, and it’ll solely get more and more extra vitality intensive on a per-coin foundation as the issue fee heads increased.

The place he is mistaken is in saying that Bitcoin mining is dirtier than different industries. The reality is that institutional-size miners’ utilization of renewable, non-carbon-emitting vitality has been proven to be larger on common than that of any massive nation on earth.

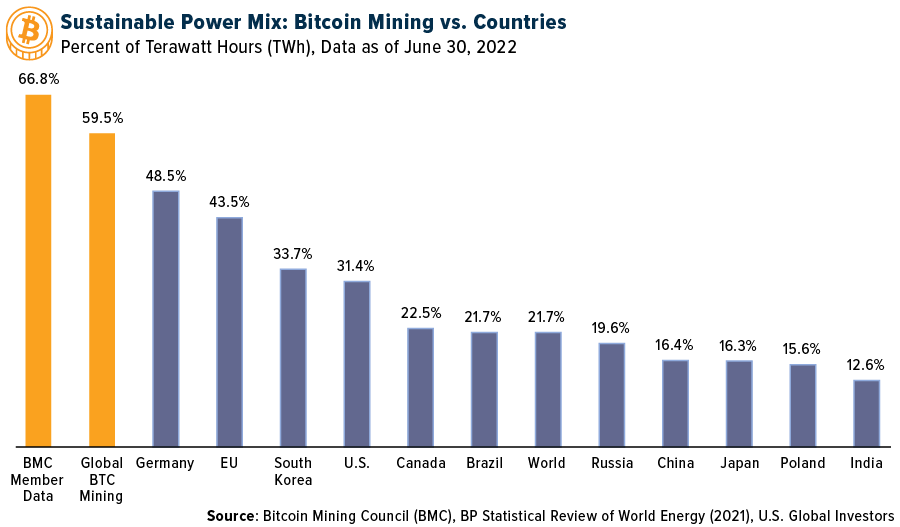

Under are the second-quarter survey outcomes from members of the Bitcoin Mining Council (“BMC”), of which HIVE Blockchain Applied sciences (HIVE) is a founding member. In line with the information, sustainable vitality (wind, photo voltaic, hydro, geothermal, and so forth.) represents a powerful 66% of BMC members’ energy combine. For all the international Bitcoin community, it is almost 60%. No G20 nation comes near utilizing that degree of renewable vitality as a p.c of whole vitality use.

Sustainable energy combine: Bitcoin mining vs. international locations (Bitcoin Mining Council )

And as many others have identified, together with myself, large-scale Bitcoin miners are fairly often the patrons of final resort in the case of renewable vitality. They repeatedly eat a lot of the electrical energy that in any other case would have gone to waste throughout non-peak hours. This makes sustainable vitality extra aggressive and can encourage additional deployment of wind and photo voltaic.

Dennis Porter, CEO of the Satoshi Motion Fund, whose mission is to coach policymakers on the deserves of Bitcoin, takes it a step additional. Bitcoin mining, he mentioned in a current tweet, will someday “be such an vital a part of the grid that in the event that they attempt to ban it, we’ll all be with out energy.”

Regardless of all of this, Tesla nonetheless has no plans to start accepting Bitcoin as fee once more. The one digital asset it does settle for is Dogecoin, whose market cap is barely about 2% the dimensions of Bitcoin’s.

Shanghai Lockdown A Problem For Tesla In Q2

We proceed to love Tesla, however. The lockdowns in Shanghai have been an enormous problem for the carmaker within the second quarter, with income down in comparison with the prior quarter. Now that factories are again up and operating, although, we anticipate to see stronger outcomes when the corporate reviews on the third quarter.

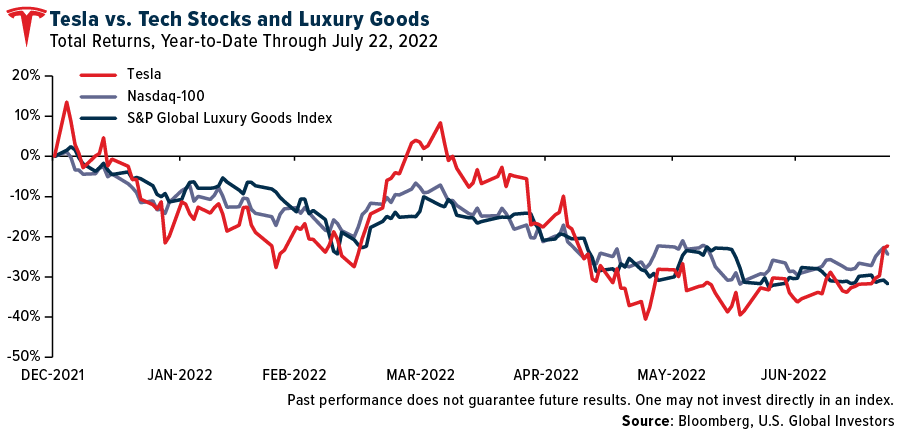

Like tech shares and luxurious items shares, each of which Tesla is taken into account a member, shares have traded down into bear market territory this 12 months on rising charges, recession fears and international provide chain points.

Tesla vs. Tech Shares and Luxurious Items (Bloomberg)

International Bitcoin Adoption To Hit “Parabolic Section” In 2030

Tesla’s suspension of Bitcoin funds raises questions relating to the digital asset’s viability as a forex and extensively accepted medium of trade. An increasing number of corporations and retailers will take your Bitcoin, however to date, a comparatively few transactions are made utilizing the crypto. In line with one supply, Bitcoin at the moment processes solely round seven transactions per second in comparison with Visa’s (V) 1,700 and Mastercard’s (MA) 5,000.

Nevertheless it will not be like this ceaselessly, says the most recent analysis by blockchain infrastructure agency Blockware Options.

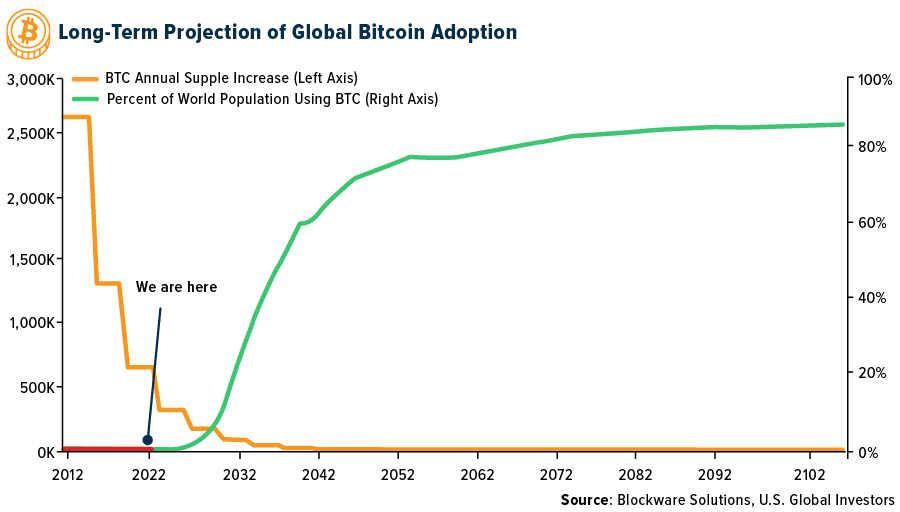

In a June report, the corporate seems at historic adoption traits for various earlier disruptive applied sciences, together with the car, radio, web, smartphone and extra. Though the velocity of adoption in these circumstances differed, one factor was sure: As soon as adoption hit 10% of the inhabitants, progress grew to become “parabolic” as penetration shifted from the “early adopters” to “early majority,” and at last to the “late majority.”

Lengthy story brief, Blockware predicts that international Bitcoin adoption will break previous 10% within the 12 months 2030. After that, progress may develop into parabolic, finally reaching 80% of the inhabitants within the 2050s.

Lengthy-term projection of worldwide bitcoin adoption (Blockware Options)

Simply as a reminder, Bitcoin provide is capped at 21 million. Divide that amongst 8 billion folks, which is what international inhabitants is projected to succeed in later this 12 months. The mannequin above means that proudly owning only one entire Bitcoin and holding it for the lengthy haul may find yourself producing not solely life-changing wealth however generational wealth.