newbie

Quantity is an important metric in crypto buying and selling and funding. A excessive buying and selling quantity results in honest and, often, much less risky value modifications. Low quantity could cause erratic value motion and open the doorways to manipulation, making it a lot simpler to execute pump and dump schemes.

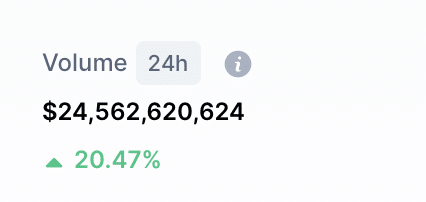

You possibly can measure quantity in just a few alternative ways. It may well consult with the whole variety of cash traded in a given interval, the whole greenback worth of all trades in a given interval, or the variety of distinctive addresses used to purchase or promote a selected coin.

Quantity can point out a number of issues relying on the calculation methodology. Let’s take a more in-depth take a look at the several types of quantity you possibly can encounter when buying and selling cryptocurrencies!

Crypto Buying and selling Quantity Defined

The buying and selling quantity of a cryptocurrency is measured by the variety of cash or tokens traded in a given interval. It’s often expressed because the variety of cash traded per day. For instance, if 1,000 BTC and 500 BTC are traded on two completely different exchanges on a selected day, the whole each day quantity of Bitcoin could be 1,500.

One other solution to measure quantity is to calculate the whole greenback worth of all trades in a given interval. It’s typically expressed as the whole greenback worth traded per day. For instance, if 1,000 BTC and 500 BTC are traded on two completely different exchanges for a complete of $10,000 and $5,000, respectively, then the whole quantity of Bitcoin could be $15,000.

The variety of distinctive addresses used to purchase or promote a selected coin is one other manner of measuring quantity. It sometimes measures how numerous the marketplace for the given cryptocurrency is and may showcase whale dominance for that crypto.

Wanna see extra content material like this? Subscribe to Changelly’s e-newsletter to get weekly crypto information round-ups, value predictions, and data on the newest developments straight in your inbox!

Keep on high of crypto developments

Subscribe to our e-newsletter to get the newest crypto information in your inbox

Why Is Quantity Essential in Cryptocurrency?

Cryptocurrency quantity could be a useful indicator in the case of figuring out the energy of a selected market. A big quantity signifies loads of curiosity in a selected coin and may signify that it’s being traded actively. A small quantity could point out a scarcity of curiosity in a selected coin and that it’s not being traded actively.

Excessive demand can also be measured by the variety of distinctive addresses used to commerce a coin or a token, the extra the higher. If the variety of market members is comparatively low and whales dominate the market, it’s not signal. If a small crypto has a major quantity of each day traded cash however a low variety of distinctive addresses, then it might be a rip-off.

You can even use crypto quantity to find out an asset’s value. A big quantity typically signifies loads of curiosity in a selected coin and that we’re more likely to see rising costs quickly. A small quantity typically signifies a scarcity of curiosity in a selected coin and that its value is more likely to go down. Moreover, increased alternate quantity additionally often results in lesser volatility available in the market, because it turns into more durable for a single dealer to alter the worth route a technique or one other.

Moreover, the quantity of a cryptocurrency is incessantly used to assist decide the liquidity of a selected market. Liquidity refers to how straightforward it’s to purchase and promote a selected coin. A market with excessive liquidity is one the place it’s straightforward to purchase and promote cash and the place there may be little or no value distinction between varied exchanges.

Quantity Indicators

Numerous quantity indicators are used within the cryptocurrency world. There’s nobody “good indicator” — all of them serve their very own distinctive functions.

A few of the hottest quantity indicators embrace:

- The Whole Quantity Traded: the whole variety of crypto models traded in a given interval.

- The Greenback Worth of All Trades: the whole greenback worth of all trades in a given timeframe.

- The Variety of Distinctive Addresses Used: the variety of distinctive addresses used to purchase or promote a selected coin.

- The Proportion of Whole Quantity Traded: the share of the whole quantity {that a} specific coin represents.

- The Weighted Common Commerce Measurement: the weighted common commerce measurement of all trades in a given time interval.

- The Quantity-Weighted Common Worth: the volume-weighted common value of all trades in a given interval.

How one can Use Quantity Indicators

All indicators have completely different functions. They can be utilized to measure liquidity, assist predict the longer term value of an asset, assist weed out scams, and so forth.

Some merchants use quantity indicators to assist them make choices about when to purchase or promote a selected coin. Different merchants use quantity indicators to assist verify different technical evaluation alerts. For instance, a dealer would possibly use a quantity indicator to assist verify a breakout on a candlestick chart.

Some indicators can be utilized to foretell future costs — for instance, the on-balance quantity (OBV), which is a momentum indicator. The on-balance quantity makes use of modifications in a coin’s buying and selling quantity to assist decide whether or not we’re more likely to see rising or falling costs within the close to future.

You will need to keep in mind that no single indicator is ideal. Quantity indicators ought to be used along side different technical indicators.

Can Quantity Be Faked in Crypto?

Sure, it’s attainable for quantity to be faked on the crypto market. That is typically completed by wash buying and selling, which is when a dealer buys and sells the identical coin a number of instances to create the looks of excessive quantity. Though wash buying and selling is unlawful in lots of markets, it may be tough to detect. An individual or a gaggle of individuals participating in wash buying and selling may even use a mess of distinctive addresses to cover their tracks.

Some exchanges have been accused of wash buying and selling up to now. So, it’s essential to do your individual analysis and to solely commerce on respected exchanges.

Is Excessive Quantity Good?

Excessive quantity could be good as a result of it signifies that there’s a lot of curiosity in a selected coin. This typically results in a rise within the coin’s value.

Nonetheless, it can be “dangerous”. Excessive and growing quantity doesn’t at all times equal upward value motion. Bear markets are inclined to see elevated quantity because of many individuals dashing to dump their belongings. Nonetheless, increased curiosity in a coin or a token is at all times helpful for merchants because it brings extra potential patrons and sellers.

Is Low Quantity Unhealthy?

Low quantity could be dangerous for cryptocurrency as a result of it signifies that there’s a lack of curiosity in a selected coin. This typically results in a lower within the coin’s value. Nonetheless, low quantity can be good for merchants since value motion shall be much more drastic. It leads not solely to increased danger but additionally to increased potential revenue.

FAQ

How do you calculate cryptocurrency quantity?

To calculate the quantity of a cryptocurrency, it’s good to multiply the variety of traded cash by the worth of every commerce.

What is an efficient quantity for cryptocurrency?

There isn’t a definitive reply to this query. Some individuals consider that top quantity is sweet for cryptocurrency, whereas others assume that low quantity is healthier. Finally, it relies upon by yourself buying and selling technique and what you are attempting to perform.

How do I improve cryptocurrency quantity?

If you wish to improve the quantity of a selected cryptocurrency, you should purchase extra cash or persuade different individuals to purchase extra cash. You can even attempt to get the coin listed on extra exchanges.

How does the buying and selling quantity have an effect on crypto?

Quantity can have an effect on crypto in just a few alternative ways. You need to use it to find out the energy of a market, the liquidity of a selected coin, and its value. Quantity can be used to verify different technical evaluation alerts.

What cryptocurrency has the best buying and selling quantity?

Bitcoin is a crypto with the best buying and selling quantity, and Ethereum is the second-largest crypto asset by buying and selling quantity.

Does quantity improve a crypto’s value?

Not essentially. Excessive quantity does typically point out increased curiosity in a coin and its potential improve in worth, however it may possibly additionally mark the start (or a peak) of a bear market.

Disclaimer: Please word that the contents of this text are usually not monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.