zkLend is an L2 money-market protocol constructed on StarkNet, combining the perfect of zk-rollups and Ethereum to convey extra customers to the DeFi market.

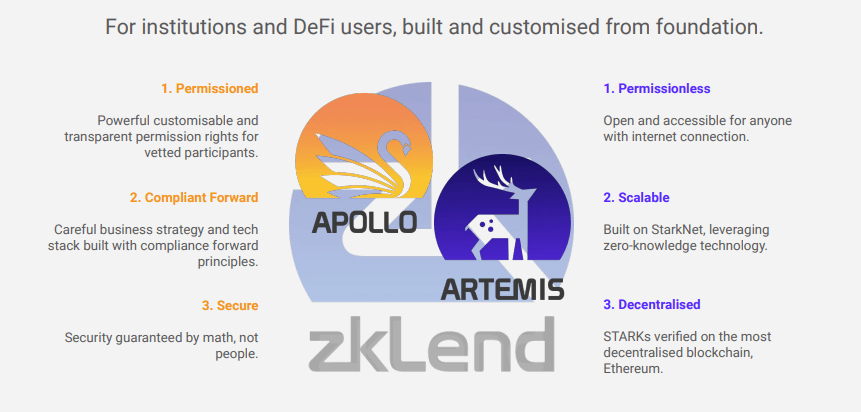

To distinguish itself from the rising competitors available on the market, zkLend gives an modern, twin resolution to the issues confronted in DeFi—a permissioned and compliance-focused resolution for institutional shoppers and a permissionless service for DeFi customers. All with out sacrificing decentralization.

Zk-rollups + StarkNet + Ethereum = zkLend

zkLend was created to advance DeFi adoption by making monetary primitives on the blockchain accessible to the retail market and the rising variety of institutional shoppers. And whereas it seems like a easy sufficient proposition, the protocol was confronted with a sequence of advanced issues it wanted to unravel—the primary one being safety.

The workforce behind zkLend began toying with constructing a protocol in 2021 when talks of Layer-2 options emerged. Whereas Ethereum was and nonetheless is without doubt one of the finest blockchain platforms to launch on, each by way of the general safety and community impact, the congestion and excessive charges it confronted on the time pushed the workforce to contemplate launching on an L2.

When Vitalik Buterin’s information to rollups was revealed in early Might final 12 months, it cemented the workforce’s place that zk-rollups have been the perfect L2 resolution for zkLend. With computations executed off the primary blockchain whereas proofing the outcomes and state-root adjustments recorded on-chain, zk-rollups offered scale with out compromising safety.

On the time, StarkNet emerged as a promising new software of zk-rollup expertise, pushing the workforce to launch the protocol on the modern blockchain.

The workforce mentioned that StarkWare’s technological competitiveness, confirmed effectiveness, and a technical, developer-focused ecosystem made it select the community. StarkNet makes use of cryptography based mostly on STARKs validity proofs—round ten occasions quicker than its competitor SNARKs (expertise at present utilized by zkSync).

With validity rollups, because the variety of transactions will increase in every distinctive batch, the transaction charges grow to be cheaper. The workforce defined that that is completely different from different L2 scaling options, the place the transaction prices sometimes scale linearly with the entire variety of transactions.

StarkNet’s scaling functionality was not theoretical however supported by the precise efficiency of StarkEx – a predecessor dapp-specific scaling engine developed by StarkWare, which processed over $200 billion value of trades in 2021. As of Might this 12 months, this quantity has handed $600 billion.

“We noticed a scrappy and strong developer ecosystem the place individuals had new protocol concepts that didn’t exist on L1. We wished to be on the forefront of innovation,” Brian Fu, the co-founder of zkLend instructed Crypto. ”And now In lower than six months, we went from being part of a nascent group to at least one that has massively expanded throughout video games, DeFi, and infrastructure tooling. ”

Constructing on StarkNet was additionally zkLend’s try and future-proof its protocol. StarkNet’s just lately up to date roadmap consists of engaged on a Layer-3 resolution for personal zk-rollup layering, enabling builders to have each private and non-private L3s on prime of the L2, additional growing its privateness zk-rollup resolution.

A twin resolution, tailored to unravel the issues of DeFi adoption

zkLend has gone to nice lengths to ascertain a rock-solid basis for its protocol. Nonetheless, the workforce isn’t blind to the challenges forward of them—the largest one being rising competitors from already established protocols on different networks.

StarkNet’s current push to grow to be the go-to gaming and NFT L2 has additionally positioned zkLend as a spine of the community, offering monetary infrastructure to hundreds of latest customers pouring into the sectors. Even Aave, by far the largest lending protocol at present available on the market, has introduced plans to come back onto StarkNet.

zkLend plans to leverage all the things StarkNet has to supply to grow to be the flagship lending protocol on the community and a family title in DeFi. The community’s low transaction prices will allow it to create extra environment friendly liquidation fashions, placing the main focus again on the borrower.

The workforce cited its KYC and whitelisting layer, market pool danger isolation, two-sided collateralization, borrowing issue, and a dynamic correlation-linked collateralization ratio as product options that differentiate the protocol from others.

And whereas these options aren’t something new available on the market, they create an ideal surroundings for what zkLend is genuinely about—Artemis and Apollo.

Artemis and Apollo are the protocol’s twin approaches to tackling the rising dimension of the DeFi market.

Because the workforce believes that the subsequent chapter of DeFi will probably be institutional, it was important to create a protocol that can cater to the wants of monetary establishments and companies getting into the market. Nonetheless, making a protocol that may match each institutional and retail wants grew to become an inconceivable mission.

As a substitute, zkLend determined to implement the twin strategy—creating two sister protocols catering to a selected viewers. The protocols are operationally impartial however are designed to leverage each other sooner or later to maximise capital effectivity.

Artemis is zkLend’s retail-oriented product, a permissionless protocol open and accessible to anybody. The workforce expects to have an MVP in early July, however V1 of Artemis gained’t launch till the top of Q3. The total model of the product can have options together with flash loans, asset tiering, a refined token utility program, and different protocol integrations.

The second model of the protocol will probably be obtainable on the finish of This autumn and embrace adaptive rates of interest, long-tailed belongings, and free swaps. Apart from these options, V2 will convey in regards to the begin of the DAO transition for Artemis, scheduled to be accomplished subsequent 12 months.

Then again, Apollo is tailored to suit the wants of institutional shoppers getting into DeFi. In contrast to Artemis, Apollo is a permissioned community, providing customizable and clear permission rights for vetted individuals.

What makes Apollo an ideal match for establishments is its deal with compliance. The product has a compliance layer that’s unparalleled on the planet of DeFi, however a regular characteristic in TradFi markets. It gives stringent regulatory compliance, in addition to KYB and KYC checks.

An MVP for Apollo is ready to be launched on the finish of the 12 months. The workforce is engaged on securing institutional launch companions and an on-chain KYB supplier in parallel to the product improvement.

Whereas the workforce didn’t reveal any additional particulars about who these companions is likely to be, they did say that numerous establishments and buyers have been included in talks about what the over-and under-collateralized lending merchandise on Apollo ought to appear to be.

“We’re already starting to see an inflow of conventional gamers, however they nonetheless are typically crypto-savvy funding funds and prop buying and selling companies,” Fu defined. “Plus, the TVL concerned continues to be small as they take a look at the waters. Success circumstances like Clearpool, Goldfinch, and Maple set the tone for the market. As extra of those use circumstances come out, establishments will grow to be extra comfy round DeFi and pace up the speed of adoption.”

In the case of launch dates, zkLend has a transparent schedule in place however stays tied to StarkNet’s timing.

“Our public launch depends on the StarkNet public mainnet launch, however we’re optimistic in regards to the timing,” Jane Ma, the co-founder and challenge lead at zkLend mentioned. “By launching alongside just a few different protocols together with DEXes and DeFi aggregators, we plan to create extra use circumstances and larger composability for StarkNet customers “

For this reason the protocol’s native token, ZEND, nonetheless doesn’t have a set launch date. The token was designed to anchor the zkLend protocol, incentivize exercise, award real contributors to the community, and provides significant governance rights to its holders.

The $5 million seed spherical zkLend raised just lately will probably be sufficient to cowl the protocol’s improvement for the foreseeable future. Led by Delphi Digital, the spherical noticed key cornerstone investments from StarkWare, Three Arrows Capital, and Alameda Analysis, amongst different large names within the VC business.

The workforce mentioned they don’t have plans for extra fundraises, however they’re leaving choices open if the scenario requires it.

“In the meanwhile our prime precedence is to get our MVP product out to market on the finish of Q3 2022, in addition to the full-pledged product onto StarkNet mainnet by early This autumn 2022,” Ma instructed Crypto. “We need to notice the roadmap we now have set and display the worth of our product to present buyers and customers first.”