Final week noticed one of many largest losses of worth within the historical past of cryptocurrency. Bitcoin and the overall crypto market disaster was hit by the Terra ecosystem’s collapse. Bitcoin plummeted to beneath $30,000. Clearly, institutional gamers took benefit of the circumstance.

Traders Flood Bitcoin

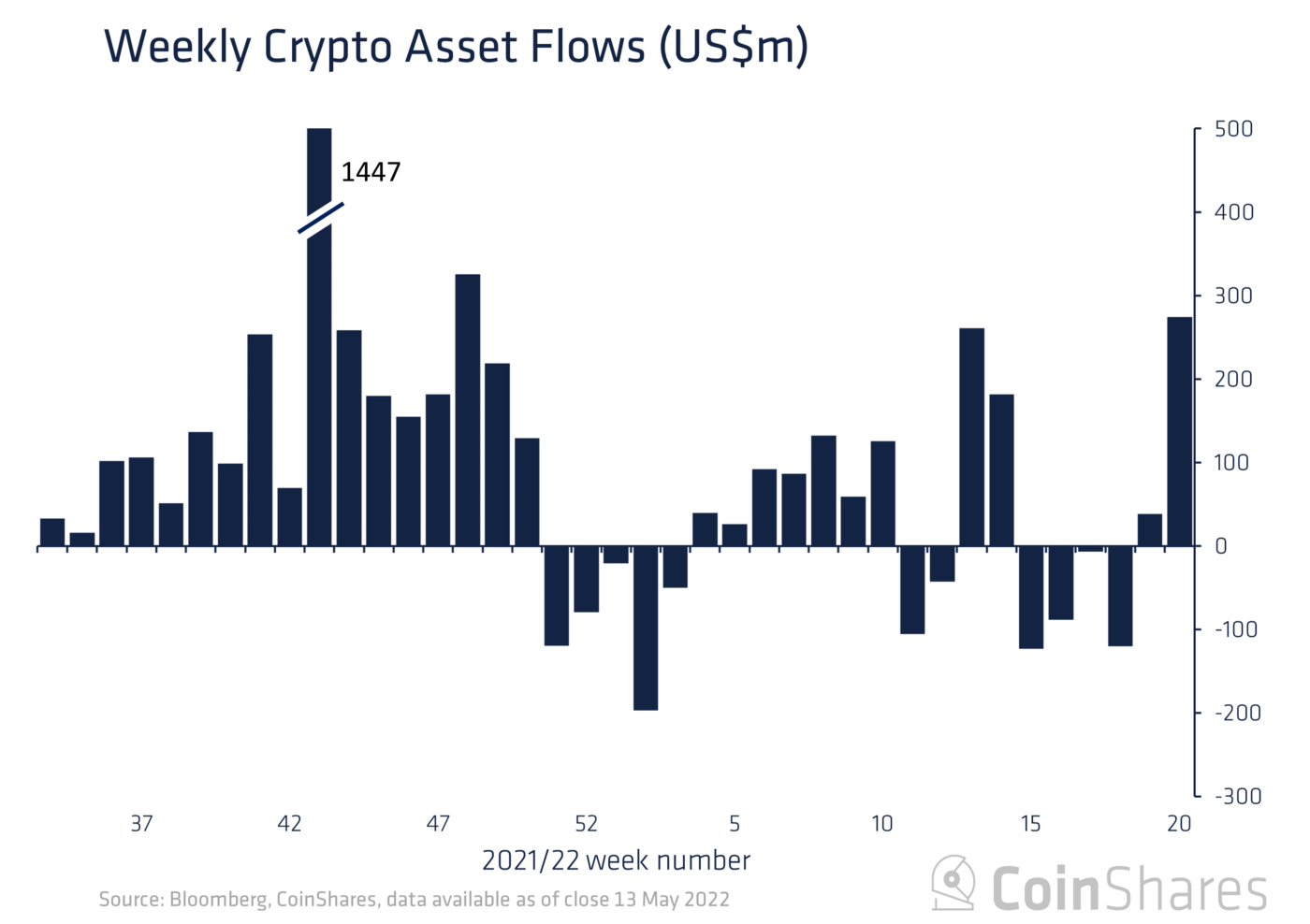

Establishments reportedly invested $300 Million into exchange-traded Bitcoin funds final week, in response to studies. In keeping with CoinShares, the earlier week recorded file weekly crypto inflows for the 12 months 2022. The online weekly inflows had been $274 million within the earlier week.

Whereas North American buyers pumped $312 million into cryptocurrency final week, European buyers noticed a $38 million web outflow. In keeping with the CoinShares report:

Traders noticed the latest UST steady coin de-peg and its related broad sell-off as a shopping for alternative. Bitcoin was the first benefactor, with inflows totalling US$299m final week, suggesting buyers had been flocking to the relative security of the biggest digital asset.

CoinShares’ head of analysis, James Butterfill, expressed amazement on the unprecedented quantity of bullish investments in Bitcoin funds regardless of elevated market volatility. “It’s the best weekly whole since October 2021, and the nineteenth highest since data started in 2015,” he mentioned.

Supply: Coinshares

Bitcoin’s worth peaked at $69,000 in November of final 12 months, and it has since been on a gentle decline, shedding greater than 50% of its worth. The Bitcoin worth has dropped by greater than 20% because the starting of Might 2022.

Associated studying | Grayscale Met With The SEC, Tried To Persuade Them To Flip The GBTC Into An ETF

Would Worth Surge?

Bitcoin plummeted in opposition to the US greenback and hit the $29,000 help stage. BTC should settle above the $30,500 resistance to start a strong rise. Bitcoin dipped beneath $30,000 after failing to achieve traction above $31,000.

The worth is presently buying and selling above each the $30,000 and the 100 hourly easy shifting averages. A break over a connecting destructive pattern line with resistance close to $29,600 was seen on the hourly chart of the BTC/USD pair. The pair may purchase bullish momentum if it closes above the $30,500 resistance.

Though the value dipped beneath $29,500, bulls had been lively close to $29,000. The worth has recovered losses after forming a low close to $29,060. Above the $29,500 barrier, there was a transparent upward motion. The worth surpassed the 23.6 % Fib retracement stage of the most recent drop from the swing excessive of $31,390 to the low of $29,060.

There’s rapid resistance close to the $30,300 mark. It’s approaching the 50% Fib retracement stage of the most recent drop from the swing excessive of $31,390 to the low of $29,060. A strong shut above $30,300 would possibly pave the trail for a big achieve.

BTC/USD trades barely above $30k. Supply: TradingView

Round $31,400 is the subsequent main resistance stage. Within the subsequent classes, a transparent break over the $30,300 and $31,400 resistance ranges may kick-start a brand new upswing. Close to $32,500 could possibly be the subsequent large resistance stage, after which the value may rise to $34,000.

If bitcoin fails to interrupt previous the $31,400 barrier mark, it may fall additional. On the draw back, $29,600 gives rapid help.

Round $29,000 is the primary substantial help. If the value breaks and closes beneath the $29,000 help stage, it’d herald the beginning of a major fall.

Associated studying | TA: Bitcoin Holds Key Assist, Why BTC Should Clear This Resistance

Featured picture from iStockPhoto, Charts from TradingView.com