Key Takeaways

- Roughly $23 billion value of worth has been worn out of the cryptocurrency business up to now 24 hours.

- The highest two crypto belongings, Bitcoin and Ethereum, each erased double-digits as promoting strain elevated.

- Now, the market seems vulnerable to getting into a chronic bear pattern.

Share this text

Panic has struck the cryptocurrency market as Bitcoin and Ethereum enter freefall. Though the correction seems to have paused, buyers are nonetheless promoting their holdings en masse.

Concern and Despair Echoes Throughout Crypto Market

Greater than $830 billion has been worn out of the whole cryptocurrency market cap over the previous month, and additional losses might be on the horizon.

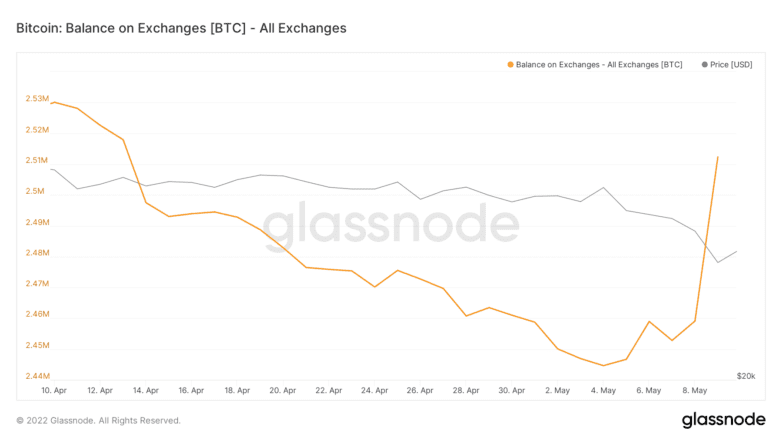

In line with knowledge from Glassnode, the whole variety of Bitcoin held on recognized cryptocurrency change addresses has elevated by practically 2.77% over the previous week. Greater than 67,712 Bitcoin has flowed into a number of buying and selling platforms, coinciding with a volatility spike. Elevated inflows to exchanges are typically seen as a bearish indicator as a result of market members normally undergo exchanges to promote their holdings. Presently, many crypto holders look like making ready to promote their holdings in anticipation of a steeper correction.

Sentiment within the crypto market shifted after Bitcoin broke by way of a historic rising trendline noticed on its weekly chart. The occasion led to a 12.67% downswing by which Bitcoin hit a low of $29,740.

The current drop is the third time the highest cryptocurrency has breached the essential demand degree since March 2013. The primary time Bitcoin broke under the extent was in August 2015, leading to a 37.67% correction that marked the top of the bear market. Equally, Bitcoin crashed by 43.32% after slicing by way of the assist trendline in March 2020.

Now that the essential assist space has been was resistance, Bitcoin may expertise equally weak worth motion. Additional promoting strain may push Bitcoin down by one other 33.46% to $19,800.

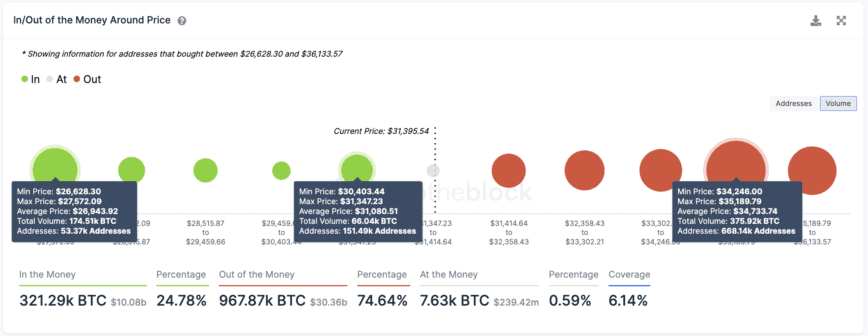

Transaction historical past from IntoTheBlock’s IOMAP means that the pessimistic outlook may play out. Bitcoin is at the moment buying and selling on a skinny layer of assist at round $31,000, and it faces stiff resistance forward. Roughly 668,000 addresses purchased practically 376,000 Bitcoin between $34,246 and $35,190.

The identical addresses could try and exit their positions to try to interrupt even on their investments within the occasion of a bullish impulse, which may imply any upswing will get rejected. Primarily based on the on-chain knowledge, Bitcoin doubtless must print a weekly shut above $35,190 to have an opportunity of invalidating the bearish thesis. If it succeeds, it may march towards $40,000.

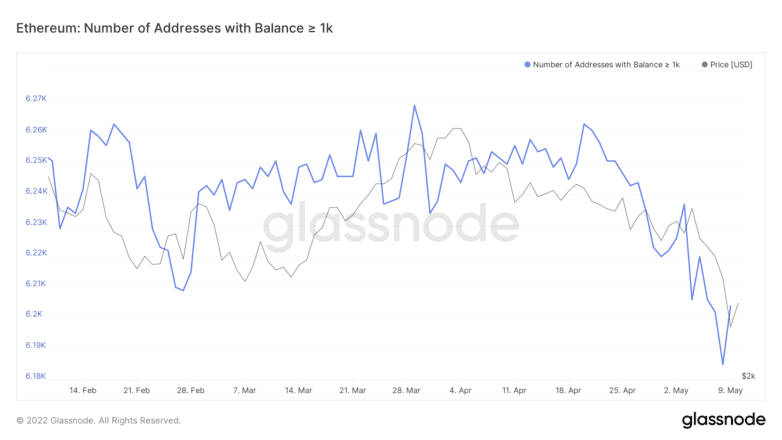

The spike in promoting strain throughout the crypto market can be seen from an on-chain perspective amongst Ethereum holders. Glassnode knowledge reveals that the variety of addresses holding greater than 1,000 Ethereum has decreased by 0.83% over the previous week. Greater than 50 whales have offered or redistributed over $2.5 million value of Ethereum every inside the brief interval.

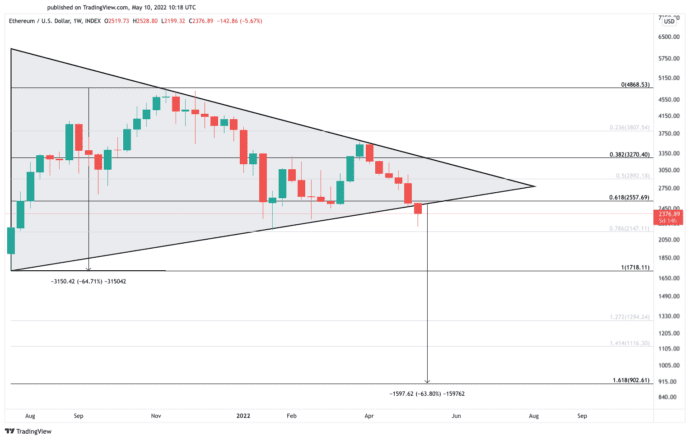

The mounting downward strain and lack of shopping for curiosity has triggered a 13% correction in Ethereum’s market worth within the final 24 hours, pushing it to a low of $2,200. The sudden downswing allowed Ethereum to interrupt out of a symmetrical triangle in a destructive posture.

The peak of the triangle’s Y-axis means that Ethereum is primed for a 64% correction. A sustained weekly candlestick shut under $2,600 may validate the pessimistic outlook, doubtlessly resulting in a downtrend to $900.

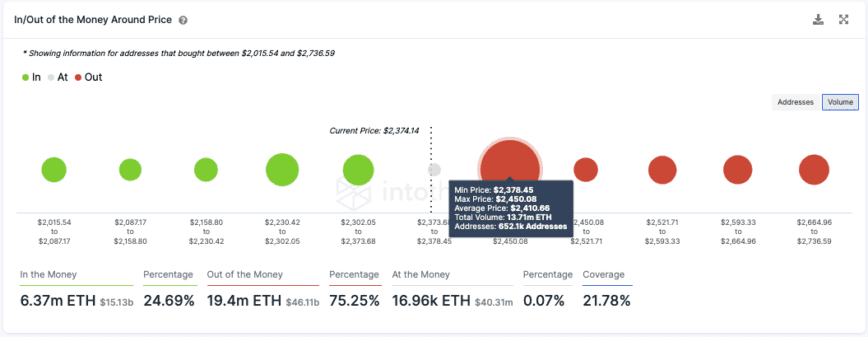

In line with IntoTheBlock’s IOMAP mannequin, it seems that Ethereum’s most vital provide wall sits at round $2,450, the place over 652,000 addresses have bought greater than 13.71 million Ethereum. Any additional indicators of weak point may encourage these addresses to exit their positions to keep away from incurring vital losses, accelerating the downward strain.

To invalidate the bearish thesis, Ethereum would doubtless must surge to $3,270 and print a weekly candlestick shut above it.

Till Bitcoin regains $35,190 as assist and Ethereum surges above $3,270, the crypto market is prone to look shaky. Apart from the highest two crypto belongings, many different cash are buying and selling on weak assist. That might imply they undergo steeper corrections than the extra established cryptocurrencies.

The final 24 hours have been one thing of a massacre throughout the market. Terra’s LUNA has crashed by greater than 60% resulting from UST dropping its peg to the greenback. Bored Ape Yacht Membership’s ApeCoin additionally dipped as little as 33%, whereas STEPN’s GMT briefly crashed by greater than 40%.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

For extra key market traits, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.