Information reveals Bitcoin long-term holders maintain considerably extra provide in loss proper now in comparison with Could-July of 2021.

15% Of Bitcoin Lengthy-Time period Holder Provide Is In Loss Proper Now

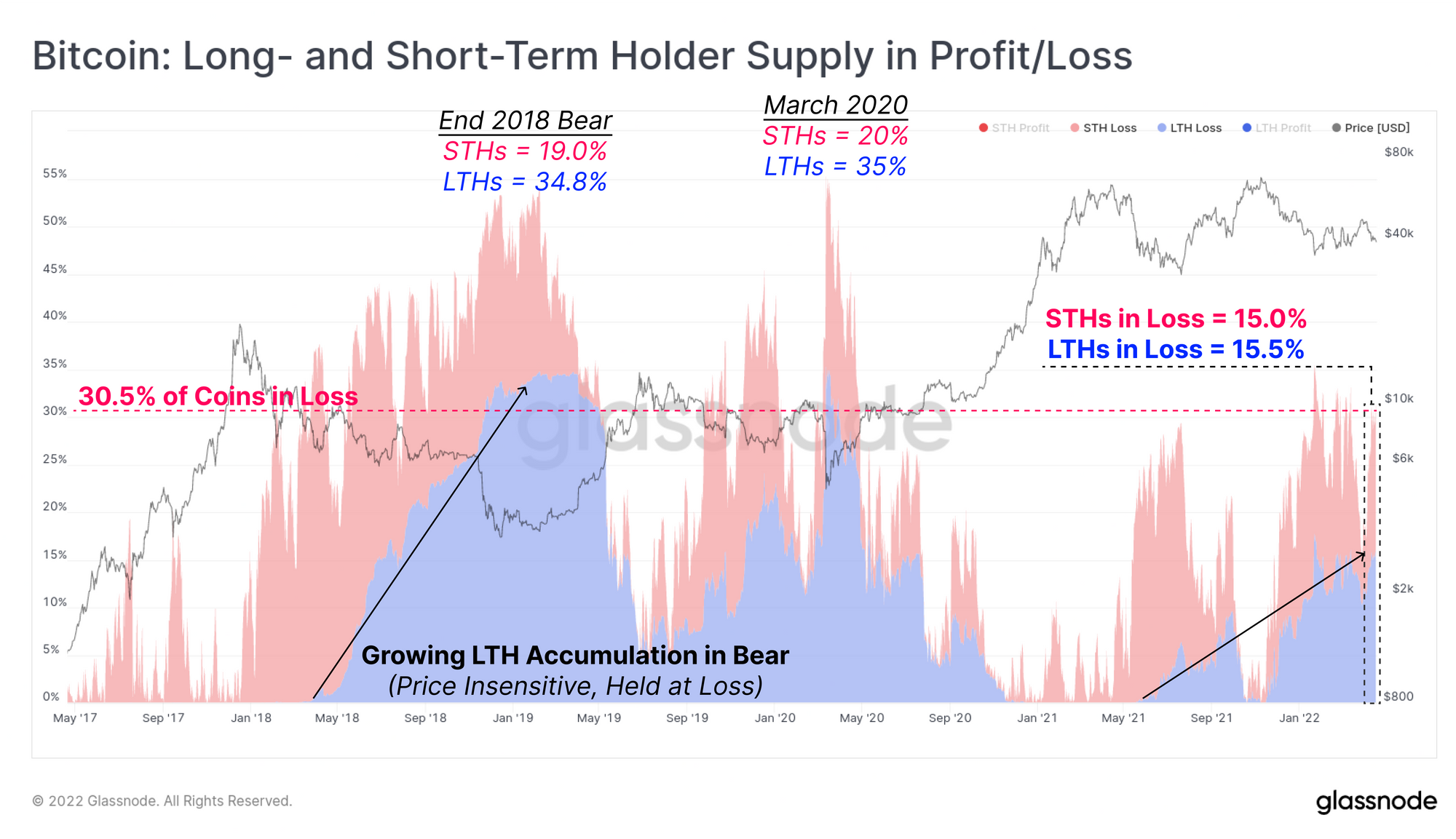

As per the most recent weekly report from Glassnode, round 30% of the overall BTC provide is being held at a loss in the intervening time.

The “long-term holder provide” is the a part of the overall Bitcoin provide that hasn’t proven any motion since greater than not less than 155 days in the past.

The opposite a part of the availability belongs to the “short-term holders.” This cohort doesn’t maintain for too lengthy and customarily sells earlier than 155 days are up. Energetic merchants normally make up a good portion of this provide.

Naturally, any cash within the Bitcoin STH provide that age past the 155-day mark are then counted underneath the LTH provide.

The related indicator right here is the “provide in revenue/loss,” which seems at every coin on the chain to see what number of cash are in revenue or loss proper now.

Associated Studying | Bitcoin Buying and selling Quantity Stabilizes At Lows Of July 2021 As Market Sleeps

The metric works by evaluating the worth a coin was final moved at, to the present worth. If the final worth was greater than now, then the Bitcoin is being held in loss in the intervening time. In any other case, it’s in revenue.

Now, here’s a chart that reveals the loss distributions of each the LTHs and the STHs.

Seems just like the loss cut up is sort of even between the 2 classes proper now | Supply: Glassnode's The Week Onchain - Week 16, 2022

As you possibly can see within the above graph, round 15.3% of the Bitcoin LTH provide is in loss presently, with STHs additionally having nearly the identical quantity within the purple at 15%.

Throughout the 2018 and 2020 bear markets, about 35% of the LTHs had been in loss at some factors, rather more than proper now.

Associated Studying | The CEO Of Ripple Says Bitcoin Tribalism Is Holding Again The Crypto Trade

Nonetheless, the Could-July mini-bear interval of final 12 months had solely half as many long-term holders holding cash at a loss.

Because of this the market profitability is in a a lot worse place in the intervening time. Whereas LTHs are unlikely to promote with these losses as they’re worth insensitive normally, the STHs at 15% are extra possible to capitulate if the Bitcoin worth continues to battle.

BTC Value

On the time of writing, Bitcoin’s worth floats round $42.5k, up 3% within the final week. Over the previous month, the crypto has gained 3% in worth.

The under chart reveals the development within the worth of the coin over the past 5 days.

The value of BTC appears to have been climbing up over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, Glassnode.com