Key Takeaways

- Cosmos and Elrond have risen by greater than 10% over the previous two days.

- Just a few technical patterns reveal that each tokens have extra room to go up.

- Additional shopping for stress might push ATOM to $33.5 and EGLD to $204.

Share this text

Cosmos and Elrond are displaying spectacular upside potential after each tokens have been in a position to maintain very important assist.

Cosmos and Elrond Are on the Rise

Cosmos and Elrond look like bouncing swiftly from essential assist areas after incurring vital losses over the previous three weeks.

ATOM has seen its worth drop by almost 33% since Apr. 3, going from a excessive of $33.3 to hitting a low of $24.4 just lately. Though the Layer 1 token threatened to interrupt via a significant assist stage, it seems that sidelined buyers are getting again into the market. Over the previous two days, a big spike in demand has pushed costs up by roughly 10%.

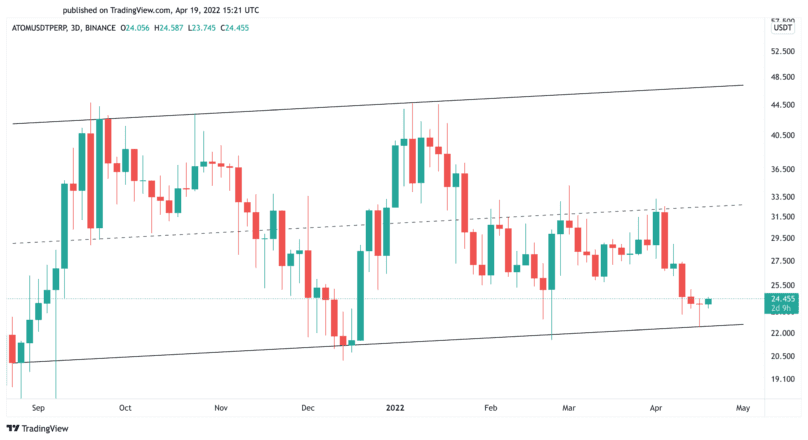

Now that Cosmos seems to have gained the power to rebound, it might have extra room to go up. Worth historical past reveals that ATOM has been consolidating inside an ascending parallel channel since September 2021.

Every time the token has examined the channel’s decrease boundary since then, an upswing to the center or higher trendline succeeds. From this level, Cosmos tends to retrace to the sample’s decrease edge, which is per the attribute of a channel.

Comparable worth motion means that ATOM may very well be on its technique to testing the channel’s center trendline at $33.5, which represents a 36% acquire from the present ranges. Nonetheless, Cosmos must maintain $24.4 as assist for the optimistic outlook to be validated. Failing to take action might lead to a correction to $17.6.

Over the previous few weeks, Elrond additionally entered a steep downtrend, dropping greater than 70 factors in market worth. The losses seem to have been contained by the ascending triangle’s hypotenuse forming on EGLD’s two-day chart. If this assist stage continues to carry, costs might transfer again to the sample’s x-axis at $204.

The Tom DeMark (TD) Sequential indicator provides credence to the optimistic outlook. It has offered a purchase sign within the type of a purple 9 candlestick on the two-day chart. The bullish formation anticipates {that a} spike in upward stress might lead to a one to 4 candlesticks upswing or the start of a brand new upward countdown.

So long as Elrond continues to commerce above the $141.5 assist stage, it has a superb likelihood of advancing to $204. But when it have been to print a two-day candlestick shut under the triangle’s hypotenuse, a downswing to $112 is probably going.

Disclosure: On the time of writing, the writer of this piece owned ETH and BTC.