Key Takeaways

- Bitcoin has dropped by greater than 20% over the previous two weeks.

- Likewise, Ethereum has retraced by 19.5% since Apr. 3.

- Each belongings have reached important areas of help.

Share this text

Bitcoin and Ethereum kicked off the week in a adverse posture. Though costs have rebounded over the previous few hours, each cryptocurrencies seem like hanging by a thread.

Bitcoin at Very important Help

Bitcoin sits on prime of one of the crucial important help areas on its pattern, as whales seem like rising their holdings.

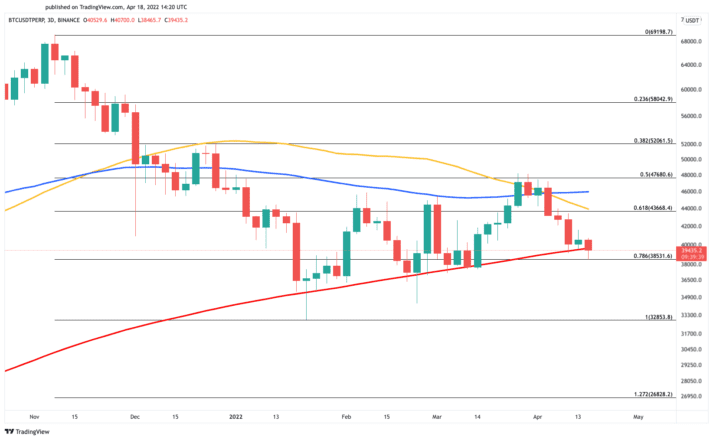

The pioneer cryptocurrency has seen its value drop by greater than 20% over the previous three weeks. It misplaced roughly 10,000 factors in market worth, going from a excessive of $48,200 on Mar. 28, to a low of $38,465 registered early this morning. The losses seem to have been contained by a important demand zone that probably defines Bitcoin’s destiny.

The 200-day shifting common at $39,500 on the three-day chart and the 78.6% Fibonacci retracement stage at $38,500 should proceed to carry to keep away from a brutal crash. Failing to take action could encourage buyers to promote, placing sufficient stress on Bitcoin to set off a correction to $28,850 and even $28,830.

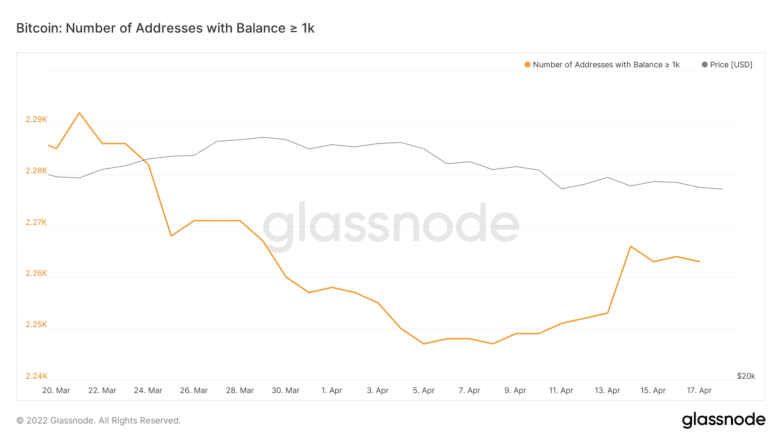

Regardless of the bearish outlook {that a} breach of the $38,500 help stage presents, it seems that whales have been making the most of the current correction to scoop up extra Bitcoin at a reduction.

On-chain knowledge from Glassnode reveals that the variety of addresses on the community with a stability better than 1,000 BTC has considerably elevated since Apr. 8. Roughly 16 new whales have joined the community inside such a brief interval.

Although the rising shopping for stress may appear insignificant at first look, it’s value noting that every of those new addresses acquired a minimal of $39,000,000 value of Bitcoin.

Additional shopping for stress across the present value ranges could assist Bitcoin bounce off the $38,500 help. Underneath such distinctive circumstances, it would rise to retest the 50-day shifting common at $43,670 on the three-day chart.

Solely a sustained three-day candlestick shut above this resistance stage can invalidate the pessimistic outlook and result in the resumption of the earlier bullish pattern.

Ethereum Threatens to Dip Decrease

Ethereum additionally seems to hold by a thread as retail curiosity fades whereas costs dip under $3,000.

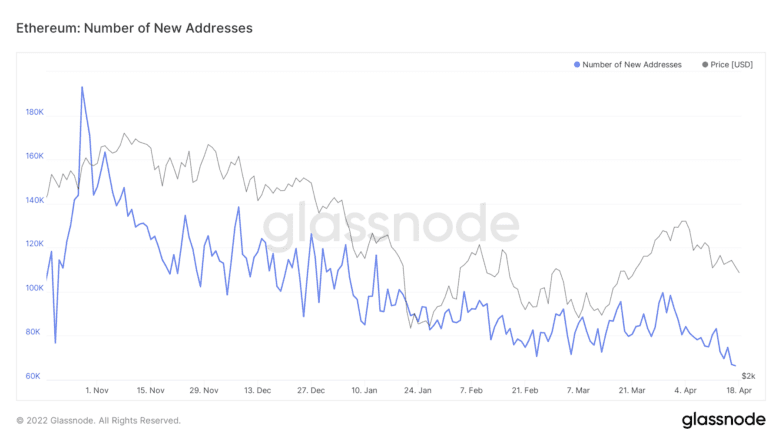

The second-largest cryptocurrency by market cap has endured a steep 19.5% correction over the previous two weeks to not too long ago hit a low of $2,883. The rising promoting stress could also be attributed to a brand new delay within the protocol’s transition to Proof-of-Stake. Because the “Merge” doesn’t but have a hard and fast date, curiosity in Ethereum seems to be declining.

The variety of new every day addresses created on the Ethereum community has continued to pattern downward. Such market habits suggests an absence of curiosity from sidelined buyers in scooping up extra tokens on the present value stage.

Community development is commonly thought-about one of the crucial correct value predictors for cryptocurrencies. Usually, a gentle decline within the variety of new addresses created on a given blockchain results in a steep value correction over time.

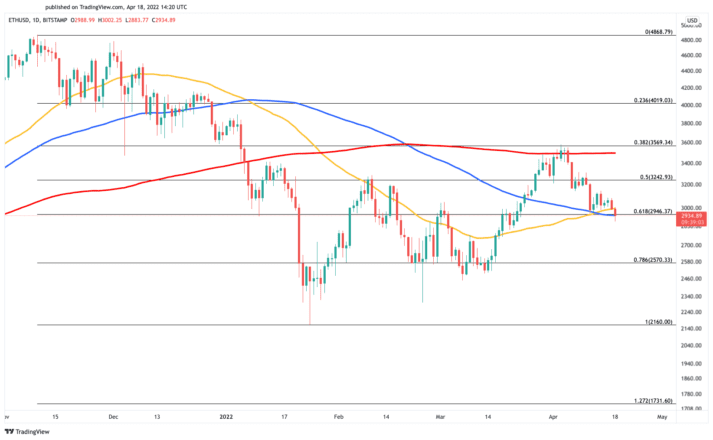

Given the dearth of curiosity, Ethereum bulls should do every part they will to keep away from printing a every day candlestick shut under $2,950. Breaching this help stage can result in a downswing to $2,570 or $2,160.

It’s value noting that there’s nonetheless some hope as Ethereum has developed a golden cross between its 50 and 100-day shifting averages. Nonetheless, bulls must step in now and push costs above $3,500 for Ethereum to renew its earlier uptrend.

Disclosure: On the time of writing, the creator of this piece owned ETH and BTC.