The SEC seems to be clamping down on crypto companies providing yield-bearing merchandise to U.S. residents. Celsius Community is the most recent in a sequence of crypto companies which have needed to shut their doorways to U.S. clients who don’t qualify as accredited traders.

An announcement on their web site states:

New transfers made by non-accredited traders in america will probably be held of their new Custody accounts and won’t earn rewards.

Present customers of Celsius’ Earn merchandise who should not accredited traders will proceed to obtain rewards for his or her cash. Nonetheless, any new cash or new clients will maintain their cash in custody however earn no rewards. Whether or not Celsius will have the ability to stake these cash themselves isn’t at present recognized.

Gatekeeping wealth constructing

An accredited investor is a selected time period within the U.S. for prime net-worth people. To qualify, you will need to have both $1 million in belongings; earn over $200,000 per yr; be a personal company with a minimum of $5 million in belongings, or be a registered skilled investor.

The purpose of the definition is to guard individuals who lack the data and understanding of advanced monetary merchandise from investing in merchandise that they don’t perceive. Nonetheless, it’s onerous to not view this as gatekeeping when solely the rich are deemed appropriate to spend money on a number of the most tasty yield-bearing merchandise.

Furthermore, how having a excessive web price qualifies you as having a stable understanding of monetary devices is questionable.

By limiting people who don’t meet the factors for accredited investments, there may be an argument that the SEC is hindering the center and dealing class from enhancing their positions in life.

With out entry to compounding curiosity merchandise supplied by firms like Celsius and BlockFi, it’s onerous to see how unaccredited traders can construct their financial savings outdoors of long-term merchandise reminiscent of pensions and 401Ks.

One of many central tenants of crypto is to empower on a regular basis folks to take management of their future by breaking away from the normal monetary system. However sadly, the SEC is closing off a number of the most mainstream crypto financial savings merchandise by forcing these firms solely to serve millionaires {and professional} traders.

Different examples inside crypto companies

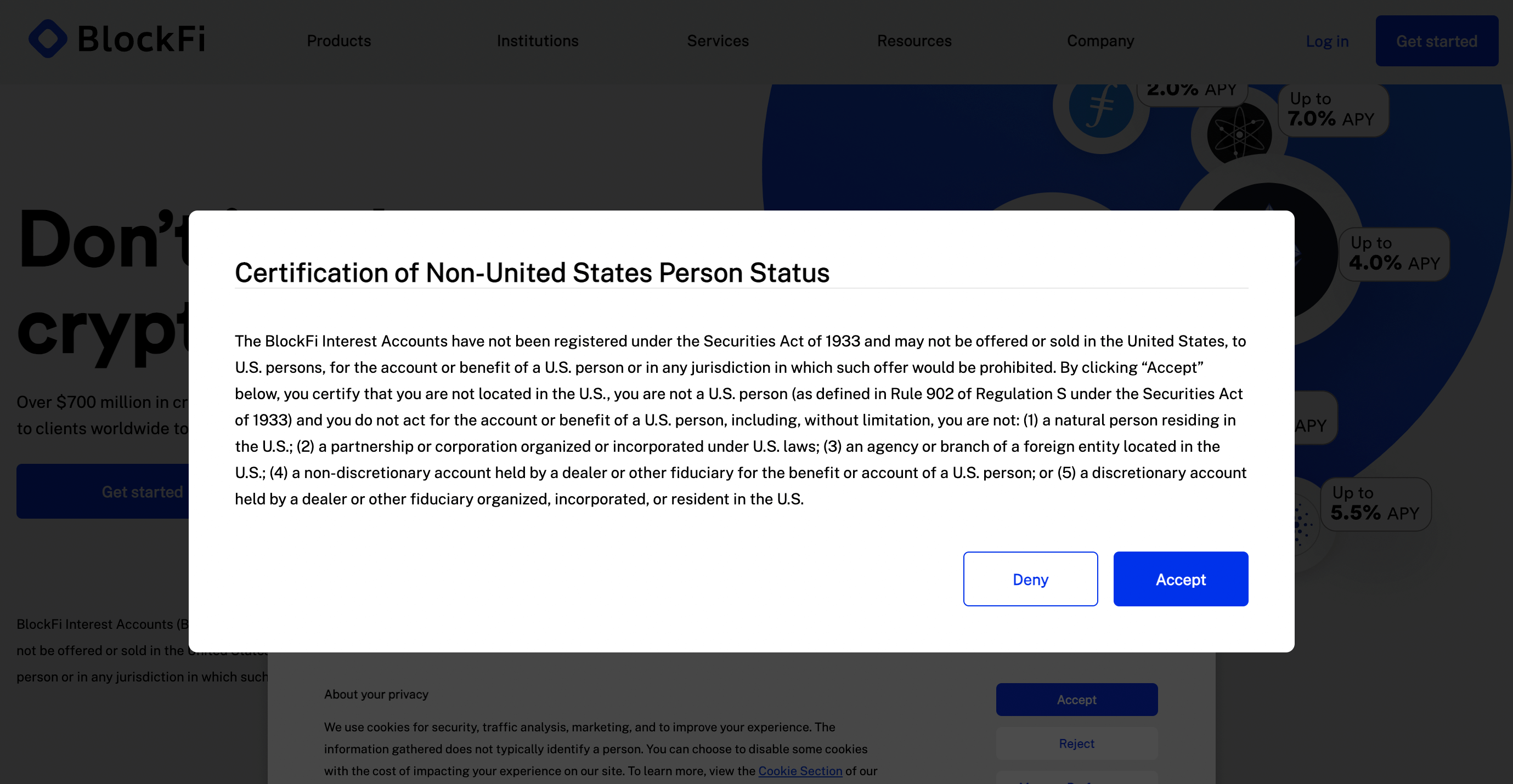

Following BlockFi’s $100 million advantageous for providing “unregistered affords and gross sales of the lending product, BlockFi Curiosity Accounts (BIAs),” the corporate lately ceased providing its merchandise to U.S. traders.

A disclaimer pop-up on the BlockFi web site requires customers to verify that they don’t seem to be U.S. residents earlier than getting into the web site. Nonetheless, a group supervisor on Reddit, Brandon_BlockFi, confirmed on April 12 that the corporate nonetheless affords its BlockFi Personalised Yield to eligible excessive net-worth U.S. shoppers, which is a separate product from BlockFi Yield.”

Nonetheless, any U.S. one who doesn’t qualify as a “excessive net-worth” particular person not has the precise to make use of any of BlockFi’s companies.

Advocating for monetary freedom

Following the modifications, Celsius mentioned it stays dedicated to crypto and decentralized finance rules. It added that:

“[We] won’t ever cease advocating for monetary freedom, and we thank our group for his or her ongoing assist. We are going to proceed to supply updates as we have interaction with regulators and make sure the supply of our companies to our customers globally.”

Evidently Celsius is, a minimum of on paper, making an attempt to “have interaction” with regulators to re-enable its companies to most of the people probably. Nonetheless, given the present regulatory panorama within the U.S., it’s comprehensible that they’d watch out with any statements which will seem too adversarial.

Nonetheless, it’s unlikely that Celsius will reverse the transfer anytime quickly. Biden’s latest govt order promised innovation and progress within the digital belongings house. Nonetheless, forcing firms to cease serving those that want their merchandise essentially the most appears opposite to this imaginative and prescient.