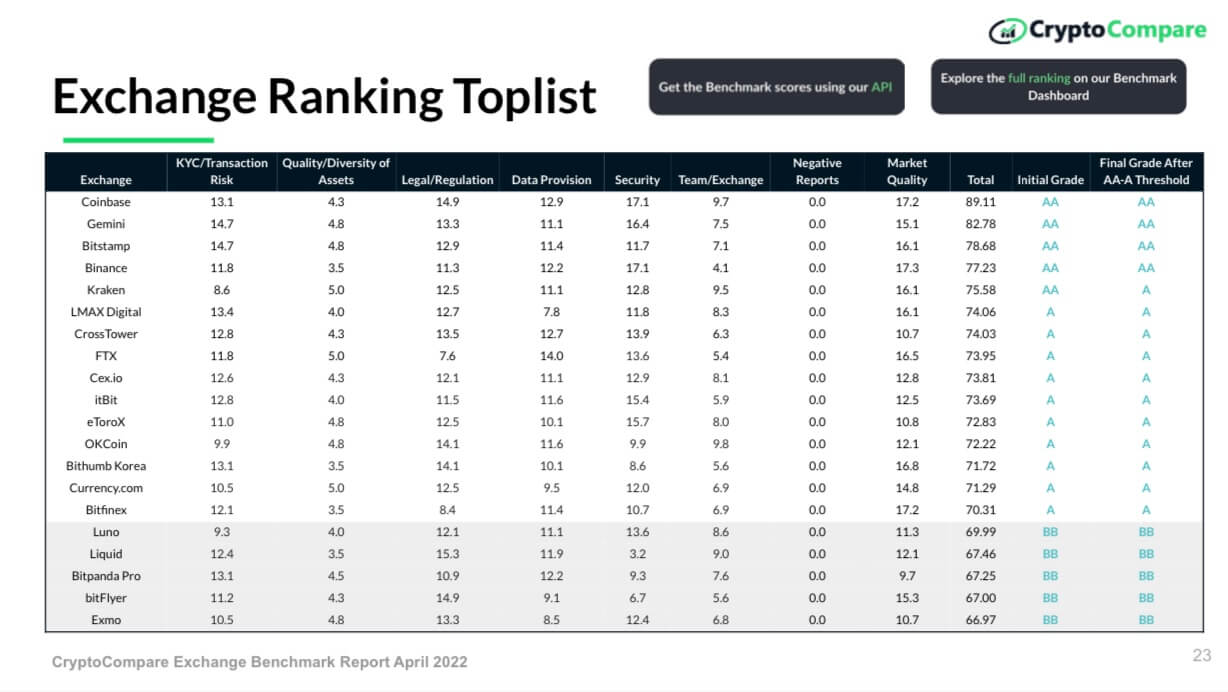

Market information aggregator CryptoCompare has named Coinbase essentially the most clear and accountable crypto trade on this planet, per the agency’s newest report that ranked 150 buying and selling platforms.

In keeping with CryptoCompare’s researchers, the Brian Armstrong-led trade is intently adopted by crypto platforms resembling Gemini, Binance, and Bitstamp.

/1 Right this moment, we’re delighted to launch our #ExchangeBenchmark report.

This bi-annual report combines over 80 quantitative and qualitative metrics to assign a grade (AA-F) to over 150 energetic spot #crypto exchanges.

Learn the complete report beneath: https://t.co/j5eFvqNzL1

— CryptoCompare (@CryptoCompare) April 11, 2022

Notably, solely these 4 exchanges obtained the AA score, which suggests they’re the least dangerous crypto buying and selling platforms to make use of. Additional down the record, 11 extra exchanges have obtained A rankings, 27 bought BB rankings, and 37 have been ranked as B.

The report went on to disclose that the highest 4 exchanges aren’t solely the most secure however are additionally accountable for almost all of transactions throughout the sector. These platforms accounted for round 96% of all crypto trades that have been made between September 2021 and February 2022, the researchers identified.

On the identical time, the overall variety of top-tier exchanges has dropped over the previous months, the researchers famous, including:

“Resulting from stricter benchmark requirements, solely 78 exchanges met the brink for High-Tier standing within the newest Change Benchmark (vs 87 in August 2021 and 84 in February 2021). In the meantime, 15 exchanges have met AA-A standing in comparison with 9 in August 2021.”

Regulatory curiosity helps the sector develop

As CryptoSlate reported, regulators around the globe have been paying more and more extra consideration to the crypto trade currently attributable to sector’s super progress over the previous 12 months. In flip, this has led to a rise in scrutiny from numerous authorities which can be nonetheless cautious of the trade.

In the end, CryptoCompare inferred that exchanges reacted positively to this heightened consideration as lots of them have been “sharpening their processes in relation to safety, regulatory danger, and KYC insurance policies.”

In keeping with the report, 99% of the surveyed exchanges at the moment implement two-factor authentication techniques, aiming to assist customers higher defend their funds. Other than that, extra crypto platforms now “possess trade or MSB licenses.”

Nonetheless, CryptoCompare has concluded that crypto buying and selling platforms nonetheless must brace for extra political affect because the trade goes mainstream, citing some cases the place blockchain corporations have been pressured to shut accounts belonging to Russian residents amid the nation’s battle with Ukraine.