A preferred crypto analyst says that an on-chain indicator with a observe report of calling tops and bottoms is strongly suggesting that Bitcoin (BTC) is in for vital worth appreciation.

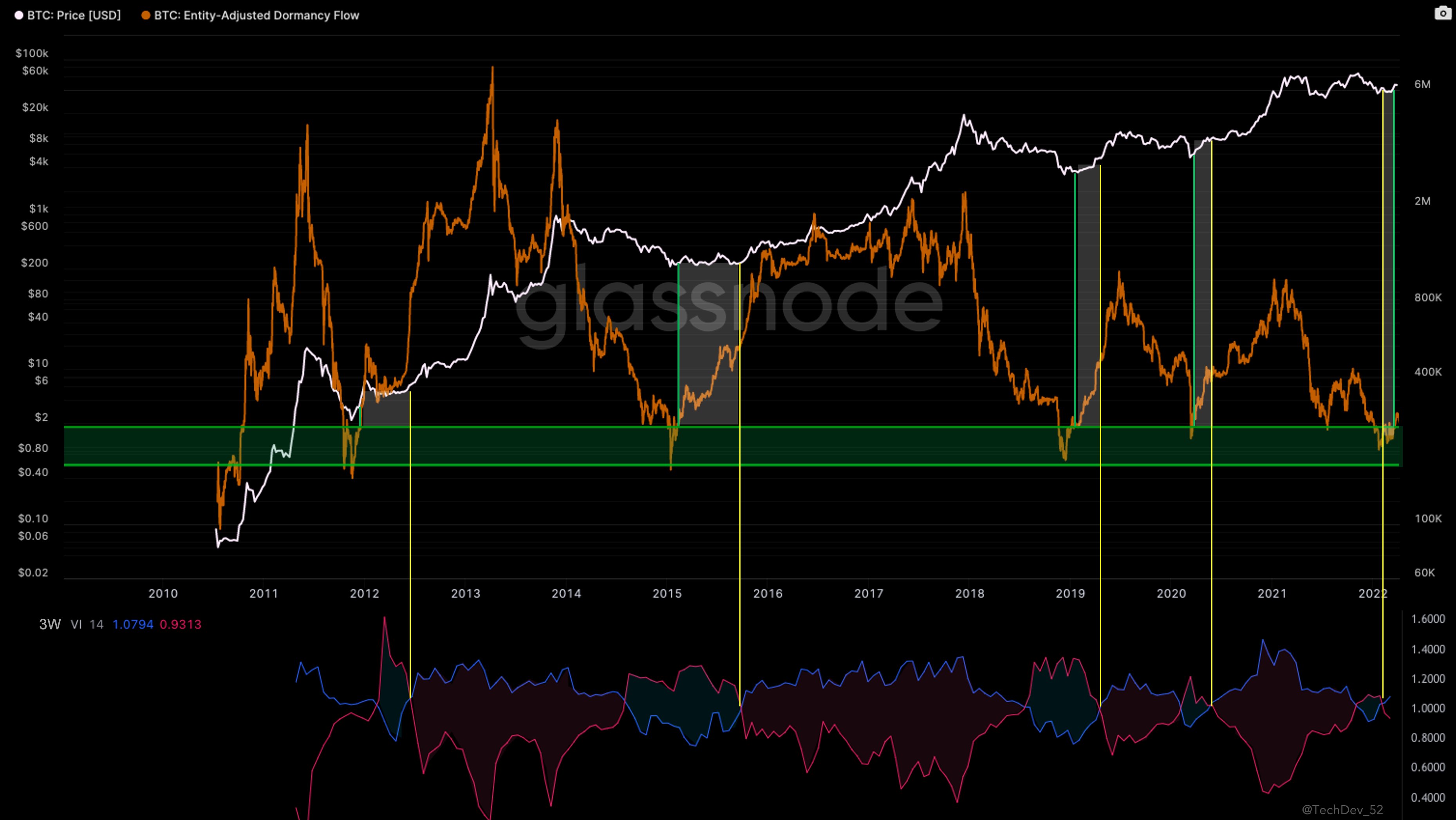

The pseudonymous analyst often known as TechDev tells his 382,000 Twitter followers that he’s watching Bitcoin’s dormancy circulation metric, which measures the typical variety of days that cash have remained untouched.

He combines the dormancy circulation with three-week candles on the vortex cross, which makes use of historic worth information to determine pattern reversals.

“The intervals between dormancy circulation exiting the inexperienced zone and the three-week bullish vortex cross have provided among the finest purchase alternatives for Bitcoin during the last 10 years.

Asymmetry very a lot to the upside right here for my part.

Get pleasure from your weekend.”

TechDev additionally presents one other chart combining two indicators that counsel bullish worth motion on the horizon. He says that Bitcoin is holding above the Kijun-Sen, which is historically used within the Ichimoku Cloud and calculates the imply worth of the final 26 intervals.

The analyst combines the Kijun-Sen with an indicator depicting the progressive width of Bollinger Bands.

Historically, a low or slender Bollinger Band width signifies that the asset is gearing up for unstable worth motion.

“Bitcoin has reclaimed the three-week Kijun-Sen at traditionally low Bollinger Band width.

Suggests macro bullish momentum with impending volatility.”

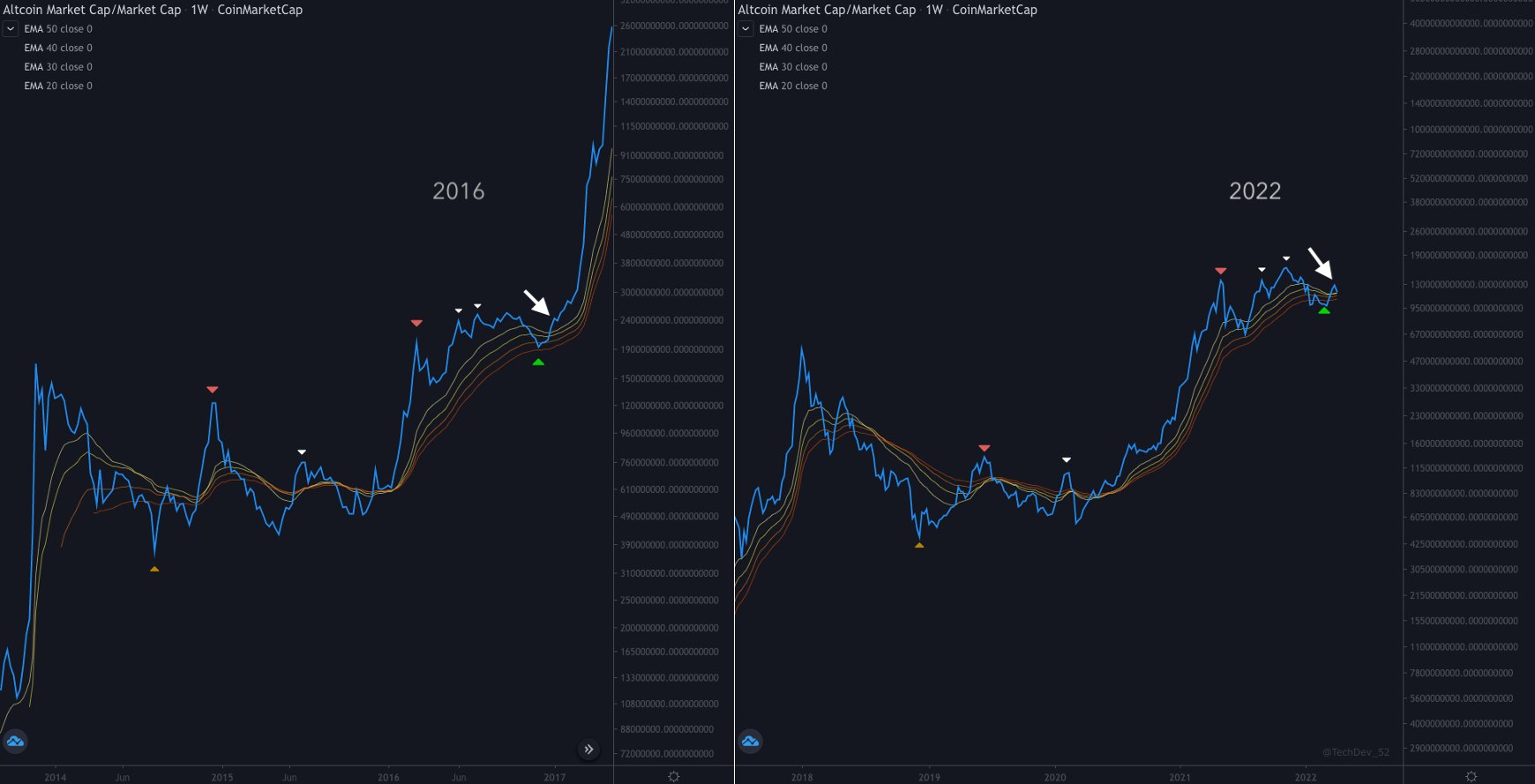

Taking a look at altcoins, TechDev additionally says bullish implications are hiding within the charts.

He seems to be at a weekly chart of the market cap of the whole altcoin market and says that it’s at the moment establishing convincing assist on a number of essential exponential transferring averages (EMA), just like 2016 earlier than large rallies.

“Altcoin Market Cap Weekly

Maintain the EMA ribbon.”

Examine Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/digitalart4k/Natalia Siiatovskaia