There are many layer 1 blockchains on the market. Meaning that there’s stiff competitors on this discipline, which makes it additionally a wholesome setting. Bear in mind, solely the sturdy survive. However who shall be that survivor?

There are a few methods to see which standards will make a distinction. Lucas, a senior intern at Bankless, wrote a Twitter thread about 5 indicators to judge blockchains. We predict they’re going to be useful. So, let’s dive in and see what we have to look out for.

Bitcoin, Ethereum, Solana, Avalanche, Cosmos, Polkadot…

The Layer 1 panorama is aggressive.

How do you consider which one may come out on high?

Listed below are the 5 questions you have to reply:

?

— Lucas ?_? (@0x_Lucas) July 6, 2022

1. Safety

Layer 1 blockchains are settlement layers for worth. Their operate is to supply a safe and immutable ecosystem. On this case, what makes a blockchain safe is its consensus mechanism, which has superior cryptographic fashions. However, the immutable function of a blockchain refers to its capability to keep away from modifications to confirmed blocks.

Furthermore, you’ll be able to measure blockchain safety in these two methods.

a) How A lot Does It Price to Assault the Community?

The one technique to successfully assault a blockchain is to do it to 51% of its hash fee. So it is smart if only some folks management community nodes, it’s simpler for them to agree and assault it. That is most probably to occur in smaller networks.

Perceive extra about 51 % Assault.#BTC #ETH #wazirXwarriors #Blockchain #Assault pic.twitter.com/QOmotZdAQt

— Nikhil D Prince ?? (@NikhilDPrince) September 21, 2020

One other well-known assault type is the Sybil assault. Right here, the attacker will flood a community with many pseudonymous nodes. These can affect a community.

b) How A lot Do Validators Obtain as Rewards, to Be Sincere Actors?

A validator is similar as a community node. They help in processing and validating new blocks. This permits them so as to add the blocks to the chain. On a PoW blockchain, this implies mining, on a PoS blockchain we check with this as staking.

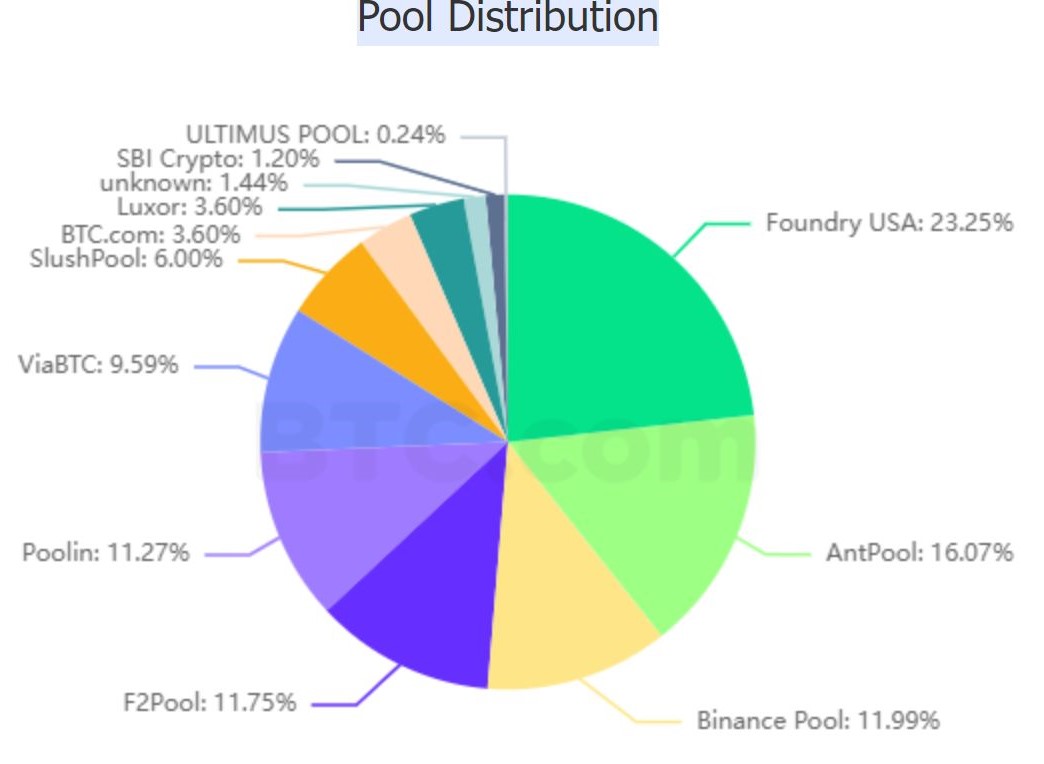

The reward quantity that validators earn varies between blockchains. Being a validator generally asks for a hefty funding. So, the reward should outweigh the funding. For instance, bitcoin presently has 12 mining swimming pools worldwide. See the image under:

Supply: BTC.com

2. Decentralization

In case anybody can’t participate in validation or run a node, the blockchain won’t be decentralized. In that case, you should use AWS (Amazon Internet Providers). This can be a absolutely managed service. It lets you shortly create and deploy blockchain networks. Nonetheless, blockchains with this function can’t be referred to as “decentralized”.

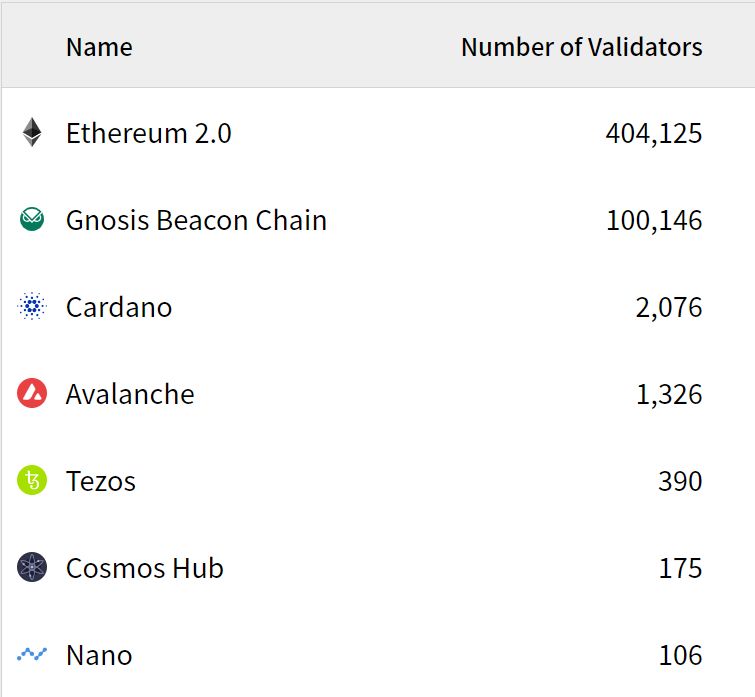

Within the following image, you will note what number of validators every layer 1 blockchain has. The extra nodes there are, the extra decentralized.

Supply: Stakers.information

3. Variety of Builders

This can be a essential query. If there are not any builders, there are not any apps. With out apps, there are not any customers. If a challenge has no customers, there’s no worth.

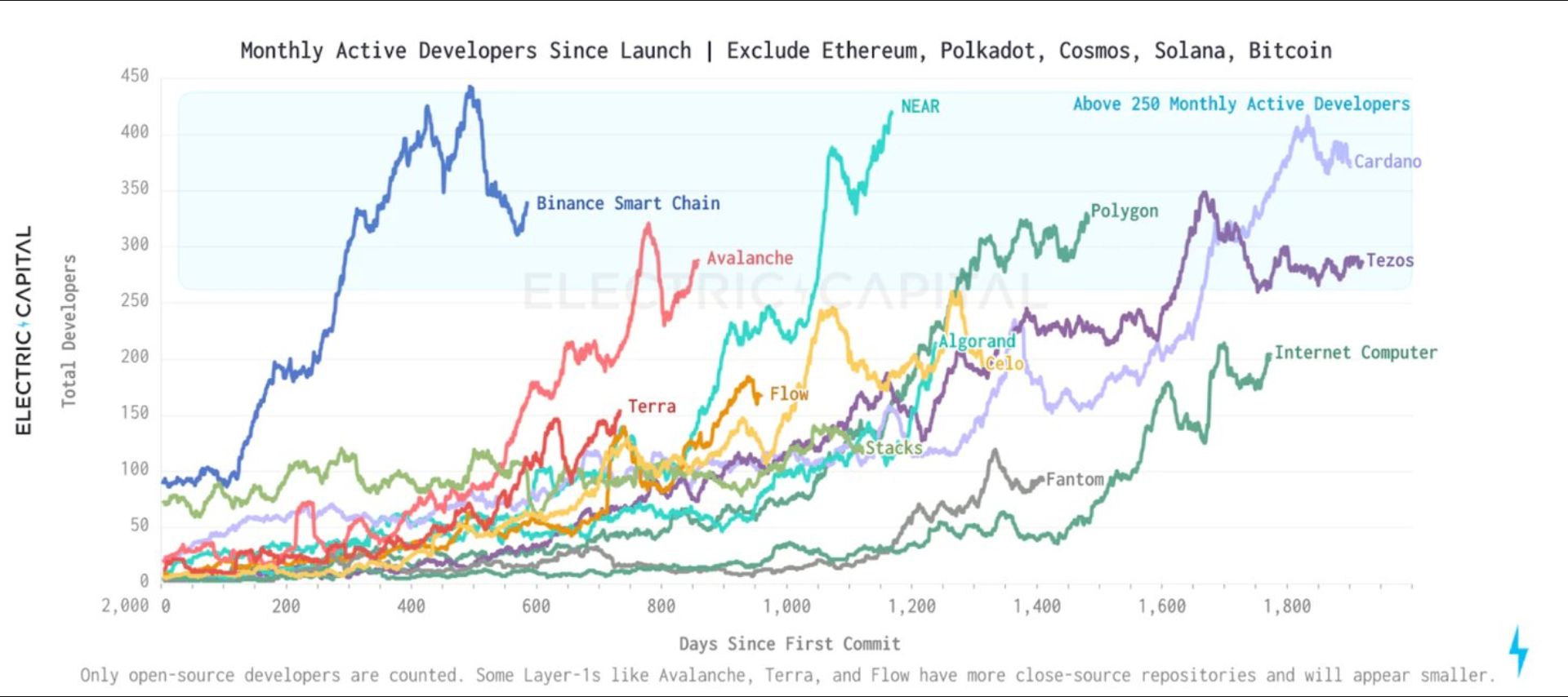

So, devs are price their weight in gold, as Peter Schiff would say. That is the place the bucket stops when a blockchain doesn’t have builders who construct use instances. Ethereum has essentially the most, with effectively over 200 lively builders per thirty days in 2021.

The image under offers you an concept of what number of builders work on quite a lot of blockchains.

Supply: Twitter

4. Utilization

This have to be an important a part of all. However not solely this, are customers prepared to pay for the companies rendered? In different phrases, will they pay for utilizing the apps? So, listed below are the fuel charges.

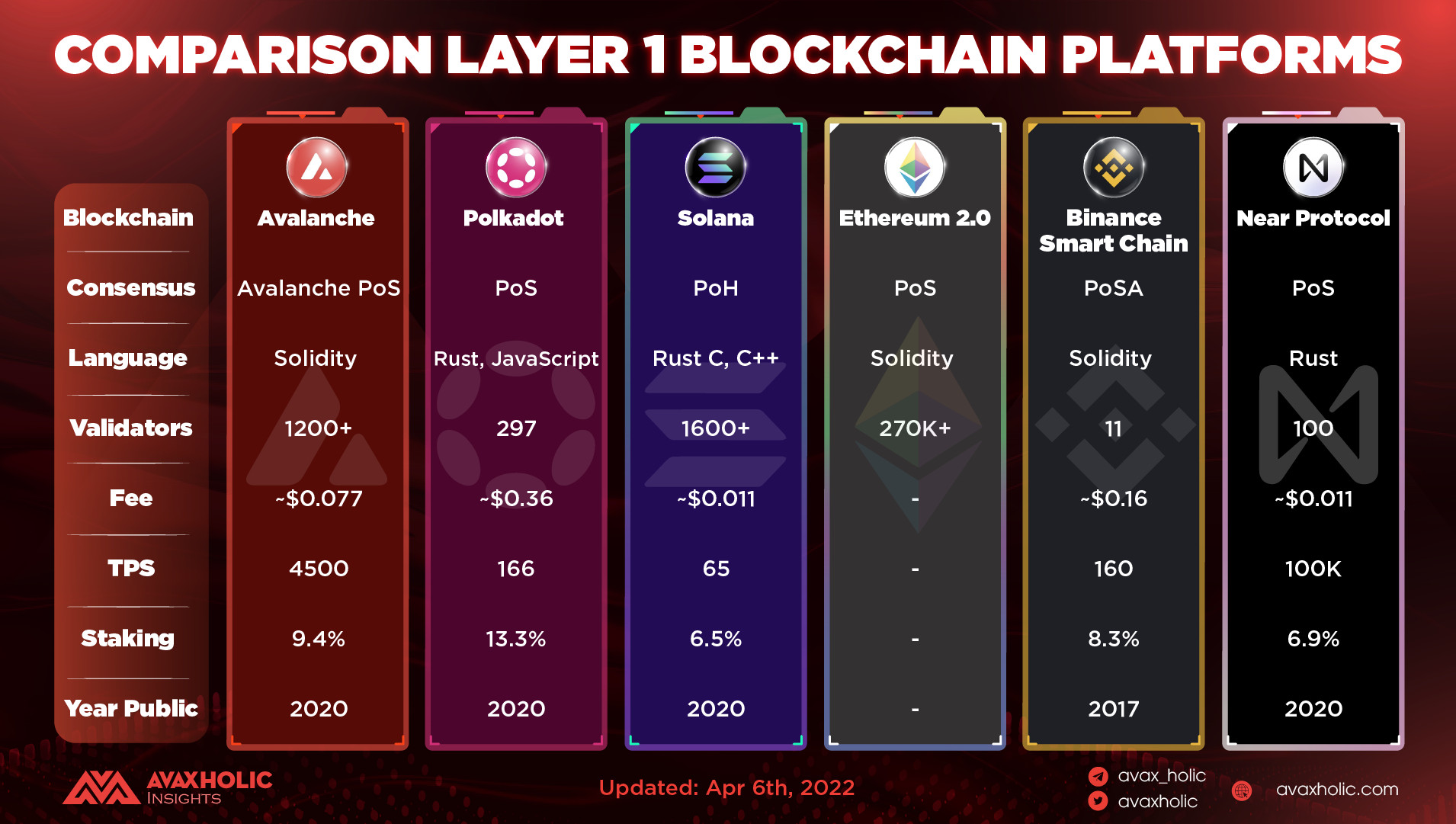

The cheaper the fuel charges, the extra well-liked a blockchain shall be. Ethereum has its L2 options. All of the Ethereum killers have their distinctive options. Backside line is that everyone likes low-cost fuel charges. Here’s a comparability chart of charges in layer 1 blockchains:

Supply: Twitter

5. Profitability

To see if a sequence is worthwhile, you have to evaluate two indicators.

How a lot is the blockchain paying for safety?

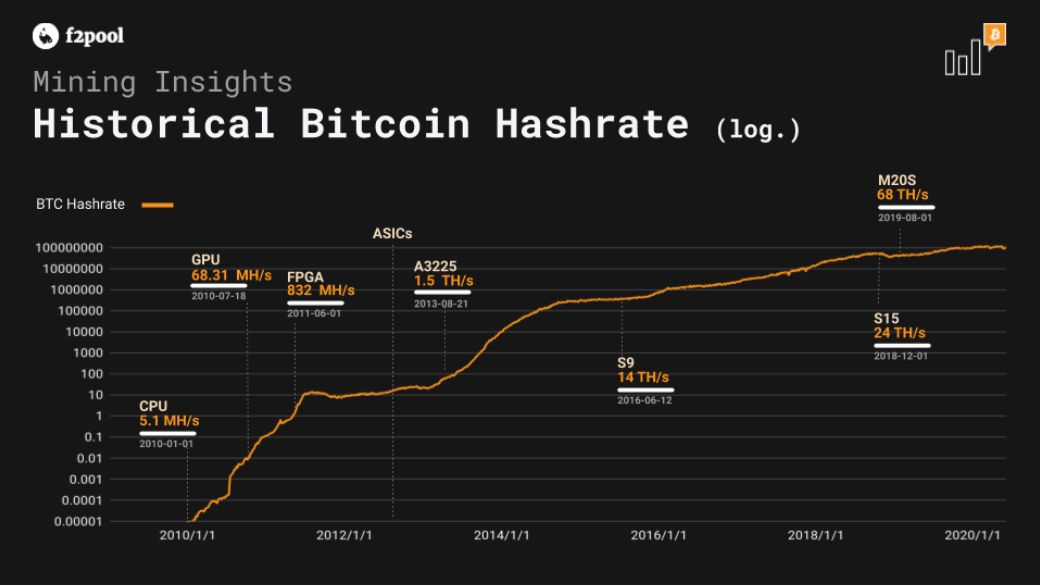

Chains use hash fee, to safe their chains, which prices cash. So, this offers you an concept of how a lot they spend on safety. As an illustration, BTC presently measures the hash fee in Exahashes. That is quantillions of Hashes per second. That’s the subsequent step up from quadrillions.

Supply: Buybitcoinworldwide

How a lot does a blockchain generate in income?

There are some ways in which a blockchain can generate revenue. Right here they’re:

- Develop software program options which have particular functions.

- Present a number of software program companies.

- Transaction charges generate earnings.

- Contract agreements.

- Speculating on cryptocurrencies.

Now, how helpful the final level is, is debatable. Nonetheless, a coin or token that appreciates, is, basically, good for a sequence.

Conclusion

Listed below are 5 good methods to seek out out if a layer 1 blockchain goes to make it. A blockchain have to be safe and decentralized. Moreover, it wants builders to construct apps and customers of the chain. Ultimately, a blockchain have to be worthwhile.

Nonetheless, this is dependent upon many components, for instance, fuel charges. It is a crucial query, although. Who builds throughout this bear market units himself as much as be among the many winners within the subsequent bull market.