The co-founder of main analytics platform Glassnode says increased costs for Bitcoin are inevitable as BTC leaves exchanges at historic ranges.

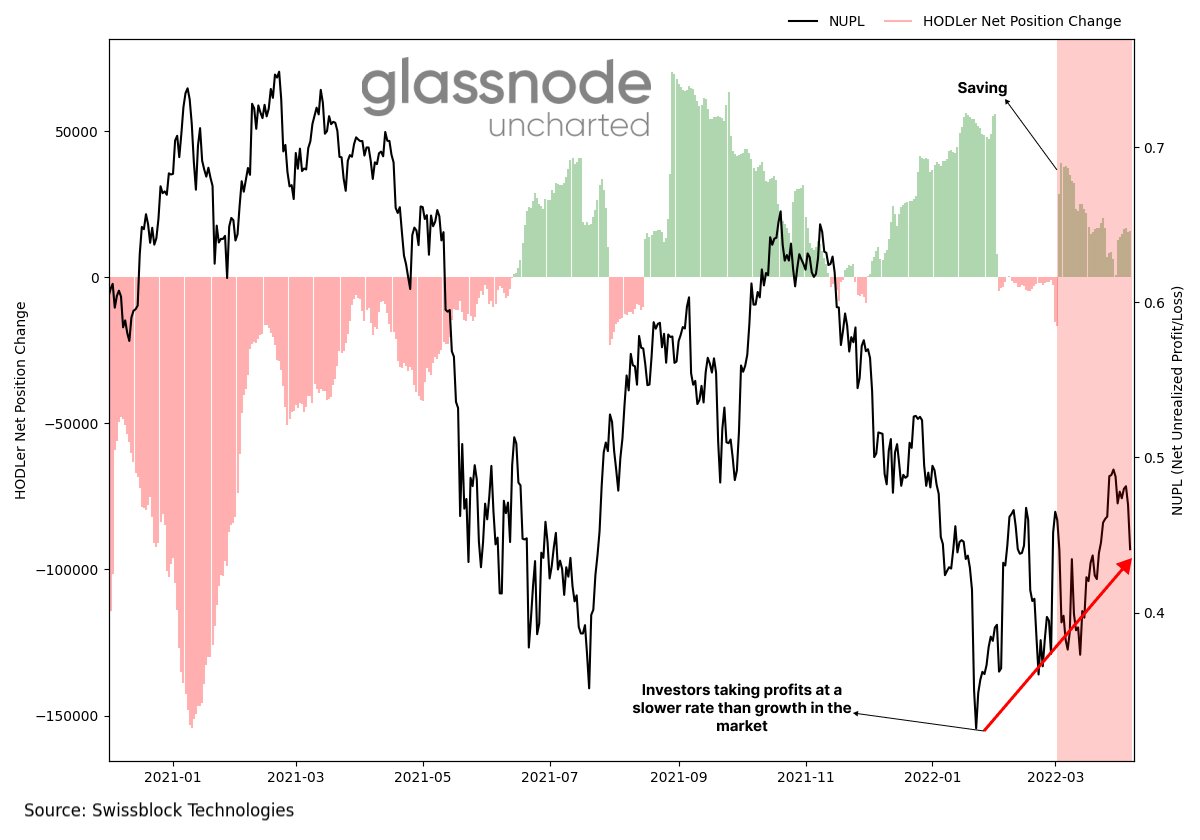

Yann Allemann tells his 52,700 Twitter followers that he’s taking a look at Bitcoin’s web unrealized revenue/loss (NUPL) metric to find out whether or not market members are in a state of revenue or loss.

Based on Allemann, Bitcoin is long-term bullish because the metric is in an uptrend, suggesting traders are taking earnings at a slower price than the expansion of the market.

“Brief-term BTC is fragile. Lengthy-term increased costs are inevitable.”

The Glassnode government additionally factors to the rising pattern the place market members are holding or saving BTC as a substitute of unloading their stacks.

“Bitcoin saving conduct is gaining floor.”

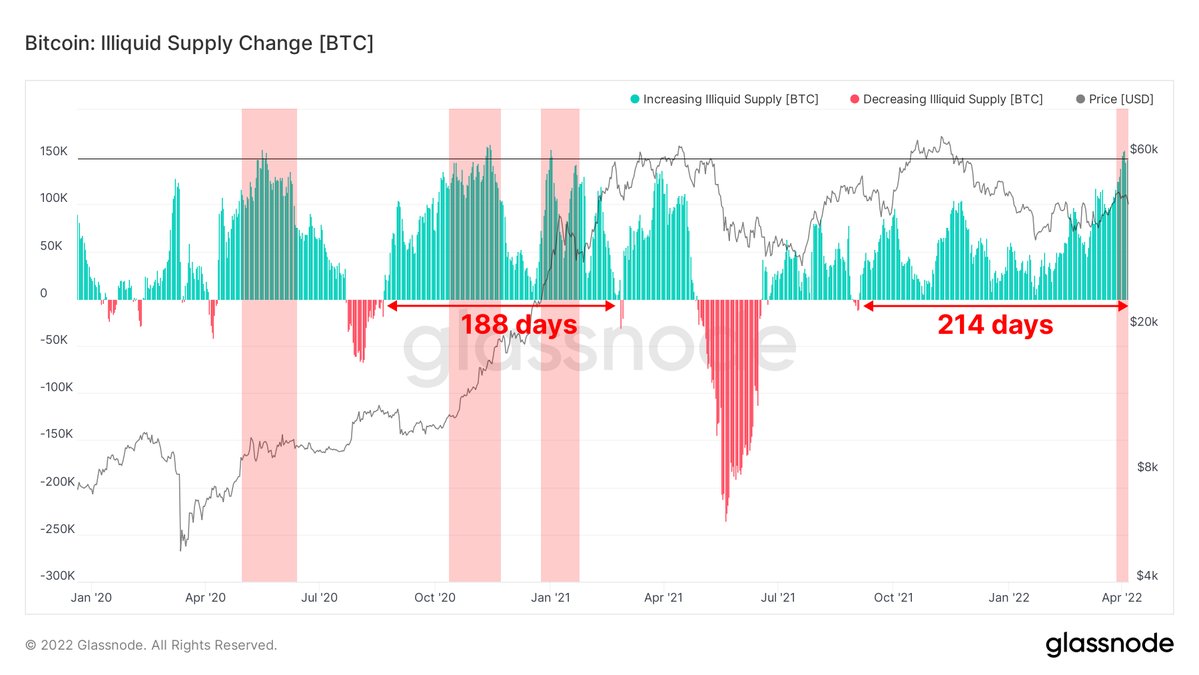

Allemann provides that the tendency of BTC traders to carry onto their stacks is clearer when taking a look at longer-term metrics. Based on the Glassnode co-founder, the illiquid provide of Bitcoin has been on an uptrend within the final six months, suggesting large accumulation.

“Bitcoin’s illiquid provide has been rising for the previous 214 days. Surpassing the 2020 accumulation.

BTC promoting stress is fading. See for your self.”

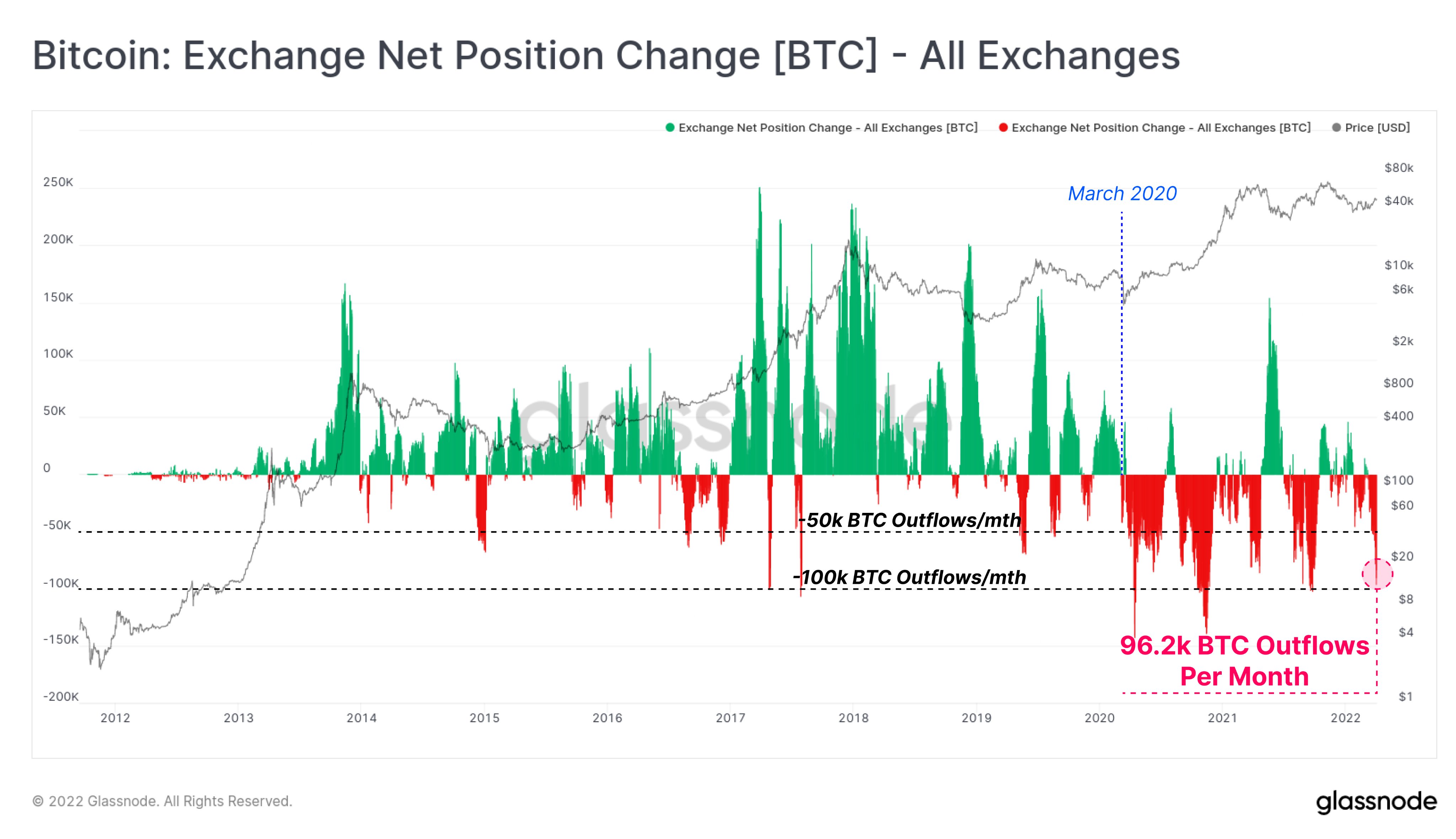

Allemann can be taking a look at trade outflows to see the size of BTC accumulation. Allemann highlights that over $4 billion price of Bitcoin is leaving exchanges each month, a historic quantity not often seen previously.

“Bitcoin trade outflow quantity just lately hit a price of 96,200 BTC per thirty days.

Mixture trade outflows of this magnitude have solely been seen on a handful of events by historical past, with most being after the March 2020 liquidity disaster.”

In March 2020, Bitcoin carved a backside at round $3,800 earlier than igniting a bull market that despatched BTC to round $65,000 by April 2021.

Test Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/Mia Stendal/Chuenmanuse