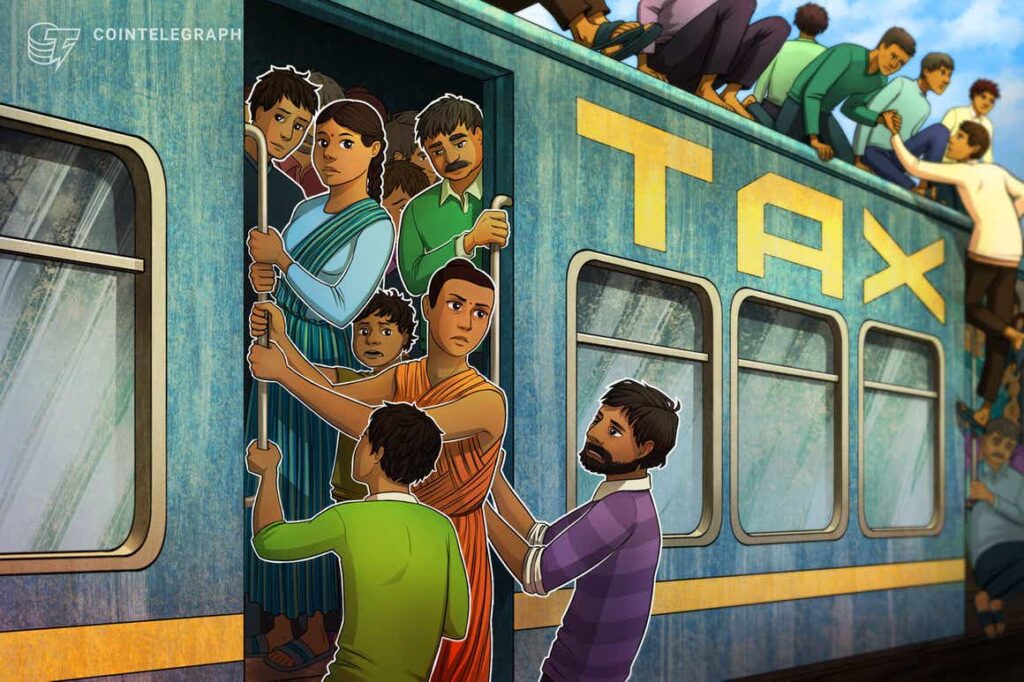

The Indian Finance Invoice 2022, with new 30% crypto tax guidelines, was approved on Thursday by the Rajya Sabha, the higher home of the Indian parliament, to make it a regulation, which is able to come into impact beginning on April 1.

The approval of the invoice by the higher home of the parliament comes inside every week of the decrease home’s (Lok Sabha) approval.

The Finance Invoice was launched throughout the funds session 2022–2023 of the parliament in January. The Finance Invoice amended tax guidelines to impose a 30% crypto tax on digital asset holdings and transfers. Other than that, merchants can’t offset their losses towards earnings, and every buying and selling pair will likely be thought of independently for tax deductions.

As per the brand new modification proposed within the Finance invoice 2022 to sections of crypto tax.

Loss cant be set off towards any revenue. Just like betting tax guidelines. #reducecryptotax

— Aditya Singh (@CryptooAdy) March 25, 2022

If 30% tax was not regressive sufficient, the federal government additionally imposed a 1% tax deduction at supply (TDS) on every commerce, claiming it might assist them monitor the motion of funds. Nevertheless, change operators have warned that the 1% TDS would dry up liquidity.

Associated: Taxman: India’s new tax insurance policies may show deadly for crypto business

The notorious invoice has been scrutinized by numerous consultants, merchants and change operators alike. Nevertheless, the federal government has determined to hold ahead with its regressive strategy with out taking enter from the stakeholders of the crypto ecosystem.

One more reason for the crypto group’s outrage is the truth that the brand new crypto tax has been closely impressed by nations’ playing and horse betting tax guidelines. This signifies that the Indian authorities likens the crypto market to playing.

“It isn’t unlawful to purchase/promote crypto belongings in India however we’ve got put taxation treating it like winnings from horse races..” -T.V Somanathan (India Fin Secretary).

It has extra to do with their view than simply tax. #reducecryptotax #faircryptotax Day-53 #IndiaWantsCrypto @Unocoin— Sathvik Vishwanath (Unocoin) (@sathvikv) March 26, 2022

The brand new crypto tax coverage in India was finalized and accredited inside two months, whereas the finance ministry has but to supply a regulatory framework across the nascent market regardless of years of assurance. Many crypto entrepreneurs within the nation consider it can result in a mind drain of expertise and that merchants will ultimately flip to decentralized exchanges and overseas platforms to conduct their crypto trades.