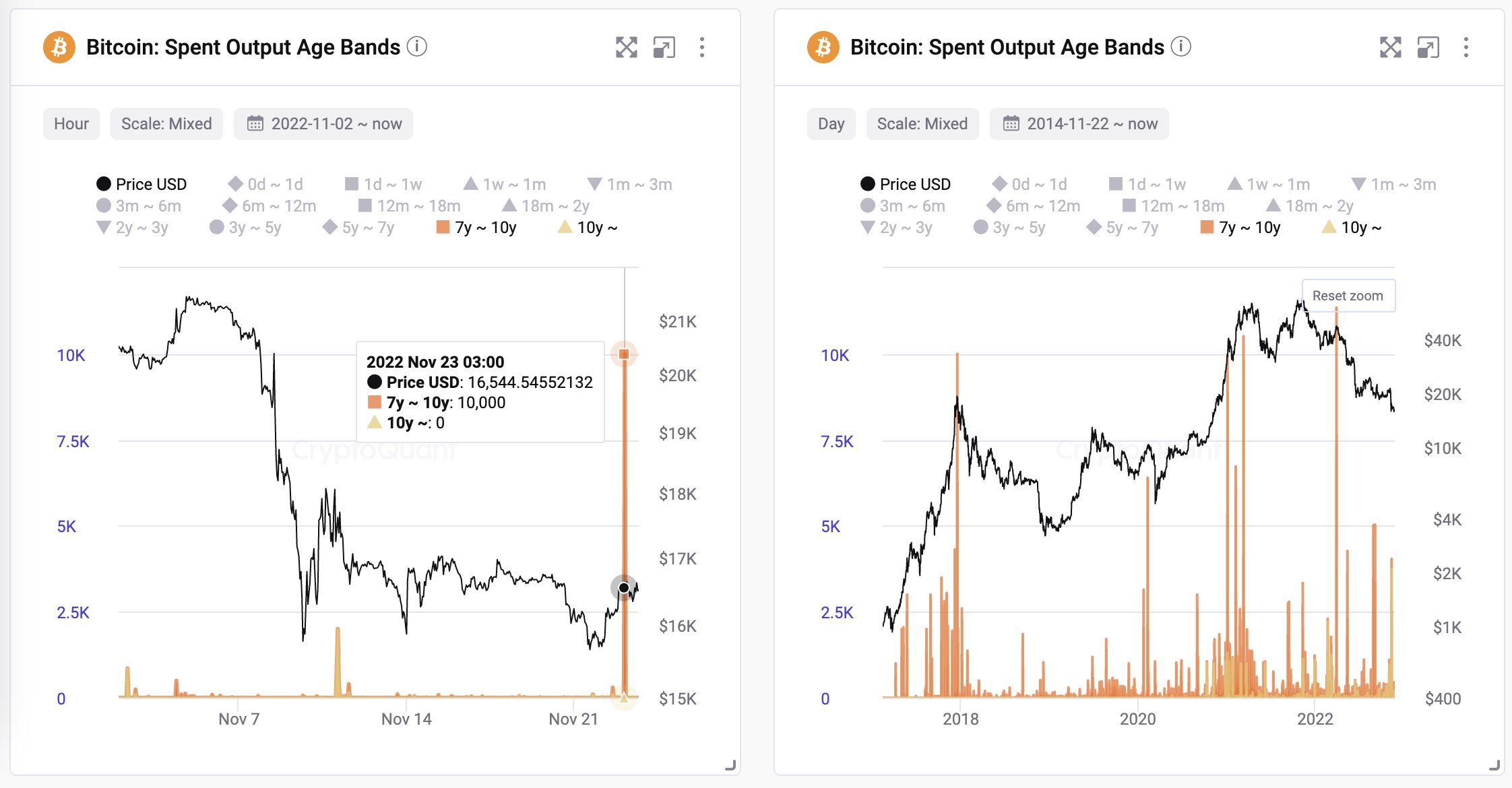

The co-founder and chief govt of on-chain knowledge analytics agency CryptoQuant is revealing {that a} stash of seven-year-old Bitcoin (BTC) linked to the hacking of the Mt. Gox trade in 2014 is on the transfer.

CryptoQuant CEO Ki Younger Ju says that 10,000 Bitcoin from the pockets of now-defunct crypto trade BTC-e had been allegedly moved by criminals, with a small portion of the stash being transferred to the HitBTC buying and selling platform.

“Seven-year-old 10,000 BTC moved immediately. No shock, it’s from criminals, like a lot of the previous Bitcoins. It’s the BTC-e trade pockets associated to the 2014 Mt. Gox hack. They despatched 65 BTC to HitBTC a couple of hours in the past, so it’s not a authorities public sale or one thing.”

Requested why the alleged criminals are promoting Bitcoin now when the flagship crypto asset has fallen by over 70% from its all-time excessive, the CryptoQuant CEO says that the previous Bitcoin has already appreciated by over 5,500% since 2015.

“Nicely, they don’t care. It’s 55x revenue for them anyway. They acquired these Bitcoins when the value was $297 in Jan 2015, and the BTC worth is $16,617 now, so roughly revenue and loss is 5,594%.”

In line with the quant analyst, the massive Bitcoin stash may increase the BTC’s draw back danger.

“I’m not saying they’re going to promote all these 10,000 Bitcoins.

We by no means know when they may promote the remainder of the BTC.

What we do know is that 10,000 BTC was moved by criminals and may very well be potential sell-side liquidity since they despatched 0.6% of their property to exchanges.”

Ki Younger has beforehand said that the motion of previous Bitcoin tends to have bearish penalties most often.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/Thorsten Griebel