Blissful Friday eve, readers. The inventory market is stumbling into the tip of the month, Fed indicators are spooking buyers, and international financial uncertainty is rampant.

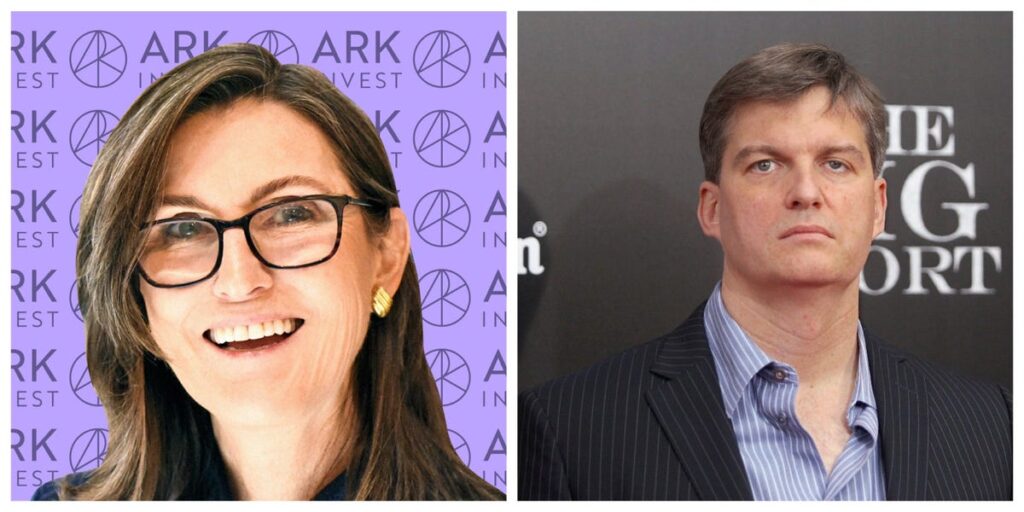

Let’s examine what Cathie Wooden and Michael Burry need to say about it.

If this was forwarded to you, enroll right here. Obtain Insider’s app right here.

Ark Make investments, Jim Spellman/Getty Pictures

1. Two market icons have a warning for the financial system. Because the inventory market closes out a brutal month and bonds crater, buyers have grown more and more cautious that hawkish Fed coverage is setting the financial system up for a

recession

.

The slide within the inventory market, in keeping with Ark Make investments’s Cathie Wooden, means that the Fed may find yourself sinking the financial system.

“Equities and bonds appear to be warning the Fed that its coverage measures may trigger an financial and/or monetary disaster: equities are swooning and the yield curve is almost [in] detrimental territory,” Wooden tweeted Tuesday.

Her feedback adopted Deutsche Financial institution’s prediction {that a} main US recession might be looming earlier than the tip of 2023.

In the meantime, “Huge Quick” investor Michael Burry has his sights set on family funds.

Huge quantities of low-cost cash in the course of the pandemic boosted shoppers’ wealth, Burry stated, and that’s susceptible to faltering within the face of historic inflation and falling asset costs.

“That is the issue,” Burry stated in a now-deleted tweet Tuesday. “Final 18 months – $850B in direct stim checks, $400B in money out refis, $1+T in forgivable loans ($250-500B of it fraudulent), one other $4 trillion oblique, and many others.”

“What recapitalizes the patron now?” Burry added “Greater wages cannot do THAT.”

Thiago Prudêncio/SOPA Pictures/LightRocket through Getty Pictures

In different information:

2. Nasdaq futures have gotten a carry from a rally in Meta. Shares in Fb’s mum or dad firm are up sharply within the premarket, bringing some much-needed cheer to the beaten-down tech sector. This is the most recent.

3. Earnings on deck: American Airways, Alaska Air, and AT&T, all reporting.

4. These are the three greatest methods to realize publicity to the real-estate sector and put together for inflation, in keeping with a fund that has risen in 34 of 37 quarters. Since 2012, this prime Bluerock fund has introduced in constructive returns — and one among its prime strategist shared the most effective subsectors in actual property to spend money on proper now.

5. The euro hit a five-year low towards the greenback. Russia’s halt in gasoline flows have darkened the financial prospects for Europe. The IMF warned that the continued battle in Ukraine may have “extreme financial penalties for Europe.”

6. After Elon Musk’s buy of Twitter, it isn’t fairly a carried out deal simply but. Notably, he might need to put up extra collateral if Tesla inventory falters. This is how a lot the EV-maker’s inventory has to fall earlier than Musk has to pony up extra of his personal cash to purchase Twitter.

7. Russia is going through its largest hunch in oil manufacturing for the reason that remaining days of the Soviet Union. Russia estimated its oil output may fall as a lot as 17% this yr, signaling the worst crash for the reason that Nineteen Nineties, in keeping with a brand new report. Get the small print right here.

8. BlackRock’s chief international funding strategist shared the most effective funding alternatives she sees proper now. Wei Li stated buyers needs to be taking note of the height federal funds price as a substitute of the tempo of price hikes. And, regardless of her optimism for the financial system, she defined why the danger of a coverage mistake by the Fed has grown.

9. Dogecoin buying and selling surged after Elon Musk’s takeover of Twitter. 5 crypto veterans mentioned the way forward for the meme coin — and why it is potential real-world makes use of might translate into future positive factors.

Markets Insider

10. Robinhood inventory dropped after the corporate introduced it is reducing 9% of workers. After a interval of speedy progress in the course of the pandemic, the cuts ought to “enhance effectivity, improve our velocity,” stated CEO Vlad Tenev. The corporate studies earnings after the shut on Thursday. This is what you wish to know.

Sustain with the most recent markets information all through your day by testing The Refresh from Insider, a dynamic audio information transient from the Insider newsroom. Pay attention right here.

Curated by Phil Rosen in New York. (Suggestions or suggestions? E mail prosen@insider.com or tweet @philrosenn.)